U.S. Highlights

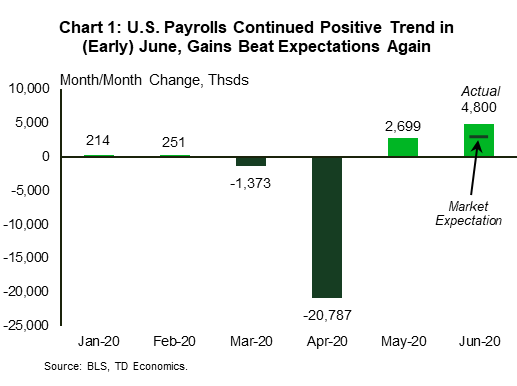

- Green shoots continued to emerge in the economic data. The U.S. gained 4.8 million jobs in June (better than expected). Meanwhile, the unemployment rate headed lower to 11.1% form 13.3% in the month prior.

- Other positive developments included rising consumer confidence, further gains in vehicle sales, a surge in pending home sales and the return of the ISM manufacturing index to expansionary territory.

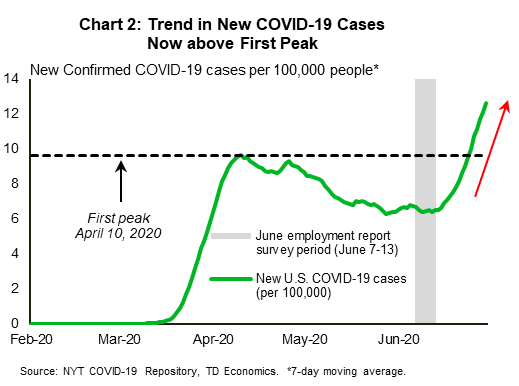

- While the aforementioned data is fairly recent, the health crisis can change direction quickly, as has been the case recently. New infections per population have now breached the April peak. This has led some states to reverse or slow their reopening plans, posing a challenge to the economic recovery.

Canadian Highlights

- Financial markets were upbeat this week. The risk-on sentiment was supported by the ongoing signs that the economic recovery had begun in May and June on both sides of the border.

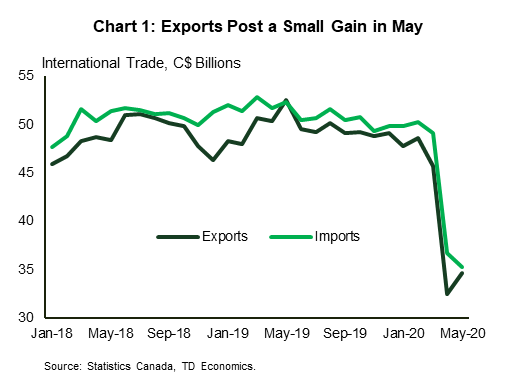

- Both residential and commercial building permits rebounded strongly in May, rising by 19% and 21%, respectively. International trade data also improved, with exports increasing for the first time since February.

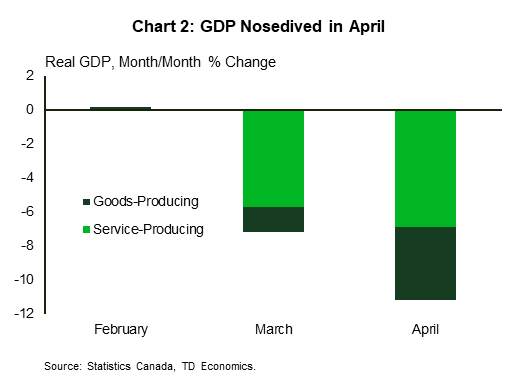

- While health and economic indicators have been moving in the right direction, the economy remains in a deep hole. Monthly numbers showed that Canada’s GDP took a nosedive in April, falling 11.6% month-on-month.

U.S. – Rising Infections Pose a Challenge to Economic Recovery

A string of broadly positive data releases this week helped reinforce the theme of an economic recovery taking shape at the end of the second quarter. With the data at hand and some encouraging signs regarding the development of a vaccine, financial markets appeared to look past the recent surge in new infections, with equity markets gaining on the week.

On the data front, the payroll report confirmed that the labor market recovery continued in early June (survey period ran through June 12th). The U.S. gained another 4.8 million jobs – much better than market expectations (Chart 1). Gains were widespread across industries, though the badly-bruised leisure & hospitality sector continued to account for an outsized potion of gains (+2.1 million).

