The cocktail of violent protests across US major cities and a rising risk appetite upset the dollar and let other major currencies collect sizeable gains for more than a week now. On Friday at 12:30 GMT the famous nonfarm payrolls report may not be an ideal one, but it could add some floor under the buttered greenback if the data indicate that the worst of job losses is likely behind.

The worst could be befind us

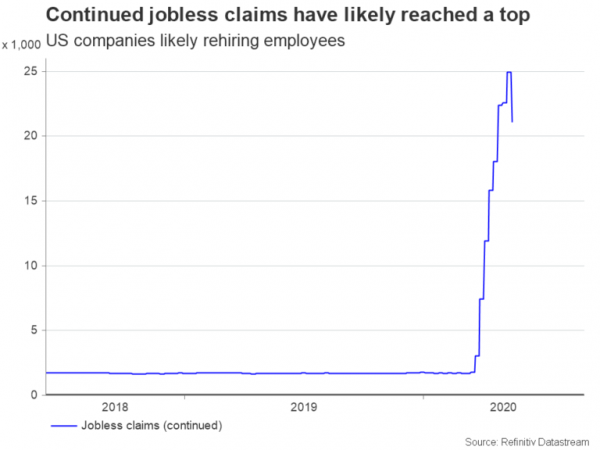

The destructive protests, which have set buildings on fire, are another headache to brick-and-mortar retailers who are gradually resuming business activities after two months in a lockdown and should the demonstrations extend further, June’s employment report (due in July) may underestimate the real picture of a recovering labour market. So far, more than 40 million Americans have filed for initial jobless claims, but the weekly number has been quickly decelerating since the peak at a record high of 7 million in April, indicating that the government’s aid programs that aim to cover wage costs for the hardest hit by the virus companies have started to take effect. More importantly, the measure which tracks the number of people who have applied for unemployment benefits more than once has also started to correct lower, adding evidence that companies are re-hiring staff.

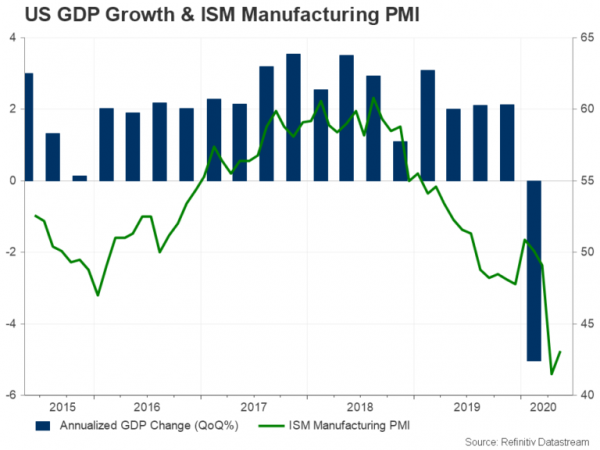

This week the ISM PMI survey for the month of May further drove hopes that the worst may be behind us despite arriving weaker-than-expected. The manufacturing and services PMI readings remained in the contraction area but managed to extend the rebound from record lows, while more encouraging was the improvement in the employment and new orders sub-indices, which signalled that the business recovery could pick up steam in the coming months.

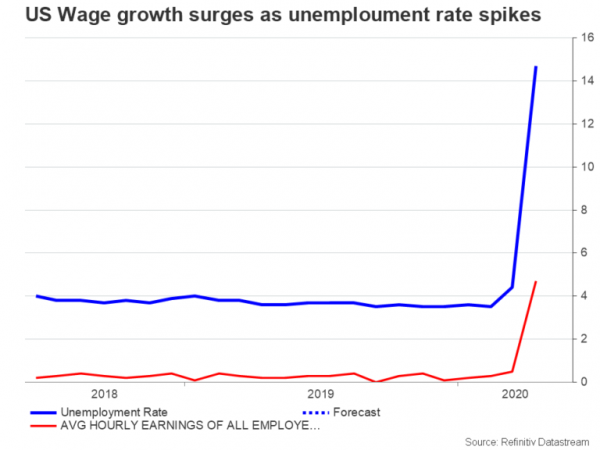

Friday’s Nonfarm payrolls for the month of May are now expected to enhance this positive sentiment and give a breather to the dollar If the data show that job positions declined by 8 million, much less than April’s devastating loss of 20.5 million. On the other hand, the unemployment rate may surge from 14.7% to a staggering 19.8%, but a growth slowdown in monthly average hourly earnings, which are forecast to ease from 4.7% m/m to 1% in May, could reveal that low-income employees, whose job cuts were the most severe, are returning to work now amid the relaxing measures and the rising traffic in the US and elsewhere in the world.

Fed could take a back seat, but stumulus plans may remain on the table

Everyone is aware that a quick bounce back to record low unemployment rate levels could be a tough task as governments may not fully remove restrictions before an effective vaccine comes to light, forcing companies to operate at limited capacity for longer. However, at the current re-opening phase governments and central banks are thirsty for some encouraging news that point to a V-shaped economic recovery and the NFP release this week, although still painful, could add weight to that view if the job numbers show that re-hiring has begun to outpace new layoffs in May.

Note that the Federal Open Market Committee is gathering next week to decide on policy. Hence, after the upside susprise in the private ADP employment survey on Wednesday, the NFP readings could arrive at a good time to help policymakers figure out whether they should introduce more aggressive stimulus actions to boost market confidence such as the controversial negative interest rates or/and the risky Main Street Lending program that aims to help small and medium-sized companies that don’t have access to public markets.

Could the dollar get its blood back?

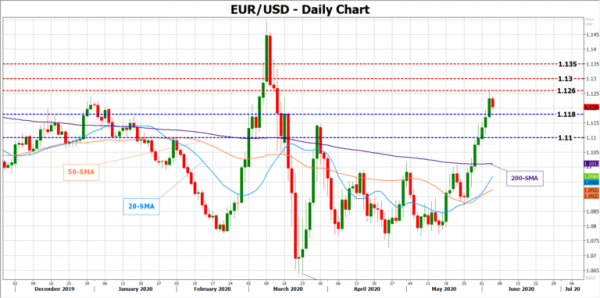

Better-than-expected employment figures could persuade the Fed to take a back seat and wait and see how the economy is responding to the existing programs. In this case, the dollar could find the opportunity to get some blood back from its major rivals such as the euro which enjoys an exciting rally on the back of the dollar’s weakness, the re-opening phase, and rising prospects of a better fiscal co-ordination between the EU member states.

Technically, EUR/USD could stabilize near the 1.1260 resistance level and slip lower to retest the 1.1180 barrier. If the latter fails to act as support, the selling pressure could strengthen towards the 1.1100 mark.

Otherwise, should the NFP disappoint noticeably, the euro bulls could break the wall around 1.1260 and gear towards 1.1300, while slightly higher the 1.1350 hurdle could next come into the radar.