U.S. Review

A Tough Week for the U.S. Economy

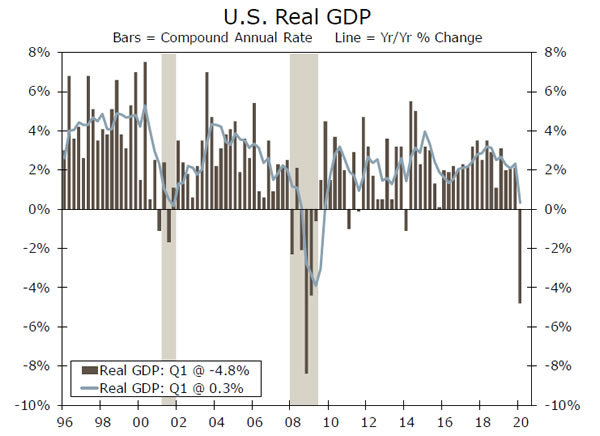

- U.S. GDP declined at an annualized rate of 4.8% in the first quarter, only a hint of what is to come in the second quarter.

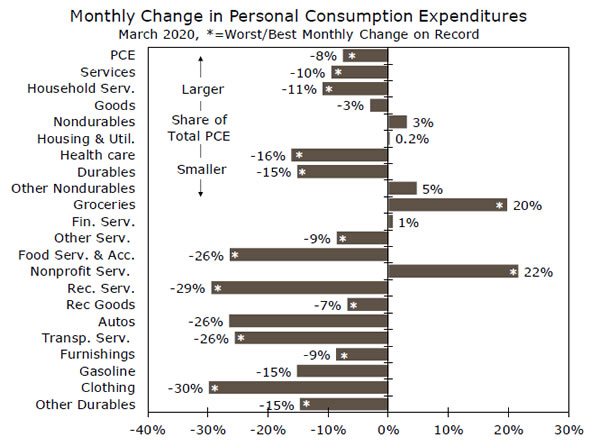

- Consumer spending has dried up as people have been confined to their homes—most evident in the record plunge in services consumption in March. April will be even worse.

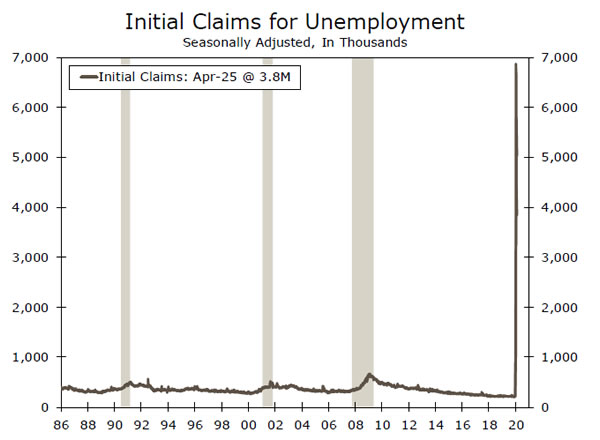

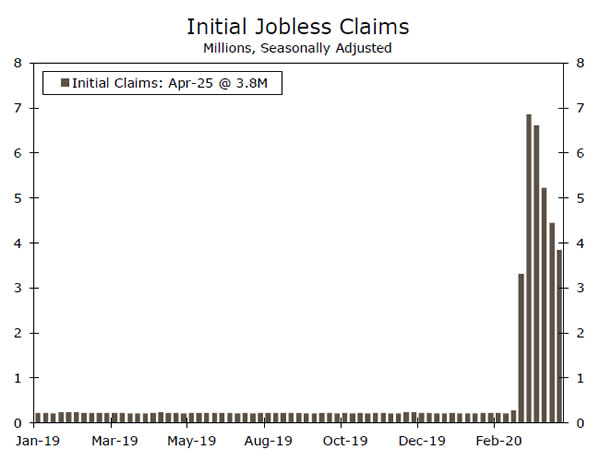

- More American jobs were lost last week, bringing total initial jobless claims to roughly 30 million.

- The U.S. experienced significant declines in activity in March and April, but with many states set to at least partially re-open today, could the U.S. economy be on the road to recovery?

