U.S. Review

With Little Economic News, Investors Focus on the Virus

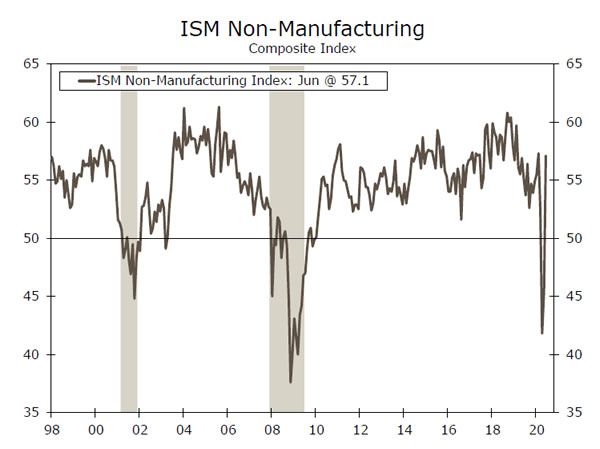

- The ISM non-manufacturing index jumped 11.7 points to 57.1, reflecting the broadening re-opening of the economy.

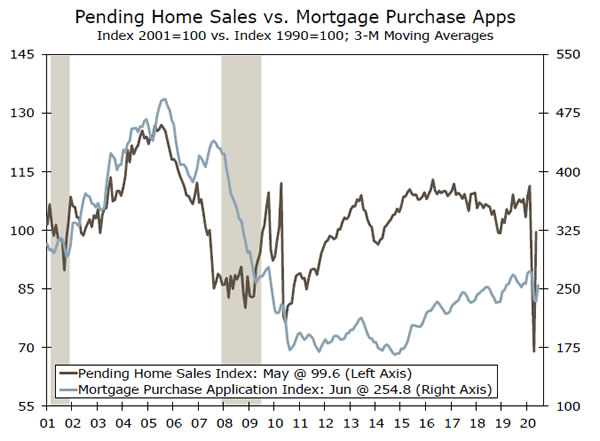

- Mortgage applications for the purchase of a home rose 5.3% and are now running 33.2% ahead of their year-ago level. Refiapplications are up less, reflecting tighter underwriting.

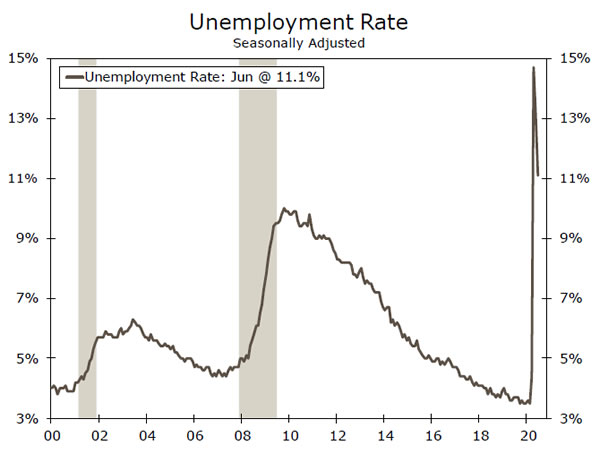

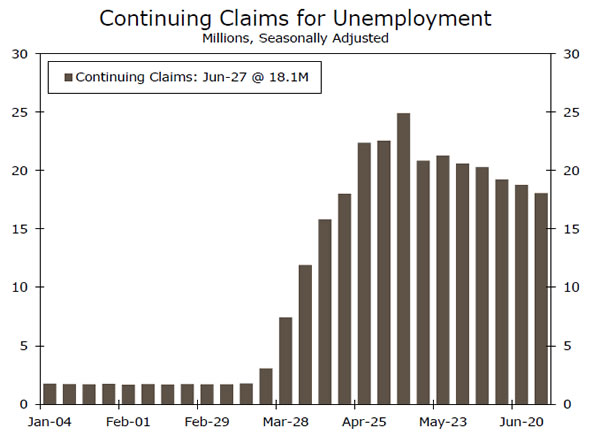

- Weekly first-time unemployment claims fell slightly more than expected and continuing claims have also come down the past two weeks, but claims for Pandemic Assistance have increased.

