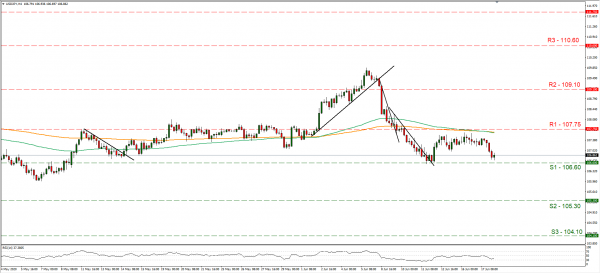

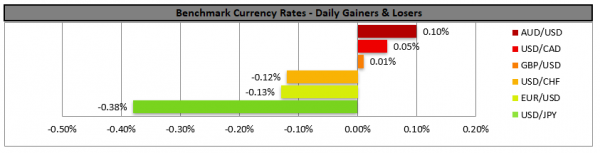

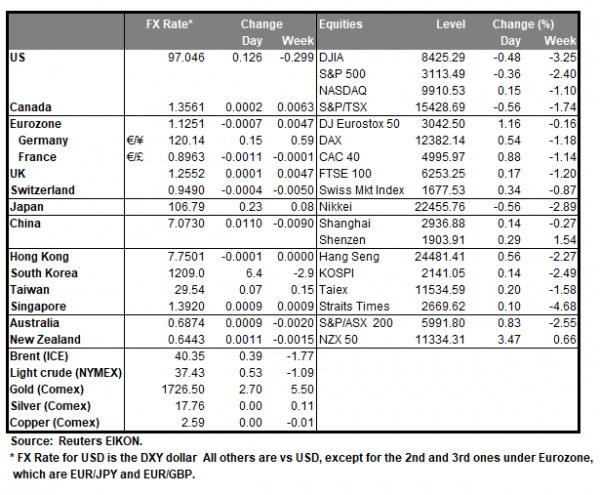

In a rather quiet market with little volatility worries seemed to have the edge yesterday, supporting the safe-haven qualities of USD and JPY. It should be noted that Fed Chairman Powell in his second testimony before the US Congress warned US lawmakers against withdrawing the fiscal stimulus. Analysts tended to note that concerns about the rise of Coronavirus cases, especially in Arizona, Texas and Florida intensified, however in the past week, US Treasury Secretary Mnuchin had stated that the US economy is not going to be shut down once again, even if the virus resurges. On another note, as per media, Trump’s former national security advisor Bolton in a book he wrote, accused Trump among others that President Trump asked explicitly Chinese President Xi Jinping’s help to win the 2020 elections. Trump answered calling Bolton a liar, yet the book that Bolton is about to release, tends to feed critics of the US President ahead of the November elections and at a very difficult moment for Trump, as Democratic nominee Joe Biden, seems to be leading the polls with a wide lead. We expect the USD to be somewhat data driven however should worries intensify about a rise of Coronavirus cases, we could see the safe haven qualities of the USD providing further support.USD/JPY maintained a sideways motion between the 106.60 (S1) and the 107.75 (R1) lines yet tended to show some bearish tendencies in the late American session as well as today’s Asian session. We maintain our bias in favor of a sideways movement, albeit it should be mentioned that the RSI indicator below our 4-hour chart is pretty low, reflecting the presence of the bears. If the selling momentum persists, we could see the pair having an attempt at the 106.60 (S1) line, which held ground on the 12th of the month and if successful, aim for the 105.30 (S2) level. If the pair’s long positions are favored by the market, USD/JPY could aim if not break the 107.75 (R1) line, aiming for the 109.10 (R2) level.

BoE interest rate decision eyed

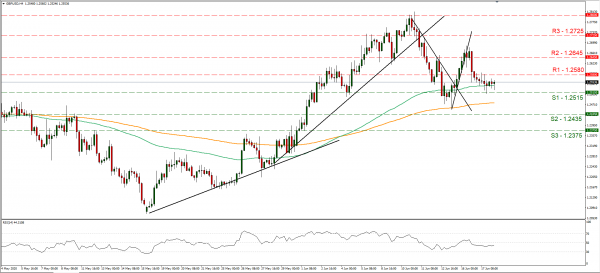

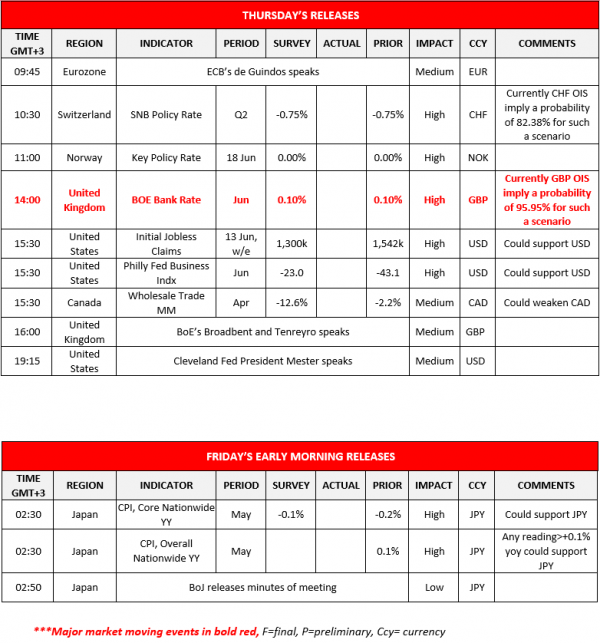

GBP seemed to be under pressure yesterday as worries about Brexit tended to weigh once again, while May’s inflation data tended to disappoint. It should be noted that the Brexit negotiations are expected to intensify, yet after a leak of a German government’s document it seems that Europeans expect the negotiations to enter a “hot phase” after the summer, despite UK PM Johnson stating that a solution was possible by the end of July. Pound traders are expected to turn their attention to BoE’s interest rate decision later today (11:00, GMT) and the bank is widely expected to remain on hold at +0.10% as GBP OIS imply a probability of 95.95% for such a scenario. Analysts after the substantial contraction of GDP in April, the disappointing CPI rates for May and the uncertainty of the Brexit negotiations are expecting the bank to expand its QE program by £100 billion. We could see the pound getting some support from the event as the BoE is expected to provide a supporting tone for the UK economy. GBP/USD maintained a largely sideways motion yesterday between the 1.2515 (S1) and the 1.2580 (R1) lines. We maintain our outlook for a sideways movement as the pair seems to remain rather steady, yet BoE’s interest rate decision as well as today’s financial releases could alter the pair’s direction. If the bulls take over the initiative over the pair’s direction, cable could break the 1.2580 (R1) line and aim for the 1.2645 (R2) level. If the bears prevail, the pair could break the 1.2515 (S1) support line, aiming for the 1.2435 (S2) level.

Other economic highlights today and early tomorrow

Today during the European session, we get SNB’s, Norgesbank’s and as mentioned above BoE’s interest rate decisions. In the American session, we get the US initial jobless claims figure, the Philly Fed Business Index for June and Canada’s Wholesale trade growth rate for April. During tomorrow’s Asian session, the release of Japan’s inflation measures seems to stand out. Also please note that BoE’s Broadbent and Tenreyro as well as Cleveland Fed President Mester are scheduled to speak today.

Support: 106.60 (S1), 105.30 (S2), 104.10 (S3)

Resistance: 107.75 (R1), 109.10 (R2), 110.60 (R3)

Support: 1.2515 (S1), 1.2435 (S2), 1.2375 (S3)

Resistance: 1.2680 (R1), 1.2645 (R2), 1.2725 (R3)