For the 24 hours to 23:00 GMT, the USD declined 2.19% against the JPY and closed at 107.74.

The Bank of Japan (BoJ), in its monetary policy statement, pledged to utilise all necessary fiscal and monetary policy tools to contain the economic downturn caused by the coronavirus pandemic. Also, the central bank pledged to buy as much bonds as needed to keep 10-year government bond yields around 0%.

On the data front, Japan’s coincident index dropped to 90.2 in March, compared to a level of 95.5 in the previous month. The preliminary figures had recorded a drop to 90.5. Additionally, the leading economic index declined to 84.7 in March, recording its lowest level since 2009 and compared to a level of 91.7 in the previous month. The preliminary figures had recorded a drop to 83.80.

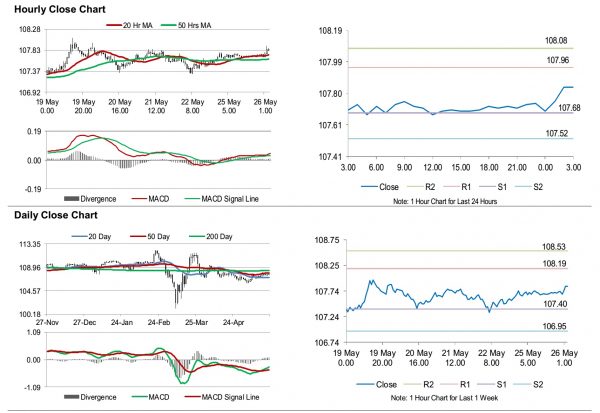

In the Asian session, at GMT0300, the pair is trading at 107.84, with the USD trading 0.09% higher against the JPY from yesterday’s close.

The pair is expected to find support at 107.68, and a fall through could take it to the next support level of 107.52. The pair is expected to find its first resistance at 107.96, and a rise through could take it to the next resistance level of 108.08.

Amid no macroeconomic releases in Japan today, investor sentiment would be governed by global macroeconomic factors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.