A Tough Week for the U.S. Economy

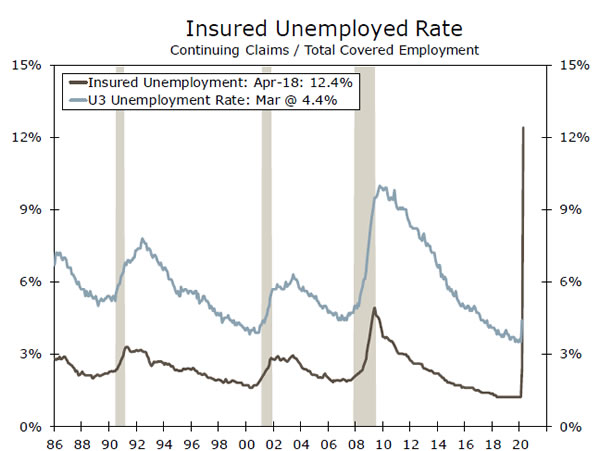

An additional 3.8 million Americans filed for unemployment insurance last week, bringing total initial claims over the past six weeks to over 30 million. This dwarfs past recessions (top chart). With so many jobs lost and more at risk, consumers have cut back sharply on spending. Services spending accounts for over 45% of U.S. GDP and is typically steady, even in the most uncertain times. Yet, services consumption declined at a 10.2% annualized rate in Q1, more than three times the next steepest rate of decline on record (-3.0% in Q4-1953). March already marks the worst month on record for a majority of consumption categories (middle chart). But, spending data was likely even worse in April—when stay-at-home orders spanned the entire month. Overall GDP contracted at a 4.8% annualized rate in the first quarter (chart on first page). But, further steep declines in April consumption will pull overall GDP lower at a record rate in the second quarter.

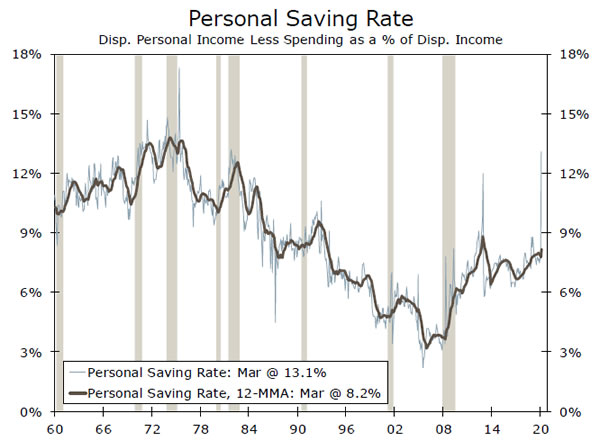

A silver lining to the rapid declines in March spending is they were met with more modest declines in income, which caused the personal savings rate to jump to a 39-year high of 13.1% (bottom chart). The saving rate should remain elevated as personal income (which includes unemployment benefits) should continue to fall less than spending. In theory, a high saving rate will give consumers the means to spend as lockdown measures are lifted, but how fast this occurs will depend on their willingness and ability to do so. Consumers are shaken, as confidence in current conditions slid 90 points in April, the largest drop in data going back to 1967. But, expectations remain lofty and supportive of an eventual rebound in spending.

Many states are set to at least partially re-open today (May 1), but does that mean the U.S. economy is on the road to recovery? The frustrating truth is, it’s too soon to say. The outlook both for the virus itself and for the economy, remain highly uncertain. While states may lift stay-at-home orders, it will ultimately come down to households to decide when they are comfortable venturing out. Even when consumers do so, the world will be very different, at least for some time. According to the CDC re-opening guidelines, social distancing and face masks will remain in our future. It also remains to be seen what the lasting impact from the virus will be.

In the post-FOMC meeting press conference this week, Chair Powell detailed “considerable risks to the outlook over the medium term,” (1) the virus trajectory (2) damage to the U.S. economy’s productive capacity and (3) the global dimension of the crisis. The rapid monetary and fiscal policy response to date should help cushion against the second and third risks, but until the virus is truly behind us (either we have a vaccine or the risk of additional outbreaks subsides dramatically), a rapid resurgence in economic activity remains unlikely.