- The producer price index (PPI) unexpectedly fell 0.2% in June and core PPI fell 0.3%. Both were expected to rise modestly.

Can the Economic Rebound Outrun the Rise in COVID-19?

With little substantive economic news reported this week, the resurgence in COVID-19 infections has re-taken center stage. What news was reported was generally favorable. The revival in economic growth that began in late April appears to be continuing and diffusion indexes, like the ISM, continue to surprise to the upside because a broader set of industries and regions are opening back up. The ISM index measures the breadth of strength or weakness in the economy but does not provide much insight into the magnitude of the improvement. The details of the non-manufacturing survey this week were positive, however, with business activity jumping 25 points to 66 and the new orders series bouncing nearly 20 points to 61.6.

The other major surprise this week was the incessant decline in bond yields. Yields fell further following the release of the surprising drop in the producer price index (PPI). The PPI has not received much attention since it was reformulated a few years ago, the index has generally not been a good guide to future inflation trends. That said, financial markets were poised for an increase this morning, reflecting the earlier rebound in energy prices and some rebound in industrial commodity prices. The drop has sent a whiff of deflation fears through markets, which had already been on edge due to the resurgence in COVID-19 cases and fears that the U.S. economy, or major states, could see renewed shutdowns.

Lower bond yields have been a godsend for the housing industry, which remains one of the few bright spots in the economy. Mortgage applications for the purchase of a home jumped 5.3% in the week ended July 3 and are running 33.2% ahead of their year-ago level. The strength in mortgage applications is good news for home sales, particularly the existing home market. Sales of existing homes slumped in April and May, because home showings were forbidden across much of the country. Pending home sales, which reflect purchase contracts, rebounded solidly in May and, combined with the stronger mortgage applications data, should be a harbinger of a rebound in sales this summer. Applications to refinance existing mortgages rose just 0.4% in the latest week, following two weeks of declines. Even with the weaker performance in recent weeks, refi-applications are up 111% over the past year. The earlier surge in applications, combined with concerns the economy will take longer to recover, have led to some tightening in underwriting standards.

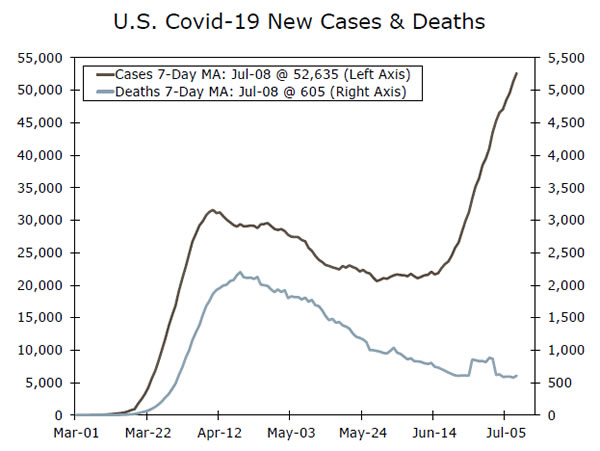

Our latest forecast, published earlier this week, has incorporated the resurgence in COVID-19 cases and our expectations as to how they will impact the recovery. While the states most severely impacted by the resurgence in infections account for a large share of the nation’s GDP growth, we do not expect widespread shutdowns to be reinstated. Moreover, we are still seeing large parts of the economy in the Sun Belt, including theme parks, reopen. We do expect the rate of improvement to slow, however, and this moderation is already evident in many of the high-frequency data series that have become popular in recent months. The improvement in first time claims for unemployment insurance also continues to moderate.

