For the 24 hours to 23:00 GMT, the AUD declined 1.62% against the USD and closed at 0.6792.

LME Copper prices rose 0.8% or $44.0/MT to $5,376.5/MT. Aluminium prices declined 0.2% or $3.5/MT to $1,511.5/MT.

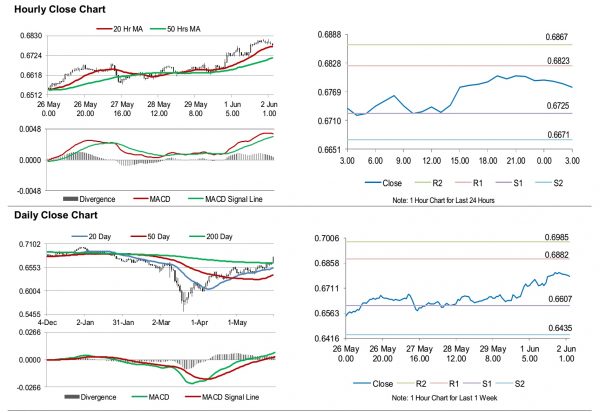

In the Asian session, at GMT0300, the pair is trading at 0.6779, with the AUD trading 0.19% lower against the USD from yesterday’s close.

Overnight data showed that Australia’s current account surplus widened to A$8.4 billion in the first quarter of 2020, compared to a surplus of A$1.0 billion in the previous quarter.

The Reserve Bank of Australia, in its latest policy meeting, kept its key interest rate unchanged at 0.25%, as widely expected.

The pair is expected to find support at 0.6725, and a fall through could take it to the next support level of 0.6671. The pair is expected to find its first resistance at 0.6823, and a rise through could take it to the next resistance level of 0.6867.

Going forward, AiG performance of construction index and the Commonwealth Bank services PMI, both for May, along with building permits for April, and gross domestic product for 1Q 2020, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.