As more workers were called back to their jobs, the number of unemployed workers fell by 3.2 million to 17.8 million. Meanwhile, the unemployment rate headed lower, falling from 13.3% in May to 11.1%. Even adjusting for potential misclassification, the unemployment rate fell to an estimated 12.3% (from 16.4% previously). One fly in the ointment was a rise in the share of unemployed workers on permanent layoff, which rose from 10.9% in May to 16.2% in June. This suggests that the health crisis will indeed have some longer-lasting scars.

An improved labor market backdrop and some progress on the reopening the economy (earlier in the month) helped prop up consumer confidence, with the Conference Board’s sentiment measure rising more than expected in June. With low interest rates an added tailwind, the purchase of big-ticket items picked up. Home buyers were busy inking deals in May, with pending home sales surging a record 44.3% on the month. Contract signings tend to lead closed sales by 1-2 months, signaling a strong near-term showing in the latter in the months ahead. Meanwhile, vehicle sales continued to rebound in June – up nearly 6% in June to 13.1 million – albeit at a slower pace than the month prior.

With the U.S. economy beginning to fire on more cylinders, the factory sector also showed signs of improved activity. Propped up by sharp gains in the ‘new orders, production and employment’ subcomponents, the ISM manufacturing index swung back into expansionary territory in June for the first time since February.

While recent economic data has continued to come in broadly positive, the virus is still a major wildcard. The improvement outlined in the employment survey, for instance, came before recent surge in new infections (Chart 2). The latter has led many states to either reverse or slow their reopening plans. A more measured reopening path will weigh on jobs and spending, among other things, ultimately posing a challenge to the economic recovery.

With the virus showing little signs of abating, the economy will continue to require fiscal and monetary support. On the monetary side, the minutes from the FOMC meeting on June 9-10 showed an increased willingness to use forward guidance and to tie monetary accommodation to specific unemployment and inflation thresholds. This may help, but as the Fed Chair has noted, more help from Congress is also likely to be necessary.

Canada – The Economy Continues to Dig Out

Financial markets were upbeat during this holiday-shortened week. Even as the surging number of COVID-19 cases in many U.S. states continued to undermine re-opening progress, this weeks’ risk-on sentiment was supported by the ongoing indications that the economic recovery had begun in May and June on both sides of the border.

This week, June’s above-consensus manufacturing and payrolls data in the U.S. drove equities and commodities higher. The S&P/TSX composite index ended the week 2.7% higher (at the time of writing), and the WTI benchmark price crossed the $40 mark once again, recovering following last week’s decline.

Canadian data released this week was also encouraging. Both residential and commercial building permits rebounded strongly in May, up by 19% and 21%, respectively, following steep declines in March and April. Construction sites across the country were allowed to reopen in May. Led by gains in Quebec (+56%) and Ontario (66%), single-family permits advanced by 38% on the month.

May’s international trade data also indicated that the pandemic grip over global economy was beginning to ease. Canada’s merchandise trade deficit narrowed to $677 million in May, following a revised $4.3 billion deficit in April. Led by gains in motor vehicle & parts and energy products, exports increased 6.7% month/month, however, imports recorded a further decline (-3.9%) (Chart 1).

Easing COVID-19 restrictions combined with production curtailments have led to a bounce-back in prices for many commodities from their pandemic-lows. However, as we note in our recent report, the road to recovery for crude and other commodities is likely to be long and bumpy. This cautious stance reflects a slow comeback in global demand amidst ongoing uncertainty around the path of the virus and the potential for setbacks, like the recent wave of infections across the U.S. south. Pre-existing oversupply issues will also continue to weigh on the prices.

With COVID-19 cases in Canada steadily declining and reopening plans on track, economic indicators have been moving in the right direction. However, the economy remains in a deep hole and it will take some time to dig out of it. April’s GDP figures released this week confirmed what was mostly already known: Canada’s GDP took a nosedive in April, falling 11.6% m/m. While no industry left unscathed, the goods sector was especially hard-hit with output dropping by a drastic 17%.