U.S. Outlook

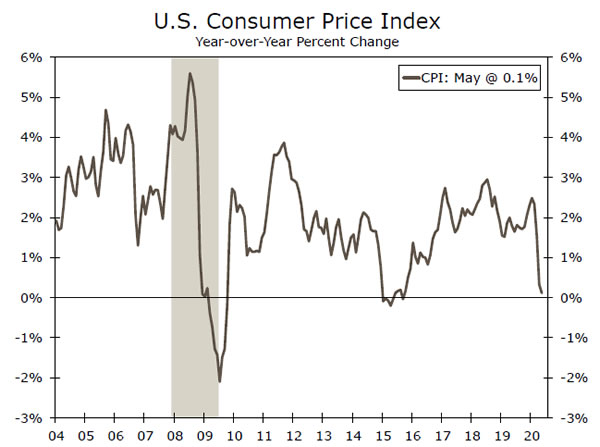

Consumer Price Index • Tuesday

Businesses slashed prices in March and April as consumer demand plummeted amid stay-at-home orders. Prices continued to decline in May, but there were some initial signs of stabilization. Most of the categories that previously saw steep declines—apparel, car rentals, airline fares and hotel rooms—remained weak, but the extent of the price declines subsided. With consumer demand beginning to recover in June, we expect that declines in the CPI due to a pronounced drop in demand are likely behind us, and expect the CPI rose 0.6% in June. There have been some anecdotal reports from businesses that due to the resurgence in consumer demand discounting is no longer required and they feel they can at least partially pass higher costs to consumers. This should result in firmer inflation in the near term. Inflation expectations, however, remain low, which will limit the extent of pass through. Inflation will likely remain tame, but prices should begin to rise from recent lows.

Previous: 0.1% Wells Fargo: 0.7% Consensus: 0.6% (Year-over-Year)

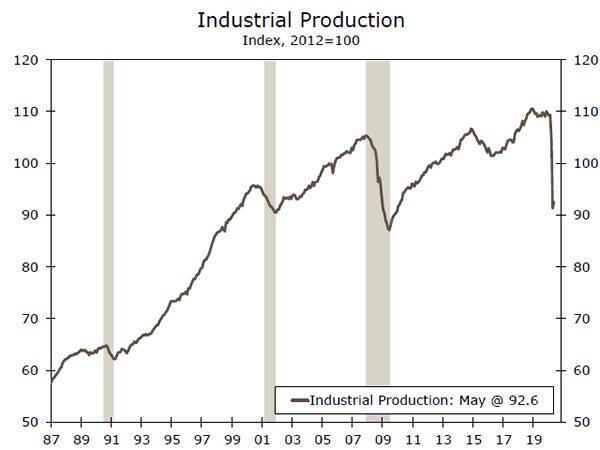

Industrial Production • Wednesday

Industrial production was halted during the COVID-induced lockdowns, but we expect the recovery that began in May continued in June. The May pick-up in production was entirely due to manufacturing output, which bounced a record 3.8%. Re-opening of auto plants around the country led to a more-than-doubling of motor vehicle and parts production (+121%), though even after that increase, the level of output for autos is still less than a quarter of the way back to its peak. We expect a further big increase in June auto production, given the rebound in auto sales over the month and limited inventory. Utilities output likely began to recover in June, as working from home provides some lift to the sector, and mining output may also start to recover, but still-low oil prices will limit any rebound. All told, while there is a long-road to a full recovery in industrial production, we expect a good outturn for June as the industrial side of the economy began to find its footing again.

Previous: 1.4% Wells Fargo: 4.1% Consensus: 4.3% (Month-over-Month)

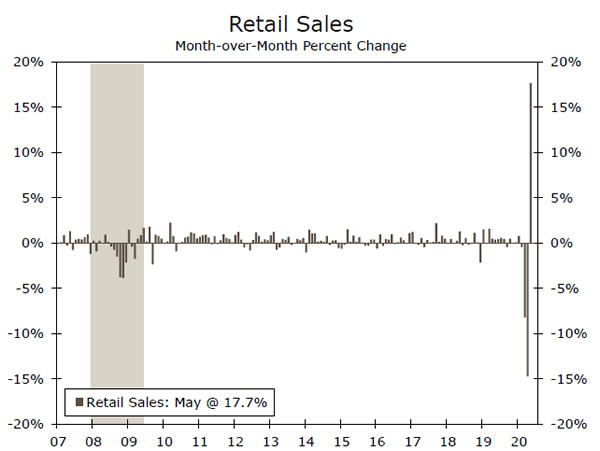

Retail Sales • Thursday

Consumer spending was in free fall in March and April with consumers confined to their homes. But, in May, as stay-at-home orders began to be lifted, retail sales came roaring back, rising a record 17.7%. This gain left total retail sales just 8% below its pre- COVID February peak, compared to some 22% below in April.