The bottom line is the U.S. economy experienced significant declines in activity in March and April, and how the economy performs in May remains unclear. But the gradual lifting of lockdown orders—barring a renewed virus outbreak—should translate to a measured U.S. recovery.

U.S. Outlook

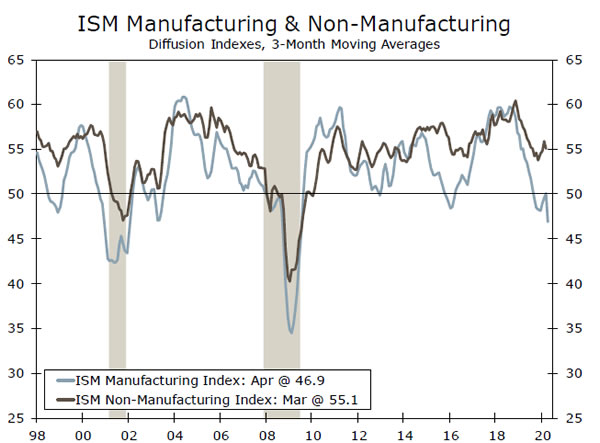

ISM Non-Manufacturing • Tuesday

The ISM’s barometer of the service sector will likely follow its manufacturing counterpart—which fell to 41.5 in April—and plunge to around 43. Typically in a recession, manufacturing falls first and further. This recession is not typical. Services are at the front lines of the pandemic and have already experienced historic declines. The Q1 GDP report, which was only a foreshadowing of the devastation we expect to see in Q2, indicated that spending on services fell 10.2% on an annualized basis, the steepest decline ever.

Declines in services are unusual in two main ways. First, people are not spending on things that are normally insulated from declines in business activity—think haircuts, visits to the dentist—out of fear of the virus or because the establishment has been forced to close. Second, spending that is in fact cyclical—think dining, airfare, car purchases—has declined at an unprecedented rate, almost to zero.

Previous: 52.5 Wells Fargo: 42.8 Consensus: 37.2

Initial Jobless Claims • Thursday

Since the middle of March, 30.3 million Americans have filed for unemployment insurance. While industry detail is not available, we suspect the trend in layoffs has shifted. The first wave was dominated by displaced leisure & hospitality workers, workers at doctor & dentist offices and administrative positions in general. A larger portion of more recent job losses have likely been in manufacturing, logistics and professional services. The criteria for receiving benefits have also widened to include many contract workers, which may be one reason claims fell less than expected last week. We expect claims to fall for the sixth straight week, but remain in the range of 3M.

For the past six weeks, eight states have had cumulative unemployment claims that equate to 24% or more of their February 2020 labor force. Hawaii tops the list, with cumulative claims roughly equivalent to 29.1% of its February labor force. Georgia (+26.5%), Michigan (+25.5%), Nevada (+24.8%) and Pennsylvania (+24.7%) are some of the hardest hit states.

Previous: 3.8M Consensus: 3.0M

Nonfarm Payrolls • Friday

Initial jobless claims suggest that 26.5 million Americans were laid off during the five weeks since the March nonfarm survey. Normally unemployment claims do not translate one-for-one in the monthly nonfarm report because the labor market is constantly in flux and many losing a job find a new one. Today, however, with much of the economy shutdown, there are fewer opportunities for displaced workers to find a new job. As a result, a much higher proportion of those filing claims are likely to remain unemployed. However, it seems likely that many who are currently out of work will not be looking—either because they are waiting to be recalled by their previous employer or dis-incentivized to look for a new job by generous unemployment benefits. They would not be counted as ‘unemployed’ and the officially reported unemployment rate would not be quite as high as implied by the gross job losses. The employment-to-population ratio is unaffected by this and should reveal the true devastation.

Previous: -701K Wells Fargo: -20M Consensus: -22M

Global Review

Busy Week for Global Central Banks

- It was a busy week for international data and events, which provided us with some additional detail on the economic effect from the coronavirus outbreak.

