U.S. Highlights

- Optimism on economic recovery and new fiscal stimulus measures lifted equity markets this week.

- Economic data continued to show the plunge in activity due to lockdown. Real personal spending was down 13.2% in April and close to 20% since February.

- The good news is that fiscal supports more than offset the impact of the drop in employment and other sources of income, allowing for a strong gain in disposable income and an unprecedented rise in the personal saving rate to 33%.

Canadian Highlights

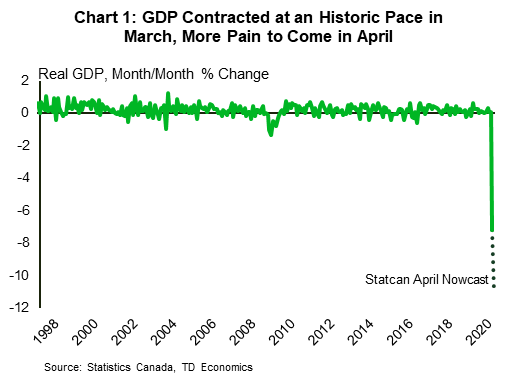

- The Canadian economy shrank by 8.2% annualized rate in the first quarter. Monthly GDP contracted by 7.2% (non-annualized) in March. More pain is in store for April, with Statistics Canada projecting an 11% decline in the month.

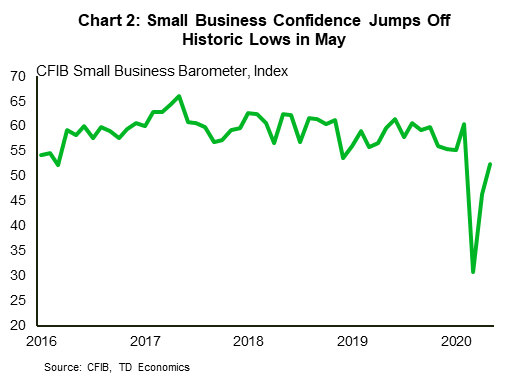

- It’s clear that the Canadian economy was in a huge hole in April. However, May has brought some good news, with the CFIB small business confidence index rising to its highest level since February.

- CMHC is projecting a significant decline in home prices next year. These forecasts appear to be conditioned on further sales declines, which may be tough to realize given historically depressed current levels.

U.S. – Spending Plunges but Fiscal Supports Boost Income

Equity investors were relatively upbeat (again) this week. Rising political tensions between China and the U.S. took the steam out of momentum as the week ended, but even so, the S&P 500 was up over 2% as of writing on Friday.

On the economic front, higher frequency and survey-based data continue to show nascent signs of recovery, while traditional, but lagged indicators demonstrate the extent of decline in activity through the peak lockdown period in April.

This story was most evident in plunging personal spending data. Real, inflation-adjusted spending fell over 13% (non-annualized) in April. On top of the 6.7% decline in March, this brings total spending down nearly 20% since February.

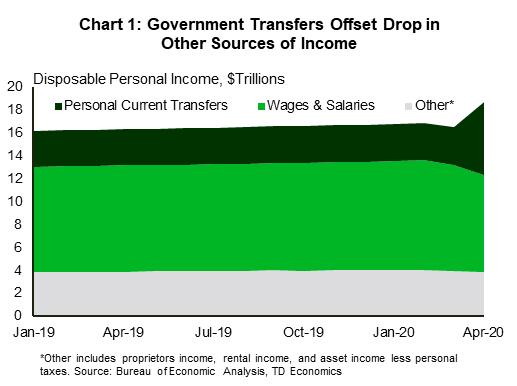

Encouragingly, the same plunge did not occur on the income side, where government transfers more than offset the drop in market income (Chart 1), allowing real disposable income to rise a record 13% in the month.