We expect another bounce in June retail sales as even more of the economy was re-opened and high-frequency mobility data suggest a pick-up in activity. But in many ways attention has already turned toward July and beyond. COVID-19 case counts are accelerating again in many parts of the country, particularly in the South and West, which threatens the economic recovery. While localized setbacks, as cities pause or roll back re-opening plans, are occurring and will likely continue we do not expect states to re-implement blanket regulations as they did in March and April. Nonetheless, increasing cases pose a serious downside risk to the consumer recovery.

Previous: 17.7% Wells Fargo: 5.4% Consensus: 5.6% (Month-over-Month)

Global Review

Signs of Life for the Global Economy

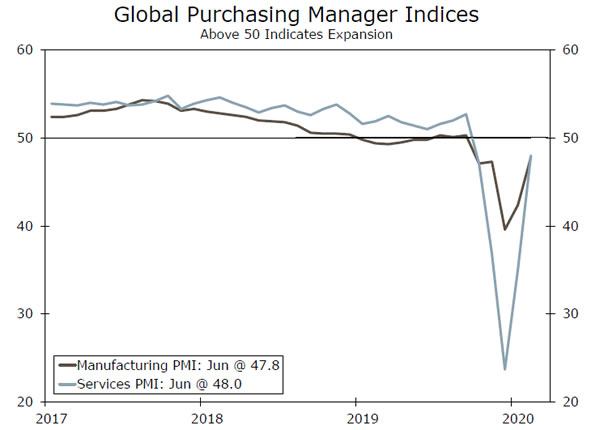

- Recent economic figures portray a global economy that is recovering from its 2020 lows. The June global services PMI rose to 48.0, an even sharper jump that the manufacturing PMI. While confidence surveys are still below pre-COVID levels, they have recouped much of their losses.

- The Eurozone reported an outsized gain in May retail sales, an outcome that could see a smaller decline and quicker rebound in GDP than previously expected. Potential fiscal stimulus and improving COVID-19 case numbers are also positive. Next week China’s Q2 GDP will be closely watched with most–but not all–of the Q1 decline expected to be recouped.

Some Hopeful Signs From the Eurozone

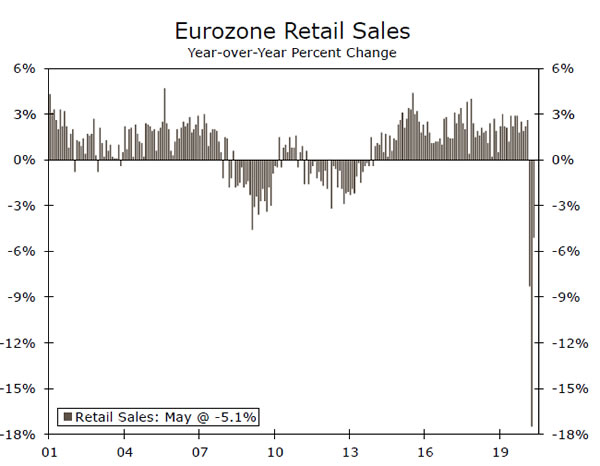

Following the gains in the Eurozone manufacturing and services PMIs from their April lows, this week’s activity data reinforced the perception of an improving Eurozone economy. Of particular note, May retail sales surged 17.8% month-over-month, beating the consensus forecast for a large 15.0% increase. Among the region’s four major economies, the monthly gains ranged from 13.9% for Germany, to 37% for France. The large May increase has recovered much, but not all, of the losses in recent months, and retail sales were still down 5.1% compared to a year earlier.

There was also some good news from the manufacturing sector. In national data for May, German industrial output rose 7.8% month-over- month, French industrial output rose 19.6% and Italian industrial output surged 42.1%. Even with these sizeable gains in May activity, Eurozone Q2 GDP is likely to record a large fall, albeit not quite as large as previously expected, while the prospects for a faster Q3 rebound have increased. These are factors behind our revised Eurozone GDP outlook, which projects a 7.7% fall in 2020 and a 2.8% increase in 2021.

