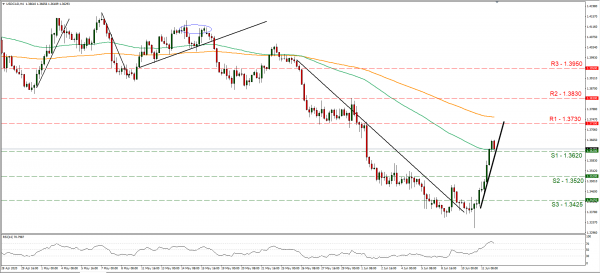

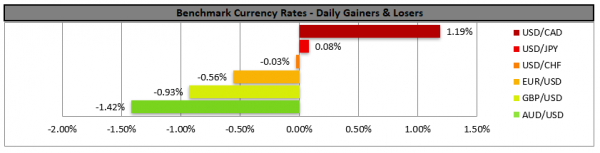

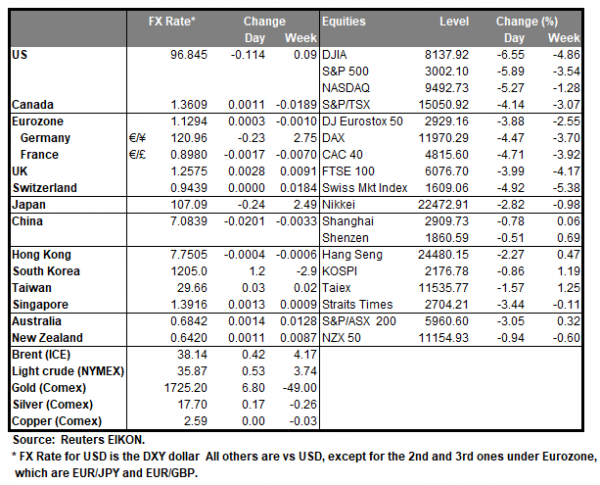

The USD gained against some of its counterparts yesterday, as its safe haven qualities were on display once again. It was characteristic that the greenback flattened against other safe haven currencies such as the Yen and Swiss Franc, while strengthened against the Aussie and the Loonie, typical commodity currencies as well as against the EUR and the pound. Analysts tend to note that the gloomy financial projections released from the Fed on Wednesday, may have scared investors and created increased demand for safe havens, while at the same time causing stock markets to fall. Without disputing it, we would also like to note that the USD may have been undervalued since the beginning of the week, as we had noted a week ago. The new rise of COVID 19 cases and headlines surfacing about new lockdown measures in various states of the US such as California, may have also contributed increased safe-haven inflows for the USD. Should investors’ flight to safety continue we could see the USD gaining further ground in the next couple of days. USD/CAD rallied yesterday breaking the 1.3520 (S2) resistance line as well as the 1.3620 (S1) resistance level, both now turned to support. Besides USD fundamentals as analyzed above, the CAD side seemed to weaken as oil prices dropped yesterday, fueling the rally further. We currently maintain the bullish outlook for the pair as long as the pair follows the upward trendline incepted since the 10th of June. Please note though that we would not be surprised to see the prementioned trendline shifting to the right, as the ascent of the pair was quite steep, and some correction seems allready to be present. If the pair finds fresh buying orders along its path, we could see it breaking the 1.3730 (R1) line aim for the 1.3830 (R2) level. Should the bears take charge of the pair’s direction, we could see it breaking the 1.3620 (S1) line and aim for the 1.3520 (S2) barrier.

Pound weakens as Brexit weighs

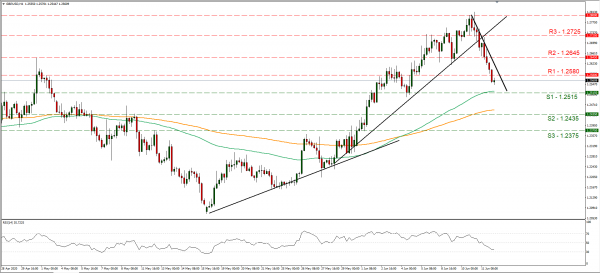

The pound weakened against the USD, EUR, CHF and JPY yesterday, as a flight to safety and Brexit concerns forced investors to reverse their positions. Analysts tend to note that the pound’s behavior lately intensely resembles a “risk” currency, gaining when market sentiment is risk-on, while losing ground when the market is more cautious, and we tend to agree with the above statement. It seems that BoE Governor Bailey’s comments on Wednesday that green shoots have begun to appear in the economy now that the worst of the lockdown has passed, seemed to have failed to convince pound traders. Also, Brexit risks tend to weigh on the pound as the UK faces a deadline at the end of the month to ask for an extension of the Brexit deadline, which is until the end of the year. EU member states such as France seem to harden their positions reportedly about fisheries, which some concessions from the EU side were possible, hence increasing the possibility of a deadlock in the negotiations, thus could weigh on the pound. Pound traders may focus on today’s UK financial releases which could highlight the adverse effect of the lockdown measures in the UK during April. As mentioned, GBP/USD tumbled breaking the 1.2645 (R2) as well as the 1.2580 (R1) support lines, both now turned to resistance. For our bearish bias to change we would require a clear breaking of the downward trendline incepted since the 10th of the month. If the pair remains under the selling interest of the markets, we could see it breaking the 1.2515 (S1) support line and aim for the 1.2435 (S2) support level. On the flip side should bulls dominate, cable could break the 1.2580 (R1) line and aim for the 1.2645 (R2) level.

Other economic highlights today and early tomorrow

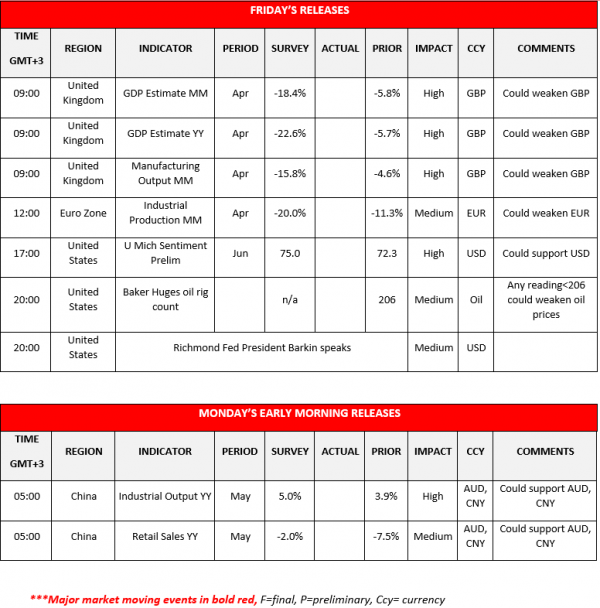

Today in the European session, we get UK’s GDP rates as well as the manufacturing output growth rates while from the Eurozone we get the industrial output growth rate, all for April. In the American session, we get from the US, the preliminary U. Michigan Sentiment for June as well as the Baker Hughes oil rig count. During Monday’s Asian session we get China’s industrial output and retail sales, both for May. Also please note that Richmond Fed President Barkin is scheduled to speak today.

Support: 1.3620 (S1), 1.3520 (S2), 1.3420 (S3)

Resistance: 1.3730 (R1), 1.3830 (R2), 1.3910 (R3)

Support: 1.2515 (S1), 1.2435 (S2), 1.2375 (S3)

Resistance: 1.2580 (R1), 1.2645 (R2), 1.2725 (R3)