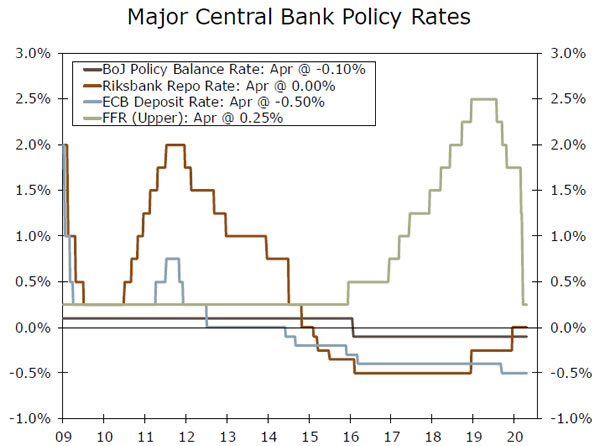

- Outside of the Federal Reserve, several major central banks took action this week, including the European Central Bank (ECB), Bank of Japan (BoJ) and Riksbank. The BoJ pledged to purchase as many government bonds as needed to stimulate its economy, while the Riksbank hinted that further balance sheet measures would be the preferred method of providing additional monetary policy support.

Riksbank Steady For Now

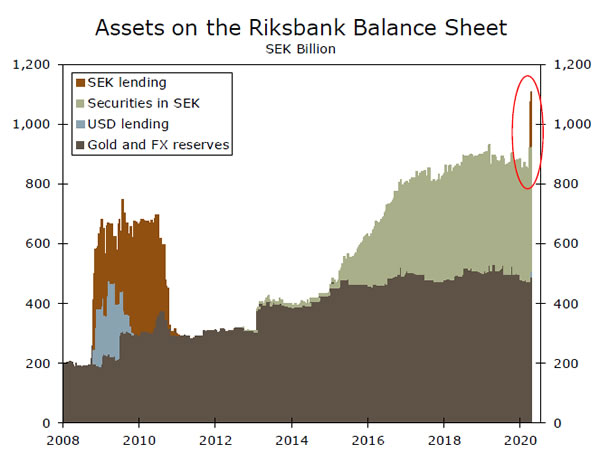

At its latest monetary policy meeting early this week, the Riksbank kept its repo rate steady at zero percent. Although the central bank said rate cuts remain an option at a later date, it signaled some hesitation to return to negative interest rates. Instead, policymakers indicated that the central bank would continue to evaluate its combination of policy measures, hinting that further balance sheet measures are likely to be the preferred method to provide additional policy support. In the accompanying statement, the central bank also said it would continue its renewed SEK300B bond-purchase program, including the purchases of covered bonds and government bonds until the end of September. So far with its current quantitative easing plans, the central bank has purchased securities at a pace of around SEK16B per week since late March, but remains well within its bond purchase limit of SEK300B. As we suggested in a recent report, we now look for the Riksbank to hold its policy rate steady at zero for the foreseeable future. That said, the next scheduled policy meeting is slated for July 1, and if any easing were to occur we believe it would likely be through balance sheet measures.

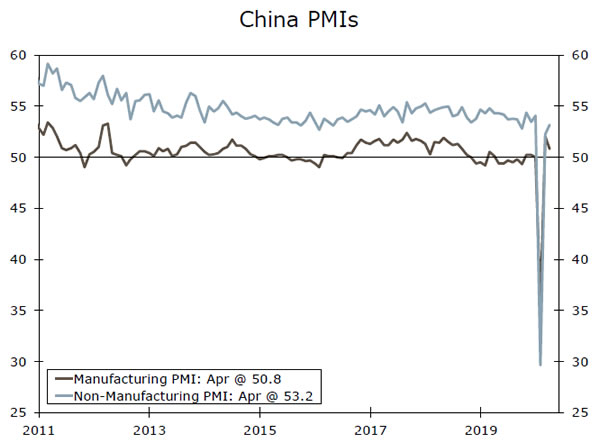

China Manufacturing PMI Slips in April

On the Chinese data front this week, we received a bit more insight into the economic effect from COVID-19. One release of note was China’s April PMIs, which suggested the domestic economy’s rebound may be restrained by weakening demand in other countries. The manufacturing PMI slipped to 50.8 from 52.0 the previous month, with exports plunging 12.9 points to 33.5. Meanwhile, the Caixin manufacturing PMI unexpectedly fell back into contraction territory, edging down to 49.4. Despite the manufacturing slump, the services sector seems to be holding up a bit better as the services PMI rose to 53.2, exceeding consensus estimates. The most recent data suggest global headwinds may hold back the Chinese economy from a strong rebound, and that any growth is likely to be domestically driven. We look for the Chinese economy to contract 1.2% for full-year 2020, but rebound 7.5% in 2021.

