- Reality bites stock markets as US virus spike accelerates, dollar recovers

- Threats of new US tariffs against EU and dire IMF forecasts not helping mood

- Fed balance sheet reduction may be playing a role too

- Daily virus numbers will continue to dictate sentiment, any stimulus news too

Acceleration in infections hampers recovery prospects

Risk aversion gripped global markets once again on Wednesday after several American states reported another worrisome spike in virus cases and hospitalizations, pouring cold water on the cheerful narrative of a rapid economic recovery. New infections in California, Texas, and Florida – the three most populated states – reached daily records, pushing the nationwide total to levels not seen since the outbreak’s peak in late April.

Hospitalizations are also rising fast in several states, amplifying the risk that lockdown measures will need to be reintroduced so the healthcare system isn’t overwhelmed, or at least that some re-opening plans will be put on ice. California and Texas are the real driving forces behind US economic growth, with both states growing by around 4-6% in recent years, so even local lockdowns could have a huge impact on the entire nation’s recovery prospects.

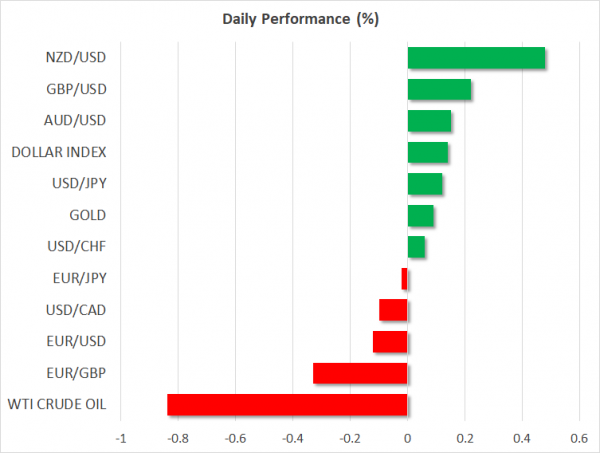

Markets naturally sank on the news. The S&P 500 closed 2.6% lower and futures point to another 0.4% loss when Wall Street opens today, with the battle between bulls and bears taking place near the 200-day moving average, which is a crucial support region. The dollar was the biggest beneficiary of defensive flows as the mood soured, while commodity currencies and oil prices were hit the hardest.

Separate news that Washington is considering fresh tariffs against European products added gasoline to the fire, reminding investors that trade tensions are very much alive, global pandemic or not. Some dire projections by the IMF didn’t help either. The high-profile institution slashed its forecasts for global growth quite sharply, citing weaker demand from extended social distancing measures.

Fed also a factor behind market wobbles?

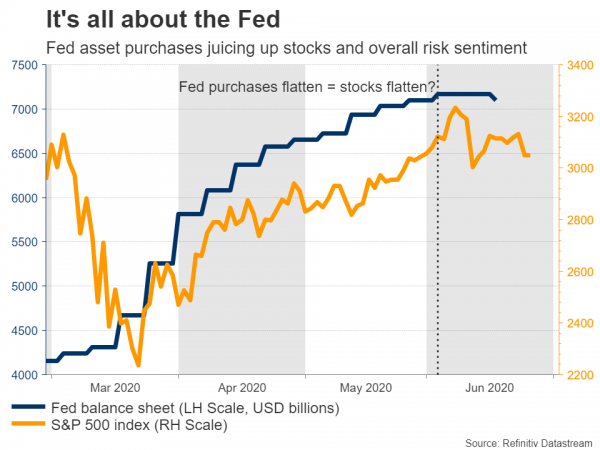

It’s quite striking that the latest wave of risk aversion came about just as the Fed’s balance sheet stopped expanding after several months of explosive growth. The central bank’s heavy-handed intervention in financial markets after the crisis hit is probably the biggest reason for the dynamic recovery in stock and bond markets, so even a small contraction in the Fed’s total asset holdings can have large ripple effects.

Of course, the latest contraction in the Fed’s balance sheet didn’t come about because the money printers have run out of paper or because policymakers are tapering their support, but rather due to technical factors like drops in repos and swap agreements. This implies that the balance sheet will continue to expand overall, but for now, we may be going through a period of reduced liquidity that augments virus fears.

That being said, the Fed isn’t the only game in town these days. The European Central Bank just announced it will set up its own facility to provide liquidity to non-euro area central banks, helping to turn the sour market mood around. European stocks crossed back into positive territory on the news, while e-mini futures tracking the S&P 500 recovered most of their earlier losses.

All eyes on virus cases

As for the rest of the day, the key driver will be the US virus numbers, especially out of California, Florida, and Texas. Further signs that the outbreak is accelerating would be a negative catalyst for stocks and a positive one for the dollar, and vice versa.

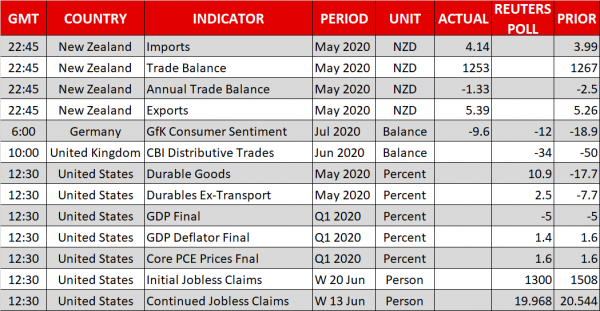

Initial and continuing jobless claims out of the US could also attract attention, to either confirm or refute the narrative that the labor market is getting its feet under it. The minutes of the latest ECB meeting are also due at 11:30 GMT.