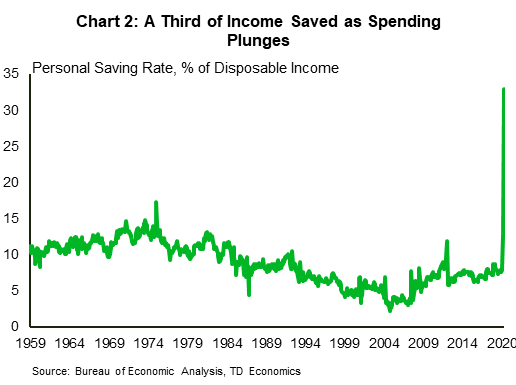

With the combination of a drop in spending and higher income, the personal saving rate rose to a truly extraordinary 33% (Chart 2). This is a hopeful sign that timely government income supports have done their job in setting the conditions for a healthy rebound in spending in the second half of the year.

Indeed, this has likely contributed to an improvement in consumer expectations. This week, the Conference Board reported that consumers remained negative on the current economic situation in May, but their expectations for the future moved higher. Economic optimism appears to be moving higher across major economies. In Europe, economic sentiment also improved according to a European Commission poll, led by expectations for employment.

Sticking with Europe, another hopeful sign this week was the European Commission’s announcement of an ambitious economic recovery proposal worth 750 billion euros – 5% of GDP. The proposal is split between 500 billion in grants and 250 billion in loans. Countries such as Italy, will receive significant support, which is important since it is facing high debt levels and rising borrowing costs. It remains to be seen if European countries will accept the proposal as it will require new revenues sources and must be passed with unanimous support of all 27 member states.

Next week is a big one on the economic front, with ISM data and the employment report for May. Jobless claims data continue to show a fall in new applications, but a high number of continuing claims – especially after including those who qualified under expanded benefits, suggests that May could see the unemployment rate rise from April. Fingers crossed, this should be the peak.

Canada – Economy Records Historic Contraction in Q1

It was a case of rising tides lifting all boats as hefty stimulus packages announced in Europe and Japan this week helped buoy financial markets around the globe, including in Canada. The TSX moved higher through most of the week, although, as of writing, appears to have lost some momentum on Friday.

On the data front, the marquee event this week was the release of Canadian GDP for the first quarter. Markets had been primed for an ugly result. Back in April, Statistics Canada released their nowcast calling for a truly horrific 10% (annualized) contraction in first quarter GDP. In the event, GDP came in somewhat above this projection, dropping by 8.2%. Household consumption posed the largest drag on GDP, as social distancing measures, job losses and government shutdowns of several industries led to an historic decline in spending. Industry-based GDP also plunged 7.2% (non-annualized) in March, providing terrible momentum heading into the second quarter. This, alongside an absolutely gruesome month for the economy in April (Statistics Canada’s nowcast, released alongside the first quarter GDP report, points to an 11% monthly contraction), sets up the economy to retrench at a nightmarish pace of around 40% annualized in the second quarter.

It clear that the Canadian economy has a huge hole to dig itself out of. Fortunately, there were tentative indications this week that at least some of the digging was done in May. Indeed, the May CFIB small business barometer, a measure of small business confidence, climbed above 50 for the first time since February and was up 22 points from its March nadir recorded at the onset of the pandemic. Progress on provincial re-opening plans and the rollout of government support program are likely stoking some optimism among small businesses.

Of course, with small businesses operating at only half their capacity, it’s clear that their road back to a new “normal” will be tough. This is true not just for small businesses, but many parts of the Canadian economy. This was reinforced by the headline-grabbing forecast for the housing market released by CMHC this week, calling for notable weakness ahead. Digging into their projection, they expect sales will continue to fall through this year from what appears to be an optimistic starting point in the second quarter, while rising at subdued rates in 2021. Our own projection builds in an historic decline in second quarter sales but anticipates improvements from there as provincial re-openings unfold and labour markets improve.

