The price of crude oil declined slightly in overnight trading even as the EIA released positive inventory numbers. The data showed that inventories in the US rose by more than 4.59 million barrels in the previous week. This was better than the estimated 7.75 million barrels. It was also the lowest inventory build-up since the first week of March. The market is perhaps worried about demand now that most people in the US are working from home and most flights are grounded. Also, there are concerns that storage facilities in most countries are already full.

The US dollar weakened slightly as the market refocused on the US economy following the ADP jobs numbers. The data showed that private payrolls in the US dropped by more than 20 million in April. This was the highest number ever recorded by the company. According to ADP, most of these jobs were in large companies with more than 500 employees. Also, the hospitality sector was the most affected as most hotels and restaurants were closed in April. Still, the economic situation is not entirely clear since the data was collected up to April 12, meaning the final two weeks of the month were not captured. Later today, we will receive data on the people who filed for jobless claims in the previous week.

We will receive several important numbers today. The Bureau of Statistics in Switzerland will release the April unemployment rate data. Analysts expect the rate to jump from a record low of 2.8% to 3.3%. This number will come a day after data from the country showed that consumer confidence had dropped to a record low in April. In the UK, the Bank of England will deliver its interest rate decision. Elsewhere in Europe, we will get the retail sales data from Italy and trade numbers from France. Finally, China will release its exports and imports data for the month of April.

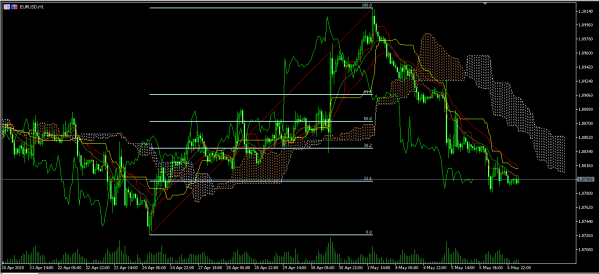

EUR/USD

The EUR/USD pair was little moved at around 1.0800 as the market reflected on a German court ruling on QE and the economic situation in the US. The price is slightly above the 23.6% Fibonacci retracement level and also below the short and medium-term moving averages. Also, the price is significantly below the Ichimoku cloud. As such, the pair may continue moving lower since bears appear to be in control. Still, they must first move below the 23.6% retracement level for this trend to continue.

XBR/USD

The XBR/USD dropped sharply yesterday, ending a seven-day winning streak. The pair dropped to a low of 29.00 and then pared back some of those losses to the current level of 30.90. On the hourly chart, this price is slightly below the 50-day EMA and is close to the highest level since April 15. The RSI has also moved from an overbought level of 80 to the current 50. The pair may move slightly lower today as bears attempt to test the 38.2% Fibonacci retracement level at 27.40.

GBP/USD

The GBP/USD pair dropped to an intraday low of 1.2300 ahead of the BOE interest rate decision. This is the lowest it has been since April 24. On the four-hour chart, the price is along the important 50% Fibonacci retracement level and also below the short and medium-term moving averages. The pair has also moved below the oversold level of 30. Therefore, while the downward trend may continue, there is a possibility of high volatility because of the BOE decision.