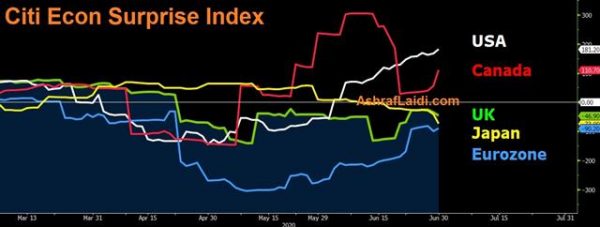

Gobal indices jumped ahead of the US open on positive findings about an experimental coronavirus vaccine from Pfizer and BioNtech, which produced a high level of antibodies. Tuesday’s news of stronger US consumer confidence data and stable US virus cases were sufficient to boost risk trades to a strong finish for the quarter. ADP jobs data also came in stronger than expected. The ISM manufacturing survey is due up next. The chart below shows positive US economic data surprises are away ahead of the rest, raising the question about sustainability. Each of the last two Premium trades is up +250 pts and open.

US consumer confidence continued to rebound in the June report at 98.1 compared to 91.4 expected. That continues a series of strong beats in US economic data. Particularly encouraging was a jump in the ‘expectations’ component to 106.0 from 96.9 a month earlier.

The data helped to launch risk trades higher, including a 1.5% rise in the S&P 500 and large gains in the commodity currencies. More broadly, the US dollar was under significant pressure, likely due to quarter-end flows.

In terms of COVID-19, cases in US hotspots remained at high levels but there was some leveling off in Florida. We warn that’s likely due to weekly trends and is likely to reverse in the day ahead. In Texas, Arizona and several smaller states, cases hit record highs.

On the quarter, the Australian dollar was the best performer by a significant margin with NZD in second place. Clustered at the bottom were the yen, pound and US dollar.

Year-to-date performance, however, offers a clearer picture of impact of the virus with the Swiss franc on top and the pound lagging. Within all that, there have been dozens of major swings.

In equity markets, the moves were massive. For US stocks, it was the best quarter since 1998 and the the first time a +20% quarter marked a -20% quarter since 1932. Within US stocks, the divergence was stark with the DJIA up 17.8% and the Nasdaq up 30.6%. Elsewhere, the FTSE 100 rose a relatively modest 8.8% while the DAX climbed 23.9%.

The day ahead features more economic data and we remind readers that non-farm payrolls will be on Thursday rather than the usual Friday slot accounting for the US holiday. The market is likely to focus on the ISM manufacturing report for June. A series of regional numbers have beaten the consensus, some by a larger margin so risks to the 49.9 consensus are undoubtedly on the upside.