Bank of Japan Pledges to Purchase JGBs Without Limit

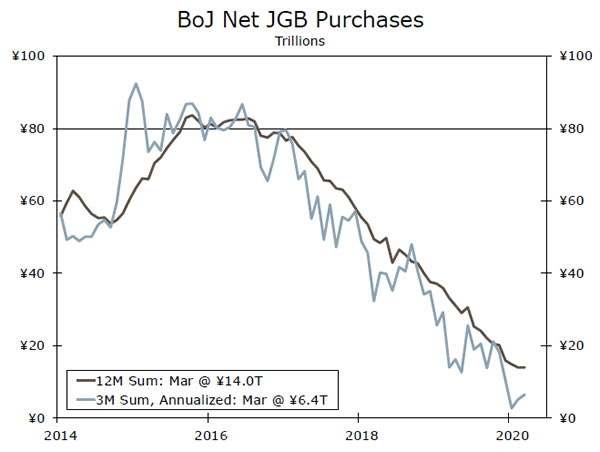

It was a busy week for Japan. The Bank of Japan (BoJ) held its policy rate steady, as expected but removed its guideline to increase its holdings of Japanese Government Bonds (JGBs) by roughly ¥80T per year. Over the last quarter the central bank only purchased government bonds at an annual rate of about ¥6T, well below the purchase cap. In our view, this suggests that the pledge to buy “unlimited” JGBs is likely more of a symbolic gesture to show the BoJ’s willingness to do whatever it takes to stimulate the economy. The central bank also significantly increased its purchase targets for corporate bonds and commercial paper. For now, we look for the BoJ to remain on hold for the foreseeable future. Meanwhile, on a data front, Japan’s March retail sales and industrial production nosedived 4.5% and 3.7% month-overmonth, respectively, as domestic and overseas demand weakened.

Global Outlook

RBA Rate Decision • Tuesday

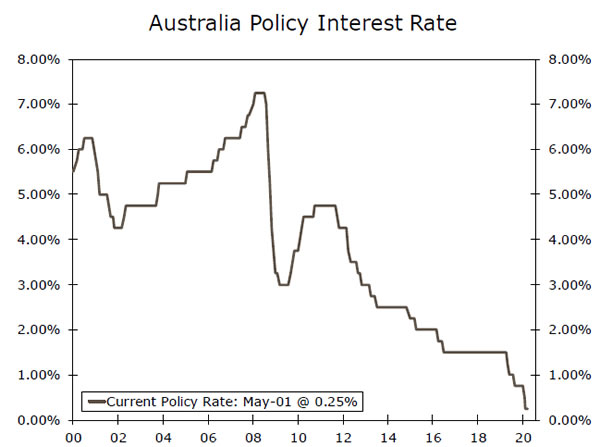

The outlook for the Australian economy has deteriorated sharply as the government implemented stricter measures in an effort to contain the spread of COVID-19. Given the recent developments, we now look for Australian GDP to contract 2.2% in 2020, which would mark the first recession since the early 1990s.

In response to the worsening outlook, the Reserve Bank of Australia (RBA) cut its Cash Rate a cumulative 50 bps during March to 0.25%, which Governor Lowe suggested was the effective lower bound for rates. Furthermore, the RBA deployed several unconventional policy measures including a quantitative easing program. Since the central bank has largely depleted its conventional interest rate tools, we expect the RBA to maintain a steady policy rate for the foreseeable future. Although we do not expect any additional easing at next week’s meeting, we will focus on any commentary offering additional scope into the depth of the coronavirus effect on the economy.

