For the 24 hours to 23:00 GMT, the EUR declined 0.34% against the USD and closed at 1.1274, after the European Commission downgraded its 2020 growth forecast for the euro area.

The European Commission forecasted that the Euro-area economy will contract by 8.7% in 2020 and grow by 6.1% in 2021, amid strict lockdowns across the region due the coronavirus outbreak. Also, it lowered its forecast for the decline in Germany’s GDP to 6.3% from 6.5%. Further, the Commission indicated that the rebound in 2021 will likely be slower than it had previously expected, lowering its growth forecast for the year to 6.1% from 6.3%.

On the macro front, Germany’s industrial production jumped 7.8% on a monthly basis in May, amid easing of lockdown restrictions, however, less than market forecast for a rise of 10.0%. In the prior month, industrial production had recorded a revised drop of 17.5%.

In the US, the JOLTs job openings unexpectedly climbed to a level of 5397.0K in May, defying market expectations for a drop to a level of 4850.0K and compared to a revised reading of 4996.0K in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1277, with the EUR trading marginally higher against the USD from yesterday’s close.

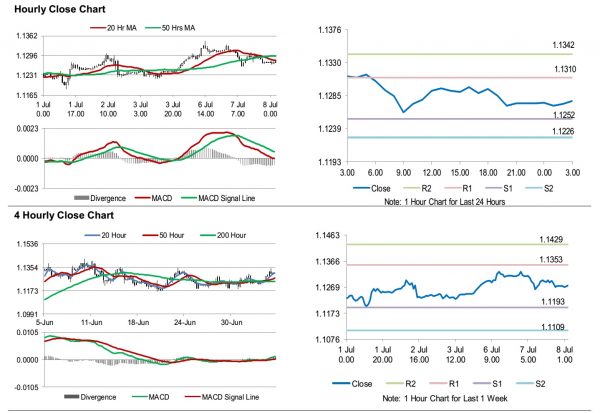

The pair is expected to find support at 1.1252, and a fall through could take it to the next support level of 1.1226. The pair is expected to find its first resistance at 1.1310, and a rise through could take it to the next resistance level of 1.1342.

In absence of crucial macroeconomic releases in the Euro-zone today, investors would keep a close watch on the US consumer credit for May and the MBA mortgage applications, slated to release later today.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.