Scant Evidence of Scandinavian Growth

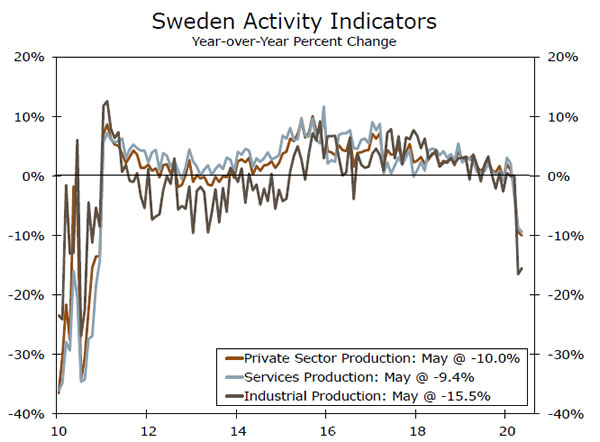

The Swedish economy was something of an outlier in early 2020, registering positive GDP growth, albeit just a modest 0.1% quarterover- quarter gain. That was nonetheless a contrast to most other G10 economies which recorded large declines, and likely stems from Sweden’s decision to essentially keep its economy open rather than imposing lockdown measures. Swedish activity has taken a turn for the worse in Q2, however. May private sector production fell 0.4% month-over-month, after a large 7.6% fall in April. Overall, May private production fell 10% year-over-year, with services production down 9.4% and industrial production down 15.5%. In Norway, mainland GDP did fall in Q1, by 2.1% quarter-over-quarter. Activity has remained subdued in the second quarter, as April mainland GDP fell 4.6% month-over-month, although May did see an increase of 2.4%.

Tough Times Across Latin America

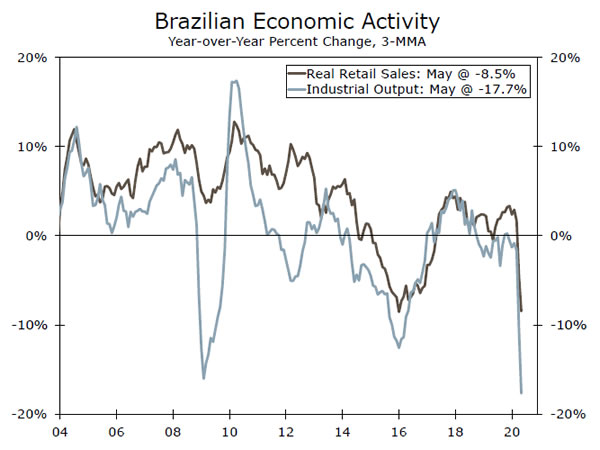

Brazil’s economy showed signs of improvement in May, although the outlook remains very challenging. May retail sales jumped 13.9% month-over-month, but that comes after a larger 16.3% fall in April. That is a similar pattern to the previously reported industrial output figures which rose 7.0% in May, but only after an 18.8% fall in April. With the political environment unsettled and jitters likely to persist, a lack of reform momentum is likely. As a result many economists still expect Brazil’s economy to contract in 2020, with the consensus forecast for a 6.5% decline in GDP.

The news from Mexico continues to be depressing. May industrial output fell 1.8% month-over-month, following a massive 25.2% drop in April output. Compared to May 2019, industrial output was down 30.7%, with much of that weakness concentrated in manufacturing and construction. Overall the softness in Mexico’s economy has been broad-based this year, prompting us to revise our 2020 outlook to a larger 9.4% decline in GDP.

Global Outlook

U.K. Monthly GDP • Tuesday

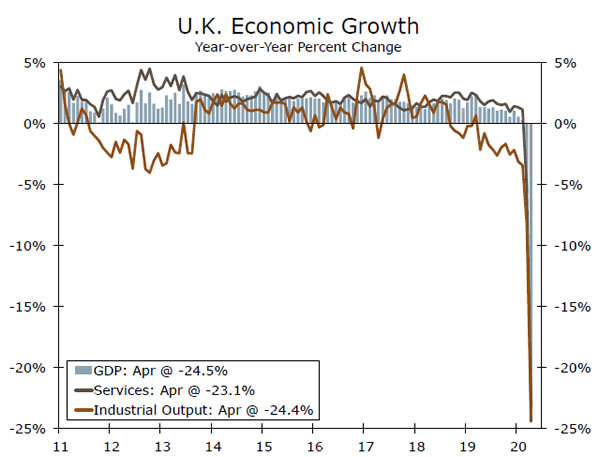

After plunging in recent months, next week’s U.K. monthly GDP is likely to show an economic rebound began in May. GDP has declined sequentially for three straight months, including most notably a 20.4% month-over-month slump in April. Retail sales data suggest the economy started to recover in May, though with lockdown measures being lifted only gradually, we expect the rebound will be less rapid than the downturn. For May, the consensus forecast is for GDP to rise 5.5% month-over-month, an outcome which would still be consistent with a large Q2 decline in GDP.