Previous: 0.25% Wells Fargo: 0.25% Consensus: 0.25%

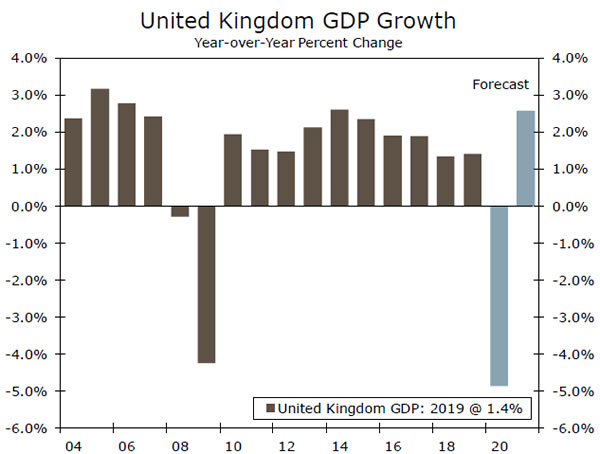

BoE Rate Decision • Thursday

Recent data and events suggest the U.K. economy is likely to contract sharply in the first half of this year, as the coronavirus pandemic has intensified. We now look for the U.K. to contract 4.9% for full-year 2020. That said, monetary and fiscal policymakers have implemented extensive actions aimed at supporting the economy. The Bank of England (BoE) has cut its Bank Rate a cumulative 65 bps this year in an effort to cushion the negative effect on its economy from COVID-19. More significantly, the Bank also announced a range of other stimulus measures including the resumption of asset purchases and the expansion of its funding-forlending program for small businesses. The BoE has signaled that it will provide further stimulus measures as needed, including expanding asset purchases. For now, we expect the BoE to hold its policy rate steady, but over the longer term, we see the risks tilted toward an expansion of its bond purchases.

Previous: 0.10% Wells Fargo: 0.10% Consensus: 0.10%

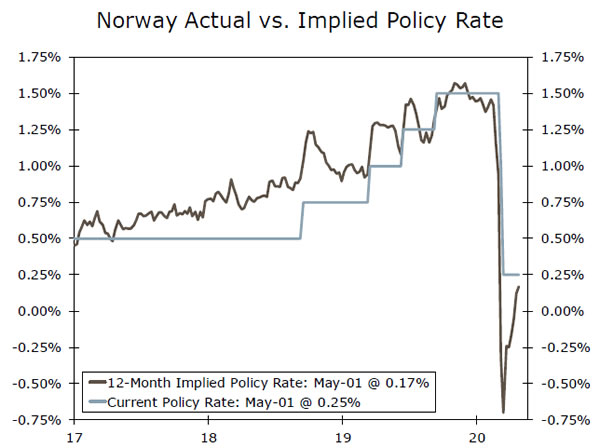

Norges Bank Rate Decision • Thursday

The Norges Bank announced aggressive easing measures aimed at lessening the negative effect of COVID-19 on its economy. The central bank slashed its policy rate a cumulative 125 bps in recent weeks to 0.25%, the lowest level on record, and maintained a relatively dovish tone, stating that it does not rule out a further reduction in rates. In addition, the central bank implemented a range of other policy measures including offering three-month loans to banks for as long as deemed necessary and reduced its countercyclical capital buffer, among other measures. Despite these actions, we expect the Norges bank to cut its Deposit Rate another 25 bps this cycle to zero in an effort to protect its economy from collapse, although we see a move into negative territory as unlikely. We will be carefully watching policymakers’ comments at next week’s policy announcement for any indication of additional stimulus measures.

Previous: 0.25% Consensus: 0.25%

Point of View

Interest Rate Watch

Euribor Remains Stubbornly High

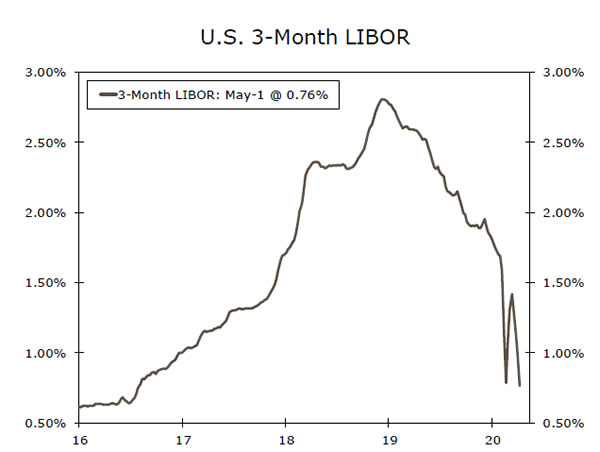

When the COVID-19 outbreak started to spread around the world earlier this year and market participants became convinced that the Federal Reserve would need to cut interest rates, 3-month LIBOR began to trend lower (top chart). In that event the FOMC did not wait until its scheduled meeting on March 18 to ease policy, the committee slashed rates 50 bps on March 3 and another 100 bps less than two weeks later on March 15.

