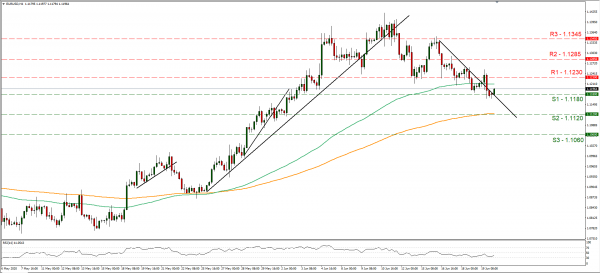

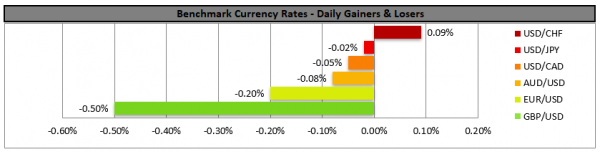

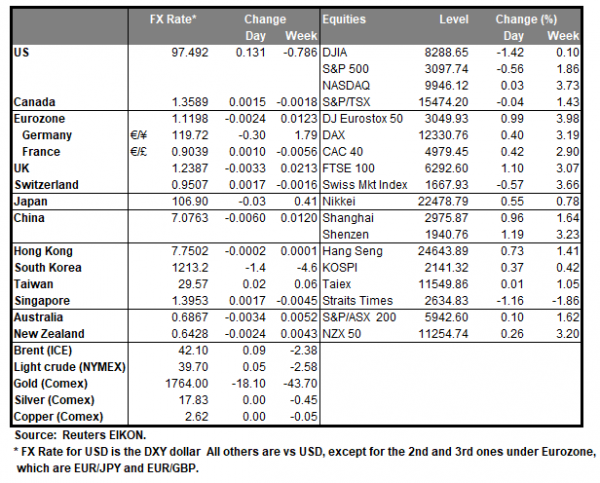

The USD strengthened slightly against some of its competitors on Friday and during today’s Asian session. Safe haven inflows seemed to be still present for the USD, as worries about a possible second coronavirus wave are rather elevated. However, the worries relate not only to the US, especially US Sun Belt states, but also to other parts of the world, like Brazil and Germany. EUR on the other hand was slightly weaker as after an EU summit, no breakthrough was reported regarding the EU’s rescue plan of €750 billion. It was characteristic that Sweden ,Denmark, Austria and the Netherlands said that the rescue plan was too large and that the support as well as the distribution of money not linked to the pandemic well enough and they oppose the idea of a common debt. It should be noted that Italy’s Prime Minister Conte stated that Italy is about to seek a wider budget gap as it tries to enhance its support for Italy’s economy. The issue had faced substantial criticism in the past and could create some turbulence for the EUR. EUR/USD dropped on Friday and broke the 1.1230 (R1) support line now turned to resistance yet bounced on the 1.1180 (S1) support line. The pair seems to have broken the downward trendline incepted since the 16th of June, hence we switch our bearish outlook in favour of a sideways movement initially. Should the pair come under renewed selling interest we could see EUR/USD breaking the 1.1180 (S1) line and aim for the 1.1120 (S2) level. If the pair finds fresh buying orders along its path, we could see it breaking the 1.1230 (R1) line and aim for the 1.1285 (R2) level.

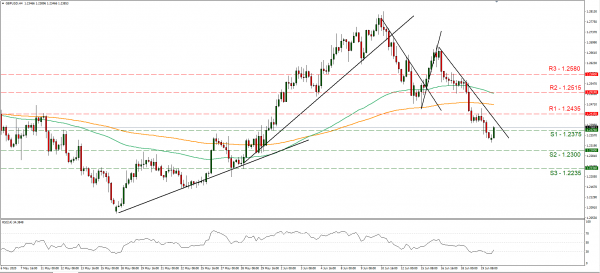

GBP failed to gain traction, despite retail sales for May jumping and outperforming market expectations, while media report that UK’s public debt exceeded its output for the first time since 1963, creating worries. At the same time Brexit related risks seem to intensify, as UK’s PM Johnson told French President Macron that negotiations cannot drag on until autumn. Both these two issues tend to weigh on the pound. On the other hand, Johnson seems about to outline further easing of pandemic rules as the countries “test and trace” system is to be introduced. UK finance minister Sunak is about to announce more stimulus measures next month, potentially including an emergency cut to value-added tax on goods. Both these issues could uplift the pound. GBP/USD dropped on Friday, yet recovered some losses, landing above the 1.2375 (S1) support line. We maintain our bearish outlook as long as cable remains under the spell of the downward trendline incepted since the 16th of June. If the bears maintain control, it could break the 1.2375 (S1) support line and aim for the 1.2300 (S2) level. If the bulls take over, GBP/USD could break the 1.2435 (R1) line and aim for the 1.2515 (R2) level.

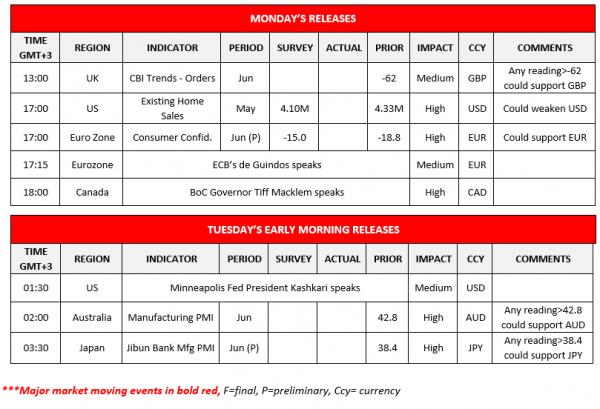

Other economic highlights today and early tomorrow

Today in the late European session, we get UK’s CBI trends (orders) for June, while in the American session we get the US Existing home sales for May and Eurozone’s consumer confidence for June. During tomorrows’ Asian session, we get Australia’s and Japan’s PMIs for June. Also please note that ECB’s de Guindos, BoC Governor Tiff Macklem and Minneapolis Fed President Kashkari are scheduled to speak today.

As for the rest of the week

On Tuesday, we get from France, Germany, the Eurozone, UK and the US, the preliminary PMI’s for June. On Wednesday, we get RBNZ’s interest rate decision, Germany’s Ifo indicators for June CNB’s interest rate decision. On Thursday, New Zealand’s trade balance for May, Germany’s GfK Consumer Sentiment for July, UK’s CBI distributive trades for June, Turkey’s CBRT weekly repo rate, and from the US the durable goods orders for May, the final GDP for Q1, and the initial jobless claims figure, are to be released. On Friday, we get Japan’s Tokyo inflation rates, and from the US the consumption rate and the final reading of the Michigan Consumer Sentiment for June.

Support: 1.1180 (S1), 1.1120 (S2), 1.1060 (S3)

Resistance: 1.1230 (R1), 1.1285 (R2), 1.1345 (R3)

Support: 1.2375 (S1), 1.2300 (S2), 1.2235 (S3)

Resistance: 1.2435 (R1), 1.2515 (R2), 1.2580 (R3)