For the 24 hours to 23:00 GMT, the GBP declined 0.38% against the USD and closed at 1.2307, amid concerns over how the British government will pay for its planned big infrastructure programme.

On the data front, UK’s mortgage approvals unexpectedly fell to 9.2K in May, due to coronavirus pandemic and defying market expectations for a rise to a level of 25.0K. In the prior month, mortgage approvals had recorded a revised reading of 15.8K. Moreover, consumer credit dropped by £4.6 billion in May, more than market expectations and compared to a revised fall of £7.4 billion in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.2300, with the GBP trading 0.06% lower against the USD from yesterday’s close.

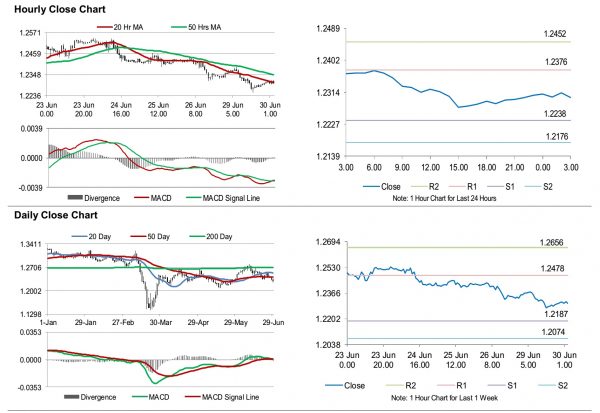

The pair is expected to find support at 1.2238, and a fall through could take it to the next support level of 1.2176. The pair is expected to find its first resistance at 1.2376, and a rise through could take it to the next resistance level of 1.2452.

Going forward, traders would keep a watch on UK’s current account and the gross domestic product (GDP) for 1Q 2020, slated to release in a few hours. Additionally, the GfK consumer confidence for June and the BRC shop price index for May, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.