For the 24 hours to 23:00 GMT, the EUR rose 0.51% against the USD and closed at 1.0980.

On the macro front, Euro-zone’s consumer price inflation slowed to 0.3% on a yearly basis in April, recording its lowest level since 2016 and compared to level of 0.7% in the previous month. The preliminary figures had recorded a level of 0.4%. Additionally, seasonally adjusted current account surplus narrowed to €27.4 billion in March, marking its lowest level in three months and compared to a revised surplus of €37.8 billion in the previous month. Meanwhile, the preliminary consumer confidence rose to -18.8 in May, compared to a revised reading of -22.0 in a previous month.

In the US, the MBA mortgage applications fell 2.6% on a weekly basis in the week ended 15 May 2020, compared to a rise of 0.3% in the previous week.

The Federal Open Market Committee (FOMC), in its April meeting minutes, indicated that rates would stay low for a long time and dismissed the probability of implementing negative policy rates. Additionally, the officials cautioned that the coronavirus pandemic has created significant amount of uncertainty and considerable downside risks to the economic outlook in the medium term. Moreover, members agreed that the central bank would utilise its full range of tools to support the US economy in this challenging period. Additionally, the central bank warned over a second wave of the coronavirus outbreak.

In the Asian session, at GMT0300, the pair is trading at 1.0963, with the EUR trading 0.15% lower against the USD from yesterday’s close.

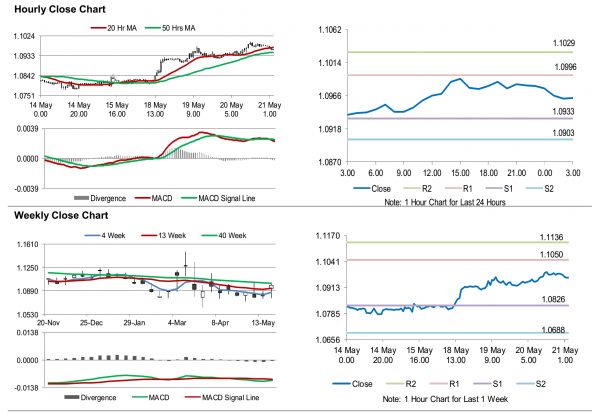

The pair is expected to find support at 1.0933, and a fall through could take it to the next support level of 1.0903. The pair is expected to find its first resistance at 1.0996, and a rise through could take it to the next resistance level of 1.1029.

Moving ahead, traders would keep a watch on Markit manufacturing and services PMIs for May, slated to release across the euro area. Later in the day, the US Markit manufacturing and services PMIs and the Philadelphia Fed manufacturing survey, all for May, along with initial jobless claims would keep investors on their toes.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.