The most attention-grabbing part of CMHC’s forecast was undoubtedly the call for declines in average home prices of between 9-18%. However, those forecasts are peak-to-trough from pre-pandemic levels, not annual average changes, as is what is typically is reported. On this basis, their forecasts range from a modest gain to a small drop this year, followed by more substantial declines in the order of 6-11% in 2021. Drops of this magnitude next year are certainly possible. However, with sales already at their lowest level since at least 1988 in April, and some pent-up demand already evident, we are comfortable with our more sanguine view..

U.S: Upcoming Key Economic Releases

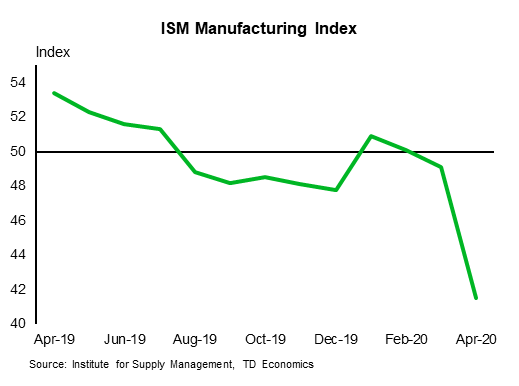

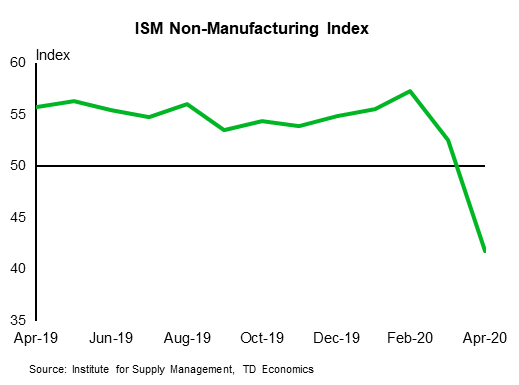

U.S. ISM Manufacturing/Non-Manufacturing Index- May

Release Date: June 1, 3, 2020

Previous: 41.5/41.8

TD Forecast: 44.5/44.0

Consensus: 43.5/44.0

Regional surveys, as well as the Markit PMI data, have been showing some fading of weakness in May. The surveys’ details have been showing more fading of weakness than the headline data due to a reversal of earlier strength in the deliveries components. Index levels have remained in contraction territory, however. The ISM surveys will likely show the same pattern. We forecast modest increases for the manufacturing and non-manufacturing indices to 44.5 and 44.0, respectively.

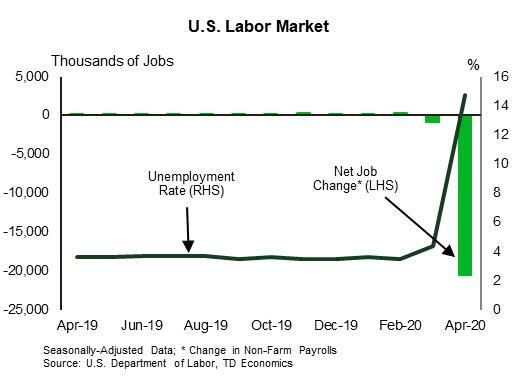

U.S. Jobs Report – May

Release Date: June 5, 2020

Previous: -20.5mn, unemployment rate 14.7%

TD Forecast: -3mn, unemployment rate 17.5%

Consensus: -8mn, unemployment rate 19.5%

Payrolls probably fell again (TD forecast: -3mn), but by much less than in April (when they plunged by 20.5mn). The drop in continuing claims in the latest weekly report suggests a turning point, with hiring starting to recover, but the net result was probably still a decline on a monthly basis. Unemployment likely rose again (TD: 17.5%), due in part to a reversal some of the statistical issues that held down the rise in April, but it should start declining after May.

