- Payroll employment increased by 2.5 million in May

- The unemployment rate fell to 13.3% and participation rose

- Hours worked still down 13% vs. pre-pandemic

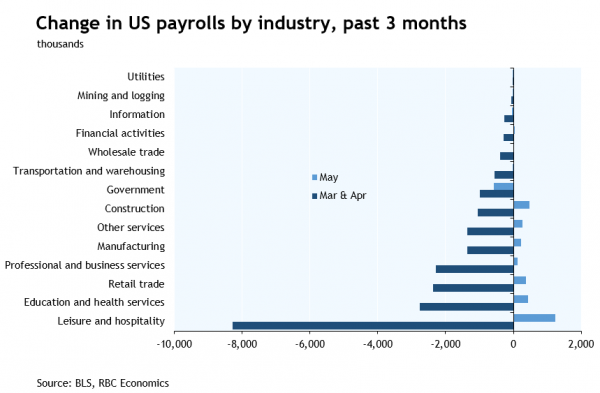

This morning’s US employment numbers were a significant and welcome upside surprise relative to consensus for a further 7.5 million job losses. We know from continuing claims data that the labour market started to turn a corner in the reference week (the second week of May) but today’s result is much stronger than that data suggested. With states beginning to re-open their economies to varying degrees, 9 of 13 industries added jobs in the month with nearly half the gains coming in the hard-hit leisure & hospitality sector. The unemployment rate fell to 13.3% in May from 14.4% in April as the number of persons on temporary layoff declined by 2.7 million. We also saw improvement in what has become a converse economic indicator: average hourly wages fell in May as job gains were concentrated in lower-wage workers who have been hit particularly hard by the coronavirus crisis.

Today’s numbers are a clear step in the right direction for the US labour market. There is still a long way to go, though, with payroll employment and hours worked both 13% below their pre-crisis levels. It remains the case that 3/4 of unemployed persons are on temporary layoff, and that should ease the transition back to work as health restrictions continue to be eased. We’re likely to see more strong jobs data in the coming months, though we think it will take a long time for the labour market to fully recover from the coronavirus shock. We expect the unemployment rate will remain elevated (but not in the double digits) by the end of this year, which should keep policymakers in stimulus mode.