The US dollar eased slightly as the Federal Reserve started its monetary policy meeting. Analysts expect the bank to leave interest rates unchanged and continue with its open-ended quantitative easing program. Some expect the bank to initiate a new tool to support the economy. In this, the bank will place a target on the US government treasury yields in a similar way to the Bank of Japan. This rate decision comes at a time when business conditions have resumed in most US states. According to recent data, more than 2.5 million were employed in May, auto sales are improving, and fewer people are seeking mortgage forbearance.

The Japanese yen strengthened slightly after Japan released its machinery orders data. According to the bureau of statistics, the core machinery orders declined by 12% in April. This was worse than the previous decline of 0.4% and the median estimates of 8.6%. The orders dropped by 17.7% on an annualised basis. Meanwhile, producer prices declined by 2.7% in May, which was worse than the expected 2.4%. They fell by 0.4% on a month on month basis. These numbers show that the Japanese economy is still experiencing challenges especially after overtime pay declined by 12.2% in April.

The price of crude oil declined during the American session after the American Petroleum Institute (API) released last week’s inventories data. The data showed that inventories rose by 8.4 million in the previous week after declining by 500,000 barrels a week before. Later today, the Energy Information Administration (EIA) will release its inventories data. Analysts expect the numbers to show that inventories declined by more than 1.7 million barrels.

EUR/USD

The EUR/USD reversed yesterday’s declines during the Asian session. The pair is trading at 1.1344, which is higher than yesterday’s low of 1.1240. On the four-hour chart, the price is still above the 50-day and 100-day EMAs and is also above the 61.8% Fibonacci retracement level. It is also above the Variable Index Dynamic Average. The pair may continue to rise as bulls attempt to move past the Friday’s high of 1.1385.

XBR/USD

The XBR/USD pair declined to an intraday low of 39.68. On the four-hour chart, the price is slightly above the 50-day and 100-day EMA while the RSI has declined from the overbought level of 81 to the current 51. Also, the price is still in an upward trend as shown by the white trendline below. This means that the pair may continue to rise as bulls attempt to retest the previous high at 43.30.

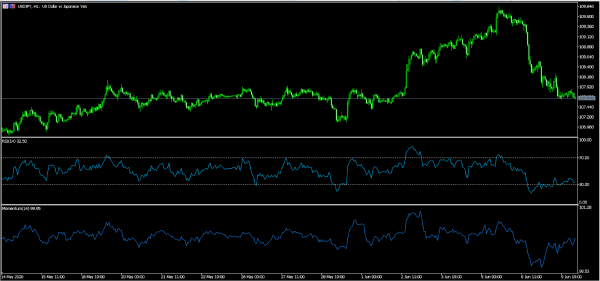

USD/JPY

The USD/JPY pair declined to an intraday low of 107.63, which is the lowest it has been since June. On the hourly chart, the price is below the 50-day and 100-day exponential moving averages while the RSI is slightly above the overbought level. The momentum indicator has been rising as the price has been in a sharp downward trend. The pair could continue easing ahead of the FOMC decision later today.