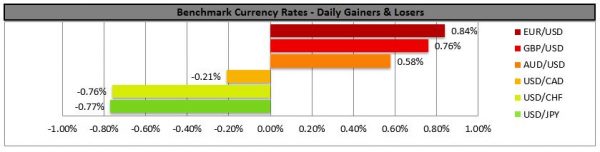

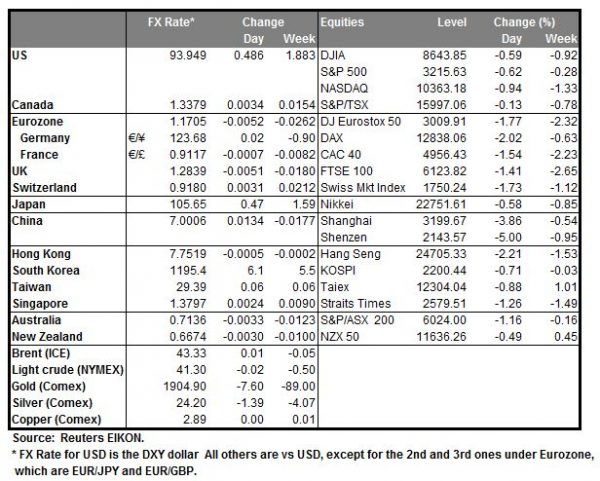

The USD remained under pressure as the tensions at the US-Sino relationships seem to be still at high levels, while at the same time the epidemiological picture in the US continues to weaken hopes for a quick recovery. It was characteristic how analysts tend to mention that the declining US treasury yields seem to weaken the USD, while at the same time some analysts tend to note that even the USD’s safe-haven qualities seem not to be present. Also worries about a possible political deadlock in the US for the new fiscal stimulus tend to create bearish tendencies for the USD. On the east side of the Atlantic, EUR-investors seem to be more confident as in the Euro-area financial data appear to underscore the recovery of Eurozone’s economy, while at the same time the common currency seems to still enjoy support from the fiscal stimulus package agreed by EU leaders last week. Should market worries intensify about the recovery of the US economy we could see the greenback relenting more ground.

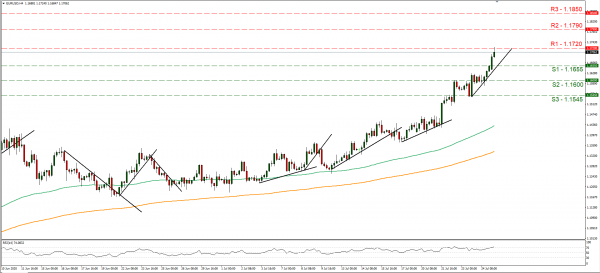

EUR/USD continued to rally on Friday and during today’s Asian session, testing the 1.1720 (R1) resistance line, thus reaching new highs since 2018. We maintain a bullish outlook for the pair and for it to change, we would require a clear breaking of the upward trendline incepted since the 23rd of July. Should the bulls actually maintain control over the pair, we could see it breaking the 1.1720 (R1) line and aim for the 1.1790 (R2) level. Should the bears take over, the pair could break the 1.1655 (S1) line as it travels further south.

Gold reaches new all-time high

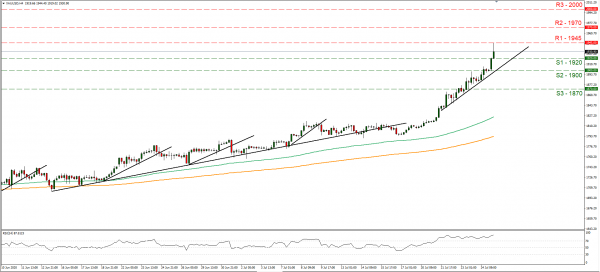

Gold’s prices reached new record highs during today’s Asian session as the weakness of the USD, may have fuelled gold’s ascent even further. Analysts tend to note that with the USD weaker at the current moment lots of funds tend to move towards gold. The escalation of the tensions in the US-Sino relationships tended to maintain uncertainty at high levels, adding to the buying momentum for gold. Should uncertainty be maintained at high levels and the USD weaken further, we could see the gold’s prices setting new records. Gold’s prices reached new record highs during today’s Asian session, by testing the 1945 (R1) resistance line. We tend to maintain a bullish outlook for gold as the upward trendline incepted since the 21st of July guides it, if not has even steepened. Please note that the RSI indicator below our chart remains clearly above the reading of 70, underscoring the dominance of the bulls, yet may also imply that gold’s long position is rather overcrowded. Should the precious metal continue to be pushed by buyers, we could see its price breaking the 1945 (R1) resistance line and aim for the 1970 (R2) level. Should the bears take over, we could see gold breaking the 1920 (S1) line, the prementioned trendline and test the 1900 (S2) level.

Other economic highlights today and early tomorrow

Today in the European session, we get Germany’s IFO indicators while in the American session, we tend to focus on the release of the US durable goods orders growth rates for June.

As for the rest of the week

On Tuesday, we get the US consumer confidence for July. On Wednesday, we get Australia’s inflation measures for Q2 and from the US the FOMC interest rate decision. On a busy Thursday, Switzerland’s KOF indicators for July, Germany’s employment data for July, Germany’s GDP for Q2, Eurozone’s unemployment rate for June, Eurozone’s consumer confidence for July, Germany’s inflation rates for July, the US GDP rate for Q2, the US weekly initial jobless claims figure and Australia’s building approvals for June are to be released. On Friday, we get Japan’s employment data and industrial output for June, China’s NBS manufacturing PMI for July, France’s GDP for Q2, UK’s Nationwide House Prices for July, France’s and Eurozone’s inflation measures for July, Eurozone’s GDP for Q2, the US consumption for June, Canada’s GDP for May and the US University of Michigan consumer sentiment for July.

Support: 1.1665 (S1), 1.1600 (S2), 1.1545 (S3)

Resistance: 1.1720 (R1), 1.1790 (R2), 1.1850 (R3)

Support: 1920 (S1), 1900 (S2), 1870 (S3)

Resistance: 1945 (R1), 1970 (R2), 2000 (R3)