For the 24 hours to 23:00 GMT, the EUR declined 0.44% against the USD and closed at 1.1289 on Friday.

On the data front, Germany seasonally adjusted factory orders dropped 25.8% on a monthly basis in April, due to the coronavirus pandemic and recording its largest decline since 1991. In the prior month, factory orders had recorded a revised drop of 15.0%.

The US dollar increased against the euro, following stronger-than-expected US jobs report.

Data showed that the US nonfarm payrolls unexpectedly rose by 2509.0K in May, defying market expectations for a drop to a level of 8000.0K and compared to a revised fall of 20687.0K in the previous month. Additionally, the unemployment rate unexpectedly dropped to 13.3% in May, defying market consensus for a rise to 19.8% and compared to a rate of 14.7% in the prior month. Meanwhile, average hourly earnings unexpectedly fell 6.7% on a yearly basis in May, confounding market forecast for a rise of 8.5% and compared to a revised rise of 8.0% in the previous month. Moreover, consumer credit declined by $68.8 billion in April, compared to a decline of $12.0 billion in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1291, with the EUR trading marginally higher against the USD from Friday’s close.

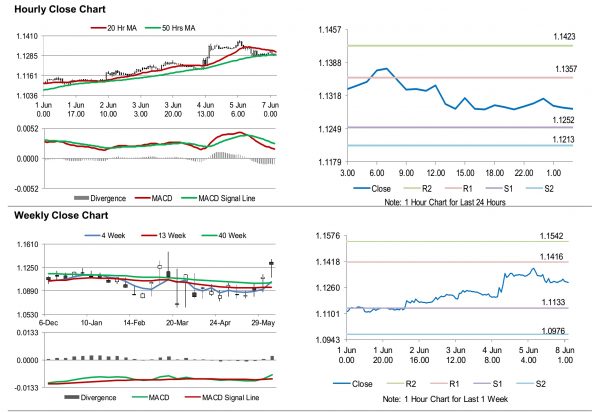

The pair is expected to find support at 1.1252, and a fall through could take it to the next support level of 1.1213. The pair is expected to find its first resistance at 1.1357, and a rise through could take it to the next resistance level of 1.1423.

Moving ahead, traders would keep a watch on Euro-zone’s Sentix investor confidence for June and Germany’s industrial production for April, slated to release in a few hours.

The currency pair is trading below its 20 Hr moving average and showing convergence its 50 Hr moving average.