- No action expected from Fed today, but signals will determine whether the ‘risk party’ can keep going

- Dollar extends losses ahead of rate decision, Nasdaq hits new record high

- Sinking greenback raises all other boats – euro, pound, franc, and commodity currencies near highs

- We’ll also hear from key ECB and BoE officials, and the EU’s top Brexit negotiator

Markets take a breather ahead of the Fed

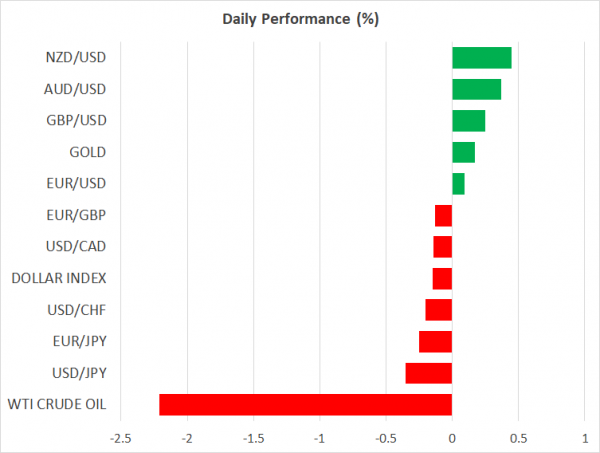

Risk appetite cooled a little on Tuesday in a move that generally looked like some profit-taking after an astonishing rally across multiple charts, with little in the way of news to justify the more cautious mood. The turbocharged commodity currencies – the loonie, aussie, and kiwi – all retreated even against a dollar that was weak itself, while stock markets mostly pulled back from their recent highs as investors took some chips off the table ahead of today’s Fed decision.

Yet, the market has regained its footing on Wednesday and the mood is more cheerful, with commodity currencies on the rise again, the defensive dollar on the back foot, and futures pointing to some mild gains when Wall Street opens. In other words, a continuation of the optimistic trends.

Will Fed add fuel to recent trends, or trigger a reversal?

Whether this serenity can last though, will depend on the Fed. Having acted powerfully already and with some recent signs that its actions were indeed effective in averting a deeper crisis, the Fed is not expected to make any more moves today. Instead, all the price action will come from the signals about how long rates will stay low, if yield curve control is a real possibility, and from the updated economic projections.

Following the recent encouraging US employment report, some think the Fed might take its foot off the accelerator. However, it’s probably much too early for that. Policymakers have been far less sanguine than market participants about the outlook and have routinely highlighted that the recovery may be protracted, so the last thing they want is to risk making a policy mistake by suggesting the stimulus may be withdrawn early.

Why undermine all your previous efforts by changing your stance prematurely, especially since there’s virtually no inflation risk on the horizon? In short, the Fed will likely stick to its uber-dovish stance until it has clearer evidence of a recovery, not just a single data point.

A reaffirmation of the ‘low rates as far as the eye can see’ stance and even more importantly, any hints that yield curve control is under serious consideration, would argue for another push higher in stocks and more pain for the greenback. Anything short of that would likely trigger a U-turn in both assets.

Multiple charts await breakout or rejection

The outlier yesterday was the Nasdaq (+0.3%), which hit a new record high despite the broader ‘risk off’ tones and is primed for another positive open today. The tech-heavy index continues to outperform as investors pile into higher quality names like Apple (+3.2%) and Amazon (+3.0%), both of which hit new records. That said, these companies don’t exist in a vacuum and rich valuations are becoming a concern given the wider outlook for consumption.

Back to the FX market, the drop in the dollar has helped to lift most other currencies, with the euro, yen, pound, franc, and the commodity currencies all hovering near multi-week or multi-month highs. The S&P 500 is a similar story. When multiple charts approach key resistance or support levels like that, it’s a signal the market is waiting for a catalyst for a break or a rejection, and that will likely be the Fed today.

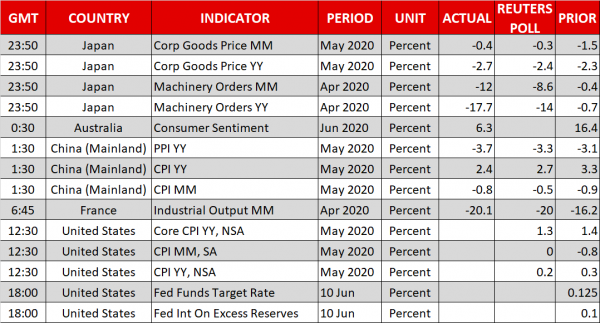

Finally, besides Fed Chairman Powell (18:30 GMT), we will also hear from BoE Governor Bailey (12:30 GMT), EU chief Brexit negotiator Barnier (13:00 GMT), and ECB Vice President de Guindos (13:30 GMT).