- Total housing starts up to 212k in June

- Ontario starts led the rise

- Go-forward risks remain but recent economic indicators for June have been stronger than expected

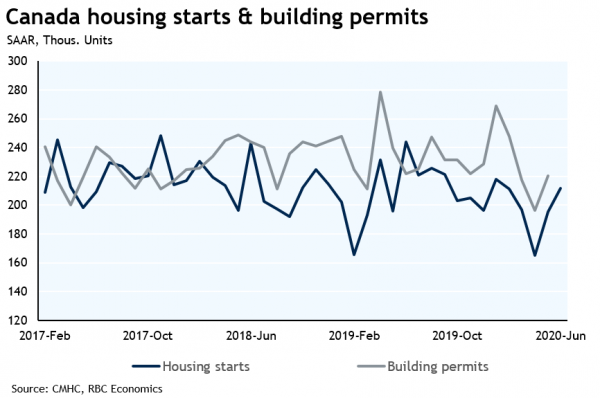

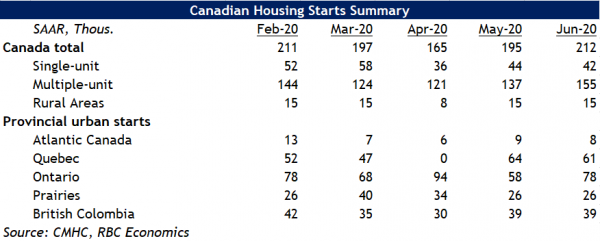

Canadian housing starts edged up to 212k in June, further rebounding from the trough of 165k in April and back to slightly above their (pre-shock) February level already. The 6-month rolling average of starts rose for the first time in seven months. Starts in Ontario more-than accounted for all of the month over month rise in June, up 36% from May to 78k. Starts excluding Ontario ticked a bit lower. Building permits have remained resilient (221k units as of May) as well, suggesting there is still some backlog of additional new building activity in the near-term pipeline.

New building activity appears to have been relatively resilient throughout the downturn – even the low-point in April wasn’t as big a decline as a lot of other economic indicators for that month. Home resales fell much more dramatically in April, but also appear to have rebounded surprisingly quickly over May and June given stronger-than-expected early reports from local markets like Toronto and Vancouver.

Government support programs like CERB payments mean that household incomes have probably held up significantly better than job markets to-date. And interest rates are exceptionally low. Against that backdrop it is not so surprising that housing activity has been more resilient than many had been expecting. There clearly remains a risk that labour market weakness will outlive exceptionally high current levels of government transfers, dealing a potential blow to household finances later in the year. Lower immigration levels will dampen housing demand, and there is always a danger that reopening the economy too quickly could prompt a resurgence in virus spread like that occurring now in parts of the United States. But, for now, housing activity joins a growing list of sectors looking more resilient than feared early in the economic recovery.