Initially, LIBOR followed the fed funds target range lower, but then it started to rise significantly. Although there were some technical reasons behind the rise in LIBOR, concerns regarding the creditworthiness of banks in a world in which many businesses will fail due to the lockdowns that state governments have mandated also pushed LIBOR higher (LIBOR represents the rate that banks lend to each other on an unsecured basis.) However, LIBOR has subsequently receded as the Fed and the federal government have taken unprecedented steps to support the economy.

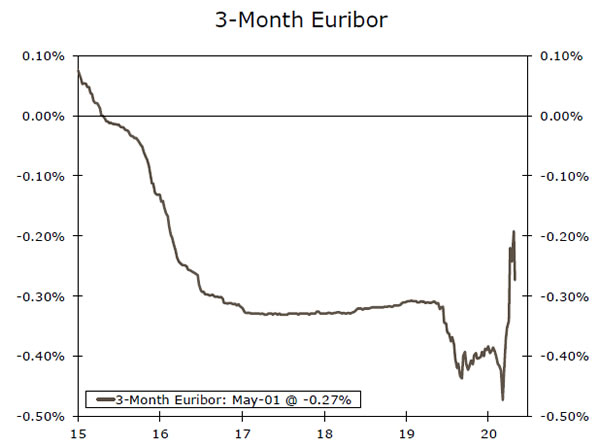

However, the situation has been a bit different in Europe. Three-month Euribor, which has been in negative territory for five years, also spiked higher in mid-March (middle chart). However, unlike its U.S. counterpart, 3-month Euribor remains elevated relative to the present setting of the European Central Bank’s deposit rate of -0.50%. Again, there are some technical reasons behind the rise in Euribor. But the elevated level of Euribor likely reflects concerns about the European banking system as well. Not only are banks in the Eurozone generally not as well capitalized as their American counterparts, but banks in countries with highly indebted governments (e.g., Italy and Portugal) hold significant quantities of their governments’ bonds. If those governments were to default, then the banks would face significant financial losses.

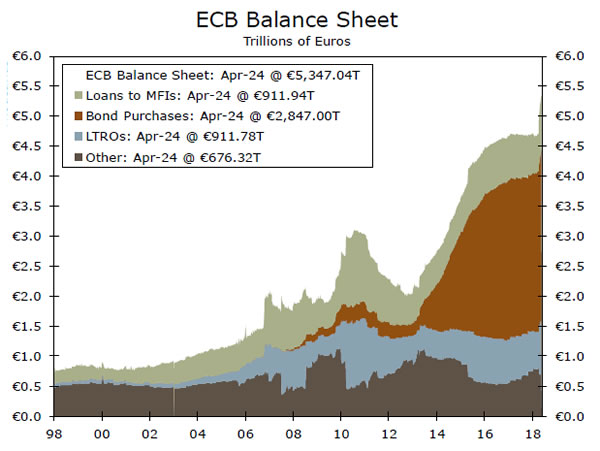

That said, we look for Euribor to drift lower in coming weeks due to recent policy actions by the ECB. Specifically, the ECB decided on April 30 to reduce interest rates on some of the special programs it has put in place to support the economy. We discuss these steps in more detail in a recent report.

Credit Market Insights

Bond Sales Are Booming

Companies have returned to credit markets in droves over the past two months, seeking cash to blunt the economic effects of the COVID-19 pandemic. These efforts have been bolstered by the Federal Reserve, which has taken numerous unprecedented steps to support the flow of credit.

Investment grade companies issued $259 billion of debt in March, easily clearing the previous record of $178 billion set in May 2016. The record-setting pace of issuance continued in April with approximately $285 billion in debt sales. High yield companies have been a little less ambitious, but active none the less with issuance in April running more than 30% above the same month last year.

