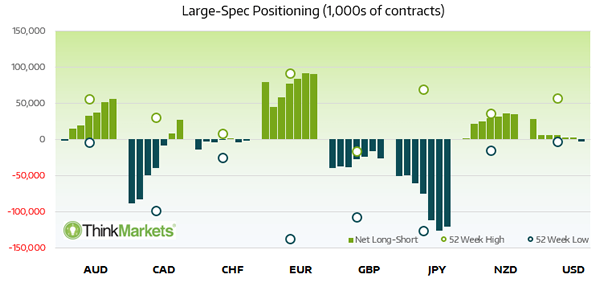

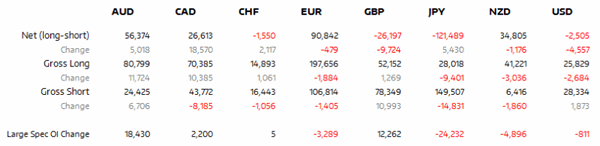

A snapshot of large speculator’s poitioning from the weekly CFTC report and analysis of related futures markets.

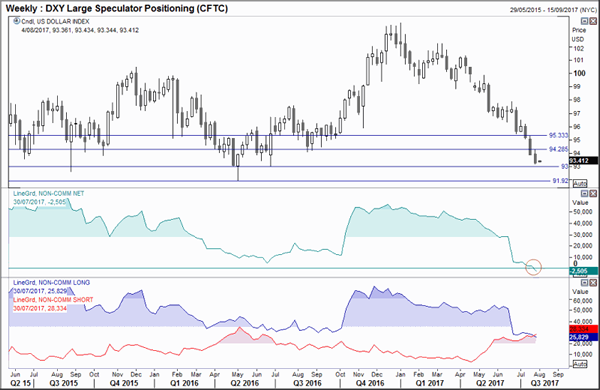

US Dollar index is now net short for the first time since June 2014

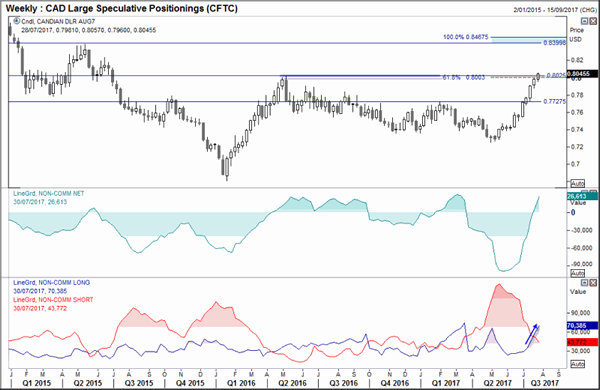

- The Canadian Dollar saw the largest week change of net positioning (+18.6k) which saw an increase of 10.4k long contracts and -8.2k short contracts.

- Overall it was minor adjustments to net positioning last week. With the exception of CAD, all other majors saw weekly net change below 10k

DXY: The US Dollar Index is now net short for the first time since June 2014. Momentum suggests we could be in for a break of 93 this week and head for the 91.92 low. This would be a significant event if this were to break, although we doubt it would do so upon first attempt. For now the near-term bias is for losses, although we are also aware of the potential for this to correct. Euro (below) made a suspiciously small bullish close last week to warn of sideways trading, and commodity currencies remain our preferred long bets this week.

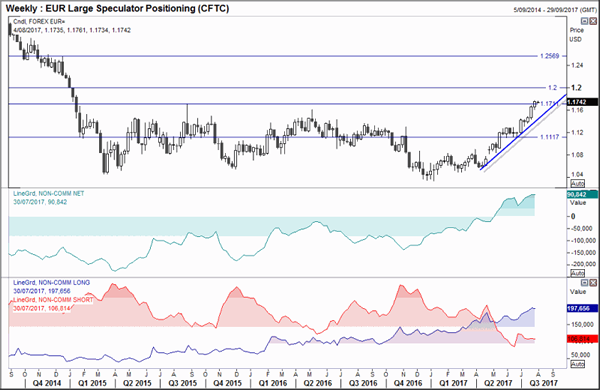

EUR: The close above the 2015 finally saw Euro break out of the 2.5yr range and likely has further to go from here. However, as last week’s range was relatively low and we have seen a slight reduction of hope interest, we suspect a pause in the rally may be due with potential for a correction. Even if we were to see sideways trading it would allow for rice to retest the bullish trendline where it could then make a run for 1.20.

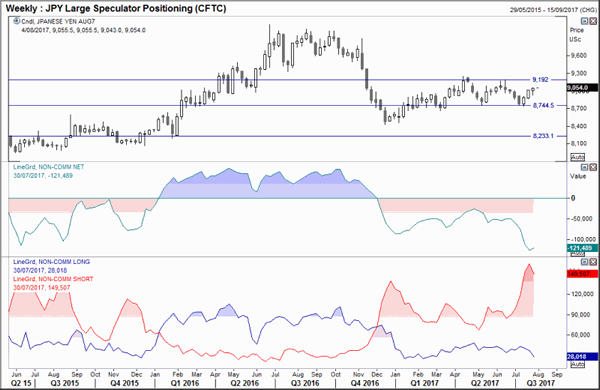

JPY: The third consecutive bullish week presented a hanging man candle to warn of potential weakness. However, we have seen a drop of short interest and long interest which also brings into question the strength of the past three weeks. As long interest is on the decline we doubt it will break above 9,192, although if we are to see this break to the upside we would want to see an increase in long positioning to confirm it.

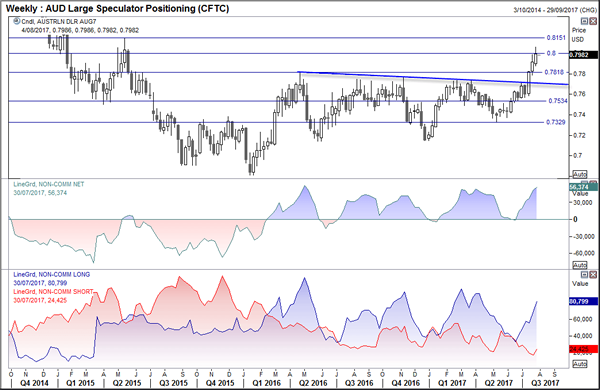

AUD: Net positioning is the most bullish since May 2016, although we also note a minor uptick in short interest. RBA are likely to verbally intervene as a rising currency creates issues for exports and growth, and this week’s RBA meeting may be the time to expect it. Technically it looks like it wants to push for the 0.8150 high, which is a likely outcome if the US Dollar continues to fall. As it is the Dollar’s weakness, not what RBA say that is the key driver here, so whilst US remains weak then AUD is on our bullish watchlist and RBS intervention is more likely to create a minor pullback over a reversal.

CAD: The close above the 2016 high last week puts the Canadian Dollar at its highest level since July 2015. The rally has been seen on rising bullish and falling bearish interest, making it a healthy trend with further upside potential. As BoC are less likely to verbally intervene, this makes CAD longs preferred over AUD, although both have potential to rise.