For the 24 hours to 23:00 GMT, the GBP declined 6.06% against the USD and closed at 1.2239.

On the data front, UK’s consumer price inflation slowed to 0.8% on a yearly basis in April, reaching its lowest level since 2016 and compared to a level of 1.5% in the previous month. Additionally, the output producer price index dropped 0.7% on an annual basis in April, more than market expectations for a drop of 0.4% and compared to an advance of 0.3% in prior month. Moreover, the retail price index rose 1.5% on a yearly basis in April, less than market forecast for a rise of 1.6% and compared to an advance of 2.6% in the prior month. Meanwhile, the DCLG house price index climbed 2.1% on an annual basis in March, compared to a revised rise of 2.0% in the earlier month.

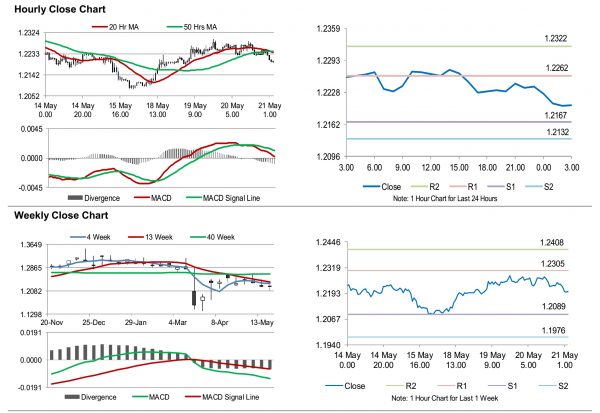

In the Asian session, at GMT0300, the pair is trading at 1.2201, with the GBP trading 0.31% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2167, and a fall through could take it to the next support level of 1.2132. The pair is expected to find its first resistance at 1.2262, and a rise through could take it to the next resistance level of 1.2322.

Moving forward, traders would keep a watch on UK’s Markit manufacturing and services PMIs for May, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.