The Australian dollar declined slightly after China released its important retail sales and industrial production data for April. The data showed that the country’s retail sales fell by 7.5% after dropping by 15.8% in the previous month. The industrial production rose by 3.9% year on year, which was better than the expected 1.5%. In the same month, fixed asset investments declined by 10.3% year on year, which was an improvement from the previous decline of 16.1%. The unemployment rate rose from 5.9% to 6.0%. These numbers show that the Chinese economy has made some slight improvements as it opens up.

The euro was little changed after the ECB warned of a deep recession in its bulletin yesterday. The region is expected to be among the worst-affected countries. According to Reuters, the bank is expected to ramp up its quantitative easing program in the coming month. We will receive several important numbers from the region today. These include the first quarter GDP data from Germany and the eurozone. We will also receive the inflation numbers from Italy.

The US dollar index was relatively unchanged ahead of the important data that will be released today. Analysts expect the headline retail sales dropped by 12.0% in April, which will be worse than the previous 8.7%. The core retail sales are expected to drop by 8.6% in the month. Industrial production will be another important data. Analysts expect that production dropped by 11.5% in April while manufacturing production fell by 13%. These numbers will demonstrate how the US economy has been hurt by the current pandemic.

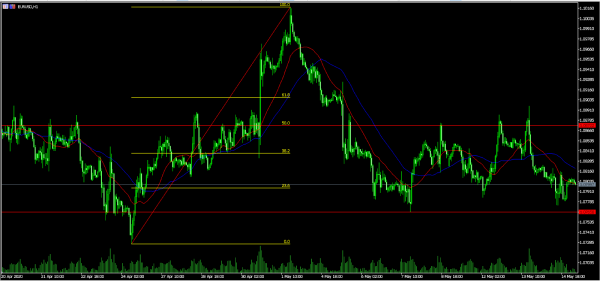

EUR/USD

The EUR/USD pair was little changed in the Asian session and is now trading at 1.0800, which is slightly above yesterday’s low of 1.0775. On the hourly chart, the price is slightly above the 23.6% Fibonacci retracement level and slightly below the short and medium-term moving average. The pair will likely see some significant movements today as the market reacts to GDP data from Europe and US retail sales.

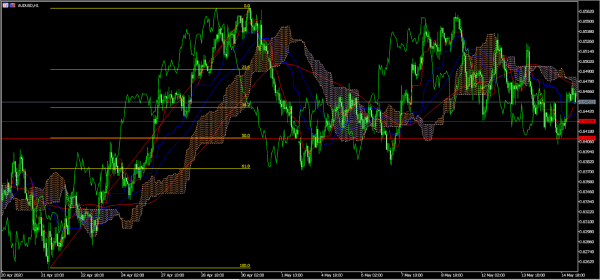

AUD/USD

The AUD/USD pair declined slightly after China released its numbers. It is now trading at 0.6452, which is slightly below the day’s high of 0.6470. On the hourly chart, the price is along the 50-day EMA and is approaching the 38.2% Fibonacci retracement level. It is also slightly below the Ichimoku cloud. This means that the pair may drop as bears attempt to test the next support at 0.6430.

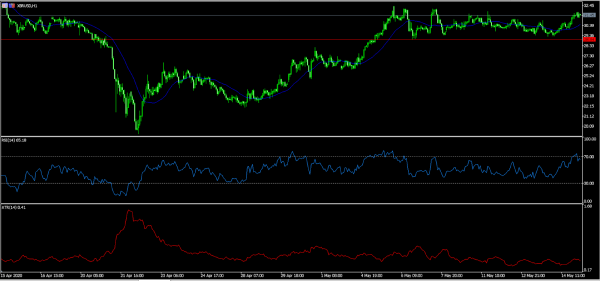

XBR/USD

The XBR/USD pair rose slightly as traders started to price-in more demand. It reached a high of 31.50, which was higher than the week’s low of 28.95. On the hourly chart, the price is slightly above the short and medium-term moving averages while the RSI has moved to the overbought level of 70. The average true range, which is an important measure of volatility, has fallen significantly. The pair may continue rising as bulls attempt to test last week’s high of 32.38.