By sector, services output is expected to rise 4.8% month-overmonth, while industrial output is seen rising 5.6%. While we may see quite sizeable gains over the next few months, we expect the pace of increase to slow later in the year. Also next week, the June CPI should hold steady at 0.5% year-over-year, while employment data for the March-May period are also released.

Previous: -20.4% Consensus: 5.5% (Month-over-Month)

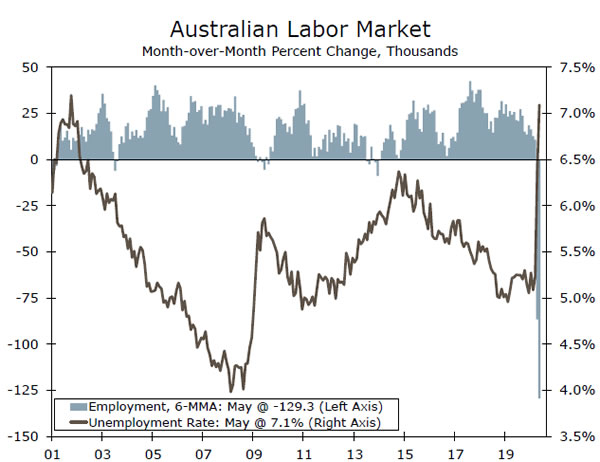

Australia Employment • Thursday

Like most countries, Australia’s economy has been hit hard by COVID-19 during the first half of this year. However, with the outbreak in Australia less severe than in many other countries, there are hopes the downturn may be less severe than previously expected, and that a renewed expansion in activity might already have begun. We should get some evidence on that front in the form of the June jobs report. For the month of June, economists expect a large employment increase of 100,000, although that would still only modestly reverse the cumulative employment decline of 838,300 seen in the March to May period. Market participants will also be focused on the split between full-time and part-time jobs, while separately the jobless rate is expected to edge up to 7.2%. June confidence surveys will also garner attention as a gauge of future prospects for the economy–we expect that both business conditions and business confidence likely rose further in June.

Previous: -227,700 Consensus: 100,000 (Monthly Change)

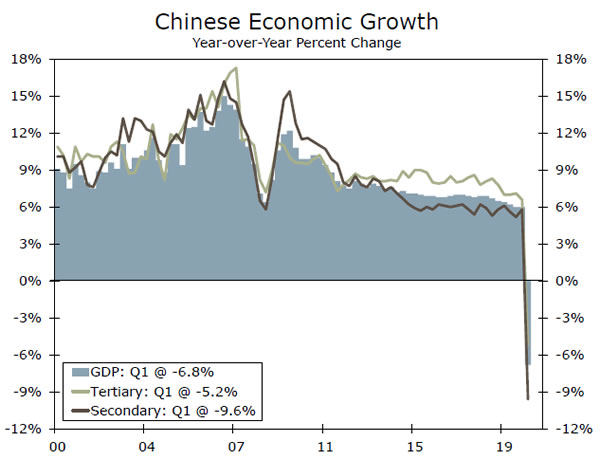

China GDP • Thursday

After being the first major country to take an economic hit from COVID-19, China has also been the first major country to rebound following efforts to contain COVID-19. This is evident from economic figures in recent months, including PMI surveys, retail sales and industrial output. The extent of the recovery so far will be reported next week with the release of China’s Q2 GDP figures.

For the second quarter, the consensus forecast is for GDP to rise by 9.6% quarter-over-quarter, reversing most–but not all–of the 9.8% decline in Q1. Growth is expected to return to positive territory on a year-over-year basis with a gain of 2.2% year-over-year. Much of the rebound should be driven by the secondary sector (which includes manufacturing), while the tertiary sector (which includes services) should show more modest improvement. This should also be reflected in monthly data, with June industrial output forecast to rise 4.8% year-over-year, and retail sales forecast to rise by just 0.5%.

