For the 24 hours to 23:00 GMT, the GBP declined 6.10% against the USD and closed at 1.2233, after UK’s economy contracted at its fastest pace since the 2008 financial crisis in the first quarter of 2020.

On the data front, UK’s gross domestic product (GDP) fell 2.0% on a quarterly basis in the first quarter of 2020, amid Covid-19 crisis. In the previous quarter, GDP had recorded a flat reading. Additionally, total trade deficit widened to £6.7 billion in March, compared to a revised deficit of £1.5 billion in the previous month. Furthermore, the NIESR GDP estimate slumped 11.8% in three months ended April, compared to a revised fall of 2.0% in the prior month. Meanwhile, manufacturing production dropped 4.6% on a yearly basis in March, less than market anticipations for a fall of 6.0% and compared to a revised rise of 0.3% in the previous month. Moreover, industrial production declined 4.2% on an annual basis in March, less than market consensus for a drop of 5.6% and compared to a revised fall of 0.1% in the prior month.

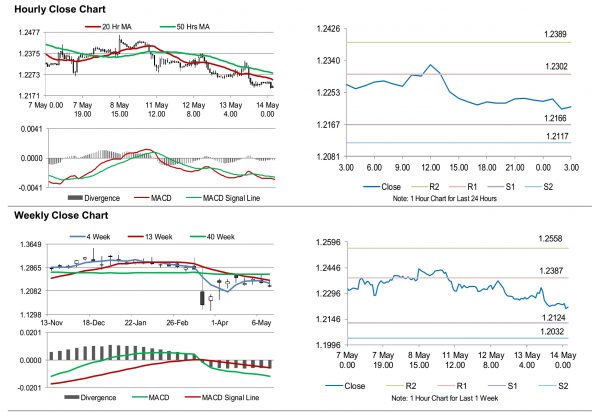

In the Asian session, at GMT0300, the pair is trading at 1.2215, with the GBP trading 0.15% lower against the USD from yesterday’s close.

Data showed that the RICS housing price balance tumbled -21.0% in April, compared to a rise of 11.0% in the previous month.

The pair is expected to find support at 1.2166, and a fall through could take it to the next support level of 1.2117. The pair is expected to find its first resistance at 1.2302, and a rise through could take it to the next resistance level of 1.2389.

Amid lack of macroeconomic releases in the UK today, investor sentiment would be determined by global macroeconomic factors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.