Service sector output, meanwhile, contracted by 9.7% on the month. However, since it makes up a larger share of the total, was responsible for the lion’s share of the GDP decline in both March and April (Chart 2). The good news is that April’s severe contraction marks the low point of the downturn. Statistics Canada preliminary estimate of May’s GDP reading is pointing to a 3% rebound. The recovery narrative will continue next week, with employment numbers likely revealing a pickup in hiring with larger swaths of the economy reopening in June.

U.S: Upcoming Key Economic Releases

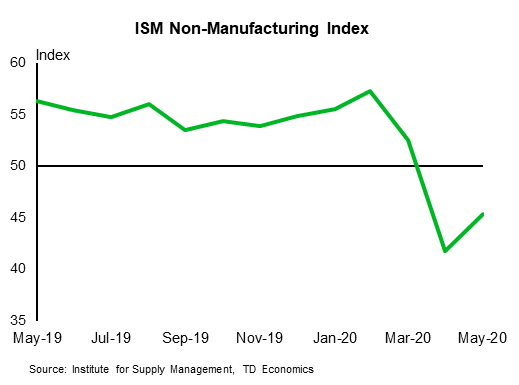

U.S. ISM Non-Manufacturing Index – June

Release Date: July 6, 2020

Previous: 45.4

TD Forecast: 52.5

Consensus: 50.0

The non-manufacturing ISM index probably rose above the break-even 50 level (TD: 52.5) as the economy “reopened,” similar to the pattern already reported for manufacturing (the manufacturing ISM index rose to 52.6 from 43.1). Of course, modest growth after a plunge implies a sizable net decline. Also, the recovery is being threatened by the renewed uptrend in COVID cases. A reversal of reopenings is more likely for non-manufacturing—particularly services—than manufacturing firms.

Canada: Upcoming Key Economic Releases

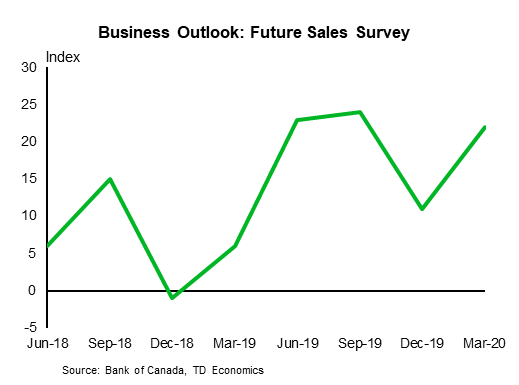

Canadian Business Outlook Survey

Release Date: July 6, 2020

The Business Outlook Survey (BOS) and accompanying Canadian Survey of Consumer Expectations (CSCE) will give the Bank of Canada a key update on business and household sentiment heading into the July MPR. Of the two, we expect the CSCE to get more attention given significant uncertainty around how Canadian households respond to COVID-19. Motor vehicle sales and high frequency credit data have all bounced back from April, but the CSCE should help address whether this reflects pent-up demand or a more lasting recovery in spending, while also offering an update on inflation expectations and the perceived state of the labour market.

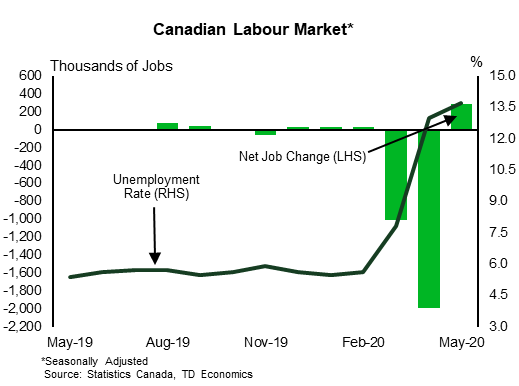

Canadian Employment– June

Release Date: July 10, 2020

Previous: 290k, unemployment rate: 13.7%

TD Forecast: 600k, unemployment rate: 12.2%

Consensus: 550k, unemployment rate: 12.5%

The pace of hiring should accelerate in June with 600k jobs added across the Canadian economy, leaving the unemployment rate to drift lower to 12.2%. This reflects both an acceleration and broadening of reopening plans after Quebec was one of few regions to roll back emergency measures ahead of the May reference week. We look for Ontario to lead regional gains while the industry breakdown should reflect the rehiring of many lower wage employees across retail trade and food services in addition to further recovery in the industrial sector. We will also be focused on the total hours worked which will give insight into economic activity for June.