U.S. Highlights

- Despite the continued surge in new infections in the U.S., financial markets were on the upswing this week on positive economic data and encouraging news on a vaccine.

- Internationally, the Chinese economy resumed growing in the second quarter. However, the recovery in the second quarter was uneven, with consumers reluctant to spend.

- In the U.S., retail sales and housing starts both rebounded sharply in June. Consumer price pressures in previously weak areas also perked up.

Canadian Highlights

- Financial markets were busy digesting central bank meetings, data releases, and COVID-19 case counts this week. Despite mixed sentiment, the S&P/TSX Composite still registered a 2% gain on the week (as of writing).

- The Bank of Canada’s interest rate decision and the accompanying Monetary Policy Report took center stage. The release emphasized that low interest rates and other forms of accommodative policy are here to stay. In other news, the Federal Government announced a $19 billion fiscal package supporting provincial reopening plans.

- Data releases confirmed that the recovery in Canada remains on track. This included a strong snap-back in existing home sales in June and decent manufacturing and wholesale trade readings in May.

U.S. – Economic Rebound Continued Through June

Financial markets were on the upswing this week on positive economic data and encouraging news on a vaccine. This came despite the continued surge in new infections. Overall, U.S. data for June was positive, but the virus’s broader spread threatens to set back progress thus far.

The big news internationally was that the Chinese economy resumed growing in the second quarter. After a 6.8% year/year decline in the first quarter, real GDP increased by 3.2% versus a year ago. However, the recovery in the second quarter was uneven, with investment outpacing consumption. Consumers have been reluctant to spend even though most businesses have reopened, reflecting the intensity of the demand shock and consumer scarring, which may take time to heal.

American consumers, on the other hand, continued to ramp up spending at retailers in June (+7.5% month-on-month). May’s gain was also revised upward, and total sales are now only 0.6% below February’s level. The rebound in sales has been uneven across categories, but even lagging areas like restaurants and bars and clothing had big double-digit rebounds in June (Chart 1).

However, retail sales only accounts for about 43% of consumer spending. Many services, like housing and medical care are not captured. This includes some of the hardest-hit areas: air travel, hotels, car rentals, child care, haircuts, movies and live entertainment. So, consumers have more money to spend on retail items because they can’t spend on these other areas. It also means the rebound in total consumer spending is likely to lag the retail front.

The strength in retail spending comes even as the unemployment rate remains at a double-digit level. This is thanks to income supports established in the CARES Act (i.e. one-time checks, and expanded unemployment benefits). The generous top-up to unemployment benefits is set to expire in two weeks. Congress is working on another fiscal package, expected before the end of July, which will hopefully include some assistance for households. Without it, consumers will likely tighten their purse strings.

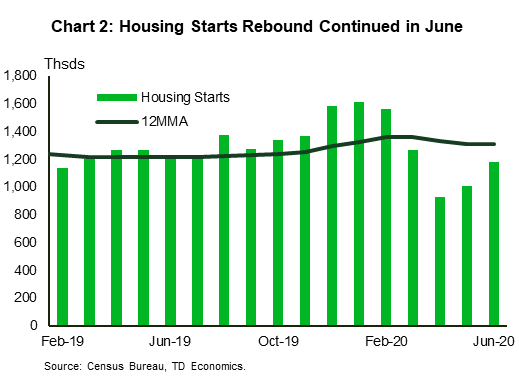

Turning to the housing market, starts jumped 17.3% in June (Chart 2). Momentum in single-family home construction looks to continue in July, with building permits up. Not surprisingly, multifamily permits fell. These projects typically involve greater risk, and given social distancing, are likely less desirable in the current climate. While starts are 24% below February levels, those were boosted by unseasonably warm weather, and are only down 3.4% versus a year ago.

Consumer prices rose again in June for the first time since the pandemic hit. A 0.2% m/m increase in core CPI in June provided some reassurance that earlier deflationary forces have ebbed. However, some of the more persistent categories, like shelter, continued to cool in June. With shutdowns returning across many parts of the country, prices may see renewed downward pressure. All told, we expect inflation to remain muted over the next couple of years.

Canada – BoC and Feds Reaffirm Continued Support

This was a busy week, dominated by central bank meetings, data releases, and rising concerns on COVID-19 case counts. Financial market sentiment alternated through the week, but the S&P/TSX Composite still managed to record a 2% gain (as of writing). Elsewhere, OPEC+ confirmed plans to taper output restrictions starting in August. This was largely anticipated, leaving oil prices stable around the US$40 mark.

Taking center stage this week was the Bank of Canada’s interest rate announcement and the accompanying Monetary Policy Report (MPR). There’s a lot to unpack, but the key takeaway is the central bank’s commitment to continued policy support until the economic recovery is set in stone.

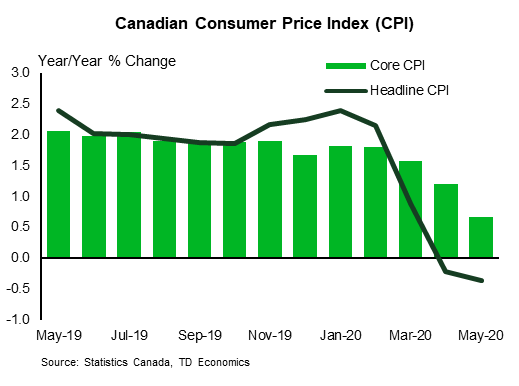

In terms of future policy action, the Bank has once again precluded the likelihood of negative rates by emphasizing that the current 0.25% rate represents the effective lower bound. Instead, it has provided a form of forward guidance by highlighting that the overnight rate will remain at current levels until CPI inflation makes a sustained return to the 2% target and economic slack is fully absorbed. Based on its newly-released forecasts, this process could drag into 2023, and in an interview, Governor Macklem stated that they expect to hold rates at this level for at least two years. The Bank also emphasized the usefulness of its asset purchase program in initially easing financial market stress and adding liquidity, and recently, providing added stimulus to the economy. There is more uncertainty relating to when this program will be wound down, but the bank has repeatedly underlined it will use available tools as necessary to respond to the crisis.