Previous: -9.8% Consensus: 9.6% (Quarter-over-Quarter)

Point of View

Interest Rate Watch

Will We Ever Get Higher Yields?

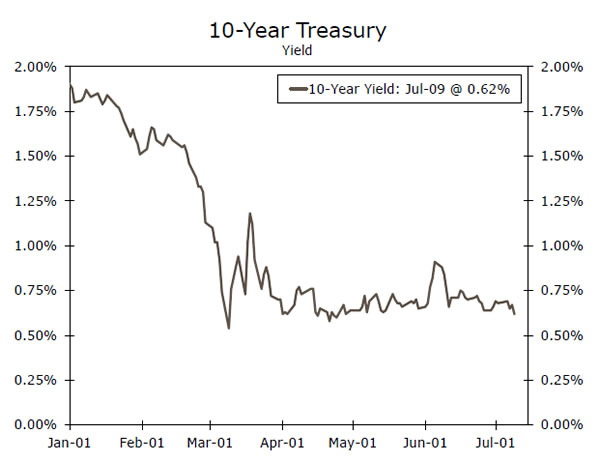

U.S. equity markets have recouped much of their losses, and the economic data have largely surprised to the upside. But at 62 bps, the 10-year Treasury yield is basically unchanged since the end of March (top chart). What will it take to see materially higher yields?

First, markets must see a stronger denial from the Fed that yield curve control is not coming anytime soon. The Fed has made clear its near unanimous opposition to negative rates, but yield curve control appears to split the committee more evenly. The threat of the FOMC adopting a yield curve control policy that caps yields at the intermediate or longer-end of the curve is probably helping to keep a lid on yields at present.

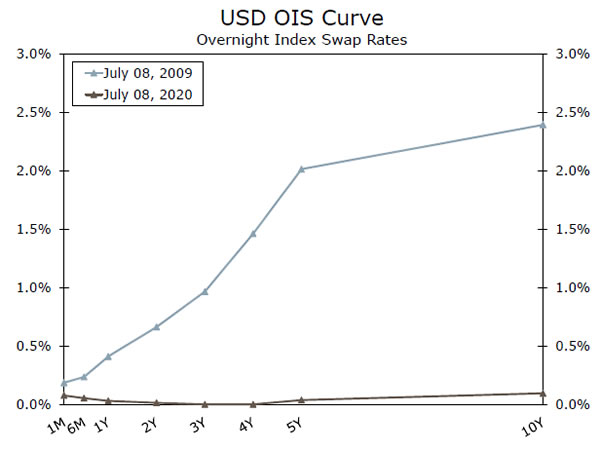

Second, markets need to price in some rate hikes eventually. The OIS market implies no hikes until the second half of the 2020s, and even then only a very gradual pace of tightening. If markets are convinced the fed funds rate will be near zero for most of the decade, this caps yields even at the back end of the curve to some extent.

Note that this is a much different development than when the Great Recession ended (middle chart). At that time, markets were priced for a fairly normal tightening cycle in the years ahead. Financial market participants appear to be drawing upon the lessons learned during the last cycle, namely low rates and strong equity gains, even in a sluggish recovery.

Third, markets need more evidence that the surge in new cases will not lead to a reversal of the recovery (bottom chart). Yes, the economic data have been strong, but fears remain that this progress will be reversed if the acceleration in cases eventually results in surging deaths and some degree of shutdown to slow the spread.

If negative rates and yield curve control are off the table, and if the economic recovery can continue without major virus-related setbacks, these developments would go a long way toward convincing Treasury market players that the risk to yields is not just one directional. But until then, Treasury yields are probably fairly wellanchored around current levels.

Credit Market Insights

Argentina Revises Debt Offer

Argentina revised its debt offer to restructure roughly $65 billion of its foreign-law bonds earlier this week as part of an effort to support the budget and kick start growth. The latest restructuring proposal follows several months of backand- forth talks between Argentina’s government and a group of major bondholders. The government has defaulted nine times, including the most recent May default when the country failed to make a $500 million interest payment.