Some companies have been sweetening their offers with clauses that may help assuage investors’ concerns about investing in such uncertain times. Several large issues, particularly within industries directly affected by the government-mandated shutdowns and travel restrictions, have included step-up clauses that increase scheduled coupon payments if the company is downgraded by credit rating agencies. While these clauses are by no means new, they are becoming increasingly relevant. There were a record number of companies on the edge of junk status in the first quarter, according to Moody’s. Given the terrible economic collapse over the past six weeks, it seems clear that a sizable portion of these corporations could become fallen angels.

Topic of the Week

Fiscal Fallout from the COVID-19 Pandemic

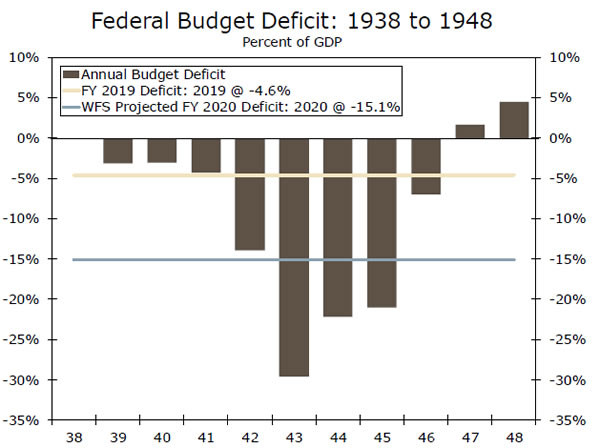

Next week, the U.S. Treasury will likely announce another round of significant increases to public auction sizes for many Treasury securities. Auction sizes have been growing to finance the gaping federal budget deficit that has developed. In fiscal-year 2020, the federal government will likely run the biggest budget deficit as a share of GDP since World War II. However, that implies that budget deficits have been this big, or bigger, at previous times in history. Are there any lessons in that experience for the situation the federal government faces today?

In a recent special report, we examined this issue by analyzing the federal fiscal situation during and after World War II. Specifically, the debt ratio exceeded 100% in 1946, but the government brought it down to its pre-war ratio of roughly 40% by 1962.

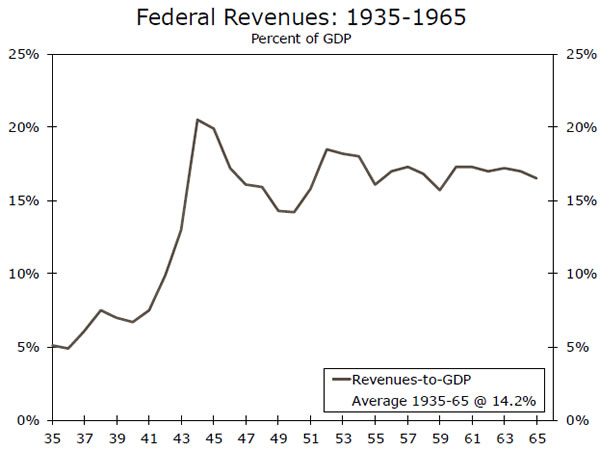

The government relied on a number of ways to reduce the debt ratio in the post-war years. While the ratio of spending-to-GDP was brought down from its wartime high, albeit not to its pre-war level, the comparable ratio for revenues did not recede quite as much. Strong growth in nominal GDP and low interest rates, the latter due in part to actions undertaken by the Federal Reserve, also helped shrink the debt ratio.

In our view, the federal government faces many more constraints today. Spending-as-a-percentage of GDP is set to rise in the years ahead as the population ages, and raising taxes after COVID-19 has passed could be politically challenging. The Fed may be able to keep interest rates low for some time, but no one knows for sure how long that will be viable. In addition, while faster labor productivity growth (and thus economic growth) would go a long way towards making the fiscal outlook more stable, it is far from certain that this will occur.

For further reading on this topic, see our special report “Fiscal Fallout from the COVID-19 Pandemic: Part III.” For a preview of next week’s Treasury refunding announcement, see “Treasury Refunding Preview: Bills Barrage Continues.”