For the 24 hours to 23:00 GMT, the EUR rose 0.29% against the USD and closed at 1.1014, after the European Commission proposed a stimulus plan to contain the effect of the coronavirus pandemic.

European Central Bank (ECB) President Lagarde, in her speech, warned that Eurozone’s economy is likely to contract as previously outlined in the bank’s medium to severe scenarios. She added that output in the region was set to shrink between 8% and 12% and the bank’s mild scenario which estimated a negative growth of 5% was “already outdated”. Further, Lagarde expressed confidence that higher public spending would not result in a new debt crisis in the euro area.

In the US, the MBA mortgage applications rose 2.7% on a weekly basis in the week ended 22 May of 2020, compared to a drop of 2.6% in the previous month. Additionally, the Richmond Fed manufacturing index climbed to -27.0 in May, more than market forecast for a rise to a level of -47.0 and compared to a reading of -53.0 in the previous month.

The US Federal Reserve Chairman Powell, in its Beige Book, indicated that economic activity “sharply” declined across all 12 Fed districts, reflecting disruptions associated with the COVID-19. Moreover, the US economy witnessed steep job losses with sectors such as leisure and hospitality being the hit hardest due to social distancing guidelines. Moreover, the report indicated that the outlook remained highly uncertain and most businesses were pessimistic about the potential pace of recovery.

In the Asian session, at GMT0300, the pair is trading at 1.1021, with the EUR trading 0.06% higher against the USD from yesterday’s close.

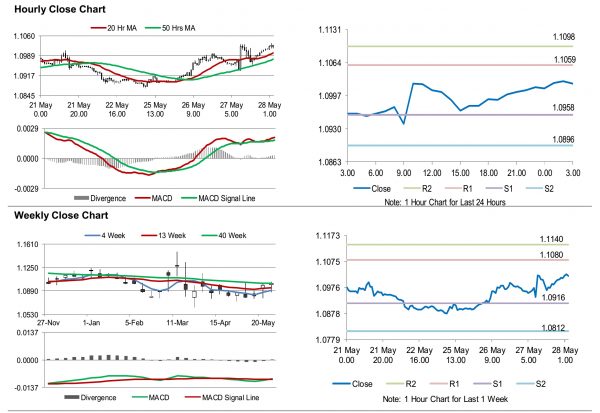

The pair is expected to find support at 1.0958, and a fall through could take it to the next support level of 1.0896. The pair is expected to find its first resistance at 1.1059, and a rise through could take it to the next resistance level of 1.1098.

Moving ahead, traders would keep a watch on Euro-zone’s consumer confidence, industrial confidence, business climate and economic sentiment indicator, all for May, along with Germany’s consumer price index for May, slated to release in a few hours. Later in the day, the US annualised gross domestic product (GDP) for 1Q 2020 and pending homes sales for April, along with the US initial jobless claims, would keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.