Canada: Upcoming Key Economic Releases

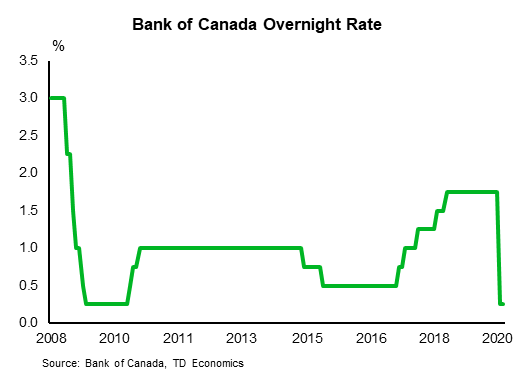

Bank of Canada Rate Decision

Release Date: June 3, 2020

Previous: 0.25%

TD Forecast: 0.25%

Consensus: 0.25%

The Bank of Canada’s June meeting will see the torch passed to Governor Designate Macklem, although we do not expect any major changes in the Bank’s message (this meeting takes place during his second day as Governor). We look for the BoC to keep the overnight rate unchanged at 0.25% and hold back on any changes to its major liquidity programs (LSAP, PBPP, CBPP), although there is some scope for the Bank to scale back less utilized programs. The statement should maintain a cautious tone, even if acknowledging that conditions are evolving in line with the Bank’s less pessimistic scenario from April, while the forward looking portion should repeat that the Bank stands ready to adjust its programs if necessary.

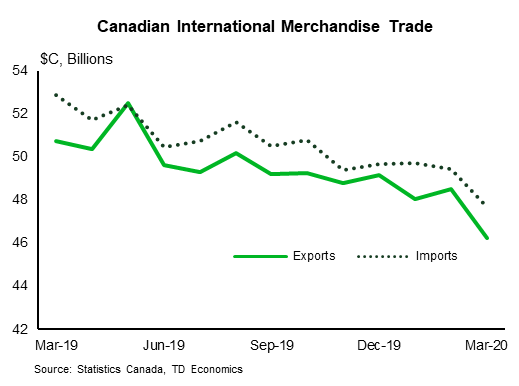

International Merchandise Trade – April

Release Date: June 4, 2020

Previous: -$1.4bn

TD Forecast: -$3.4bn

Consensus: NA

International trade will give an early look at industrial activity for April and all indications suggest it could be quite ugly. TD looks for large double digit declines across both imports and exports with the trade deficit widening to $3.4bn from $1.4bn the prior month. Transportation products should lead the decline on the export side; monthly auto production fell to zero for the first time on record after producers shutdown in mid-March, and the aerospace sector should not fare much better.

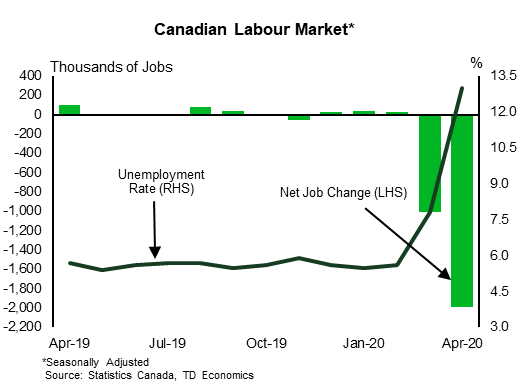

Labour Force Survey – May

Release Date: June 5, 2020

Previous: -1994k, unemployment rate: 13.0%

TD Forecast: -250k, unemployment rate: 13.5%

Consensus: NA

The Canadian labour market should see further job losses in May, albeit modest by recent standards, with employment forecast to decline by 250k. Our forecast for additional job losses reflects another significant (>1m) increase in emergency benefit applicants between the April and May reference weeks, which should offset those returning to work. Usage of emergency wage subsidies remained relatively modest through early May, after the program became operational during the last week of April, and official “reopening” plans only began to pick up steam later in May. A 250k decline should push the unemployment rate to 13.5%, a new record, with risks of an even higher print if participation continues to drift lower. Given the potential for large swings in the average workweek, we will also be keenly focused on the change in total hours worked to benchmark Q2 growth.