According to the release, the proposal seeks to reduce the principal haircut, increase coupons and shorten maturities on new bonds offered, including dollar and eurodenominated bonds due 2030. In addition, the country indicated that it will allow holders of euro-denominated and Swiss franc-denominated bonds to elect U.S. dollar-denominated bonds. The offer also extended the expiration of acceptance until August 4. The IMF said that it is an “important step” in the process and hopes that all involved parties continue to reach an agreement. Argentina has made significant progress on its proposal since April which called for a 62% haircut on interest payments and a 5% cut in the value of the principal. However, Argentina’s President Alberto Fernandez indicated that this is the maximum effort that the government can make regarding the new offer. Bondholders have not yet clearly indicated whether they will accept or reject the presented proposal.

Topic of the Week

Will WFH Have a Long-Run Economic Effect?

COVID-19 has disrupted seemingly every facet of day-today economic life. Through March and April, stay-athome orders across the country accelerated an existing trend, by mandating that a significant part of the workforce begin to work-from-home (WFH). Some of these orders have since been relaxed, but many companies and individuals have maintained these new work arrangements. If these changes in how Americans work persists beyond the pandemic, would it have any lasting macroeconomic effect?

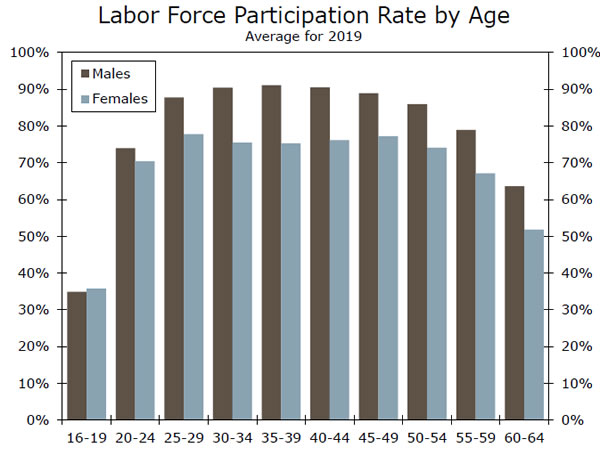

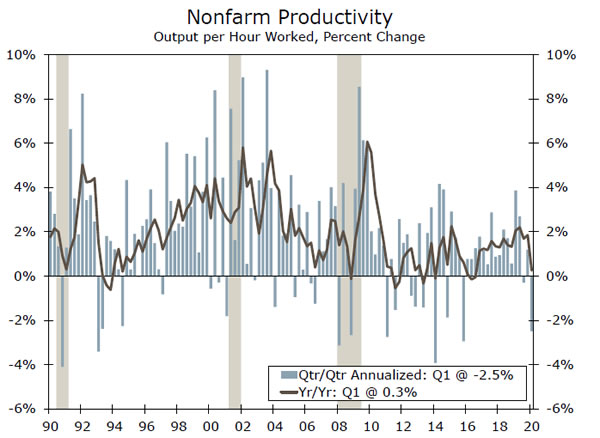

In a recent report, we looked at how WFH could impact participation and productivity within the U.S. labor force. With regard to labor force participation, female participation rose considerably through the second half of the 20th century before plateauing in the mid-2000s. There remains a substantial gap between male and female participation, however, that widens around the 30-34 and the 35-39 year-old cohorts. There may be many reasons why the female labor force participation rate recedes around this time, but one commonly cited reason is that many women drop out of the labor force to serve as the primary care giver for their children. While WFH has proved to be a difficult transition for many parents, it is possible that the new arrangement could make it easier for some women to remain in the labor force during these years. Removing this decline from in the female participation rate for women between 30 and 44 years of age would boost the labor force by roughly 0.4%. While this may have other important implications, it alone is unlikely to affect the long-run capacity of the United States. That said, if WFH boosted female participation rates across all age cohorts to the level of their male counterparts, it would result in a sizeable 7% increase, albeit with a number of caveats to consider. Finally, another important point when considering how Americans work is how it will affect productivity. There is some promising research to suggest certain workers may be more productive at home, but it is less clear if these benefits will be realized by everyone that has had to quickly adapt to new work arrangements.