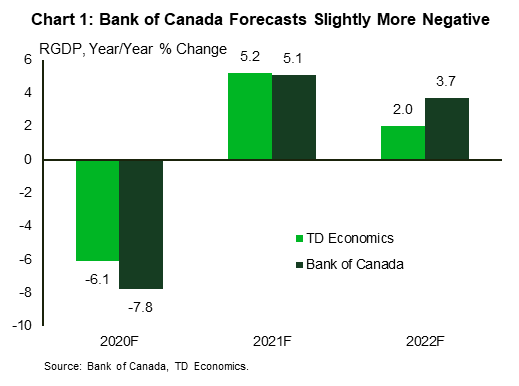

The MPR also included a baseline forecast (missing from its previous MPR), with a projected 7.8% contraction in economic activity this year (Chart 1). This is slightly more conservative than consensus forecasts (and our own).

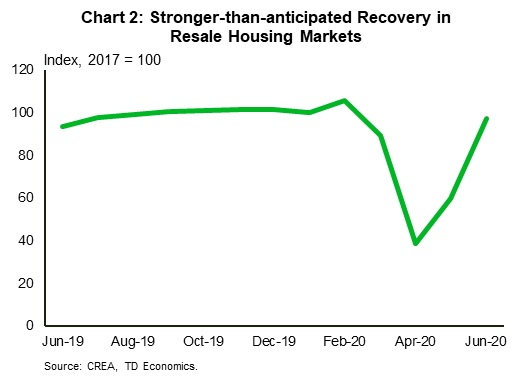

On a separate note, a suite of data releases confirmed that Canada’s ongoing recovery remains on track. Although still early, days one preliminary observation from recent data is the wedge between business and household/consumer indicators. Indeed, existing home sales staged a strong V-shaped rebound (63% m/m) in June (Chart 2). On the business activity side, manufacturing and wholesale trade posted less impressive, but still decent pick-ups in May. On the whole, higher-frequency indicators (mobility reports, OpenTable restaurant reservations, etc.) suggest that the overall recovery is ongoing, but at a slower pace.

Meanwhile, Ontario announced the beginning of Stage 3 of its reopening plan this week (excluding Toronto and some other regions), which should inject some renewed momentum to activity in July and August, provided that COVID-19 case counts remain stable or on a downtrend. On this note, the Federal Government also announced a $19 billion package to ensure safe provincial reopening plans. This came on top of an earlier announcement that the government’s emergency wage subsidy (CEWS) program would be extended to December. All told, caution remains the watchword, but with the continued downtrend in cases and reaffirmed central bank and government support, there may be some room for optimism in Canada’s recovery prospects

Canada: Upcoming Key Economic Releases

Canadian Retail Sales – May

Release Date: July 21, 2020

Previous: -26.4%, ex-auto: -22.0%

TD Forecast: 32.0%, ex-auto: 16.0%

Consensus: 22.0%, ex-auto: 14.0%

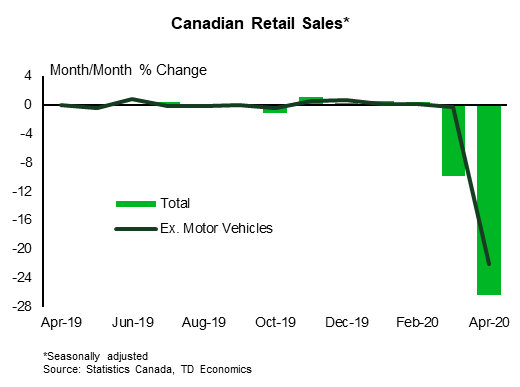

Retail sales are poised for their largest increase on record with TD looking for a 32% m/m rebound in May, well above flash estimates from StatCan (+19.1%), that would leave them down just 11% y/y (vs -33% in April). Gains should be broad-based, but we still expect autos to contribute half of the total increase, leaving ex-auto sales up 16%. Gasoline stations will also provide a sizeable contribution, helped by a 17% increase in the price at the pump, while other categories, including apparel and home furnishings, will benefit from a partial rollback of emergency measures. Volumes should come in slightly below the nominal increase, but this should prove inconsequential for GDP given the strength of the headline print.

Canadian Consumer Price Index – June

Release Date: July 22, 2020

Previous: 0.3% m/m, -0.4% y/y, index: 136.1

TD Forecast: 0.5% m/m, 0.3% y/y, index: 136.7

Consensus: 0.3% m/m, 0.2% y/y, index: 136.5

TD looks for inflation to recover to positive territory at 0.3% y/y in June, helped by a combination of base-effects and a 0.5% m/m rebound in the headline index. Gasoline prices should rise by another 10%, which along with higher prices for recreation/heating fuels should contribute most of the monthly increase in June. A stronger Canadian dollar will weigh on the food component along with lower agriculture prices, while seasonal factors and COVID disruptions will exert a headwind to apparel; shelter prices will also weigh on the headline due to a combination of lower rents and mortgage interest costs. Airfares and travel services are typically a source of strength in June but these components remain subject to elevated uncertainty from COVID-19. Our forecast would leave headline CPI down 0.1% for Q2 as a whole, in line with the latest BoC projections from the July MPR.

With energy prices driving most of the headline increase, we look for a more muted performance across core components. Ex. Food & Energy (xFE) inflation should remain unchanged at 0.6% y/y while the average of the BoC’s core measures should hold in the 1.6-1.7% range.