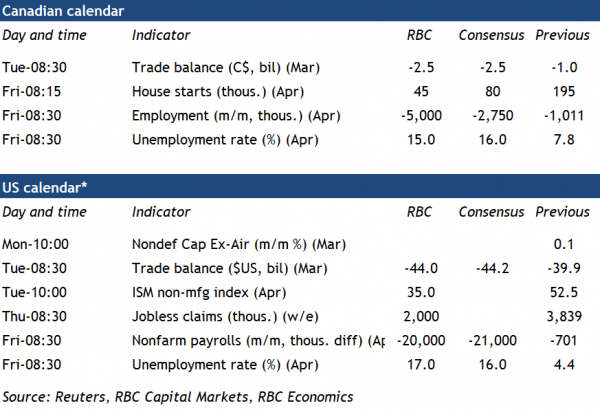

This week gave us no shortage of survey evidence that economic activity plummeted in many countries in April. European economic sentiment tanked to financial crisis lows and US manufacturing PMIs were down sharply. In Canada, manufacturing sentiment fell to a record low while a separate survey from Statistics Canada showed widespread declines across many sectors of the economy (more than half of businesses seeing revenue fall by 20% or more, and nearly 1/3 seeing declines greater than 40% year-over-year). Next week brings some of the earliest hard data for April, including jobs numbers that will highlight the devastating labour market impact of the coronavirus crisis, and trade figures showing disruption to the global flow of goods and services.

Next Friday’s jobs numbers are the highlight (or lowlight) of the week, though we already have a good sense of just how bad current labour market conditions are. More than 7 million Canadians have reportedly filed for income support (CERB and EI, the former having already paid out C$26 billion) while more than 30 million Americans have made unemployment insurance claims since mid-March. Canada recorded 1 million job losses in its March labour force survey (a snapshot of when containment measures were just starting to ramp up) and we expect the employment count fell by another 5 million in April (this month’s survey reflecting conditions in the third week of April). As we saw in March, a large portion of those who lost their jobs were categorized as outside the labour force, meaning the unemployment rate (which rose from 5.6% to 7.8%) significantly understated the increase in labour market slack. We expect the same will be true in April and are penciling in a still record-breaking 15% unemployment rate (if all those who lost their job were counted as unemployed, the rate would be closer to 30% by our count). Economy-wide hours worked will be another key data point to watch, capturing both job losses and reductions in hours worked. The measure was down 15% in the March survey week, while StatCan’s GDP “nowcast” for the entire month showed a 9% drop in economic output.

Canada’s trade data also bears watching. Both exports and imports are likely to see sharp declines (as we saw in the US advanced trade figures) amid factory shutdowns and global supply chain disruptions. Energy prices provide an added wrinkle for Canada—oil prices were 40-60% lower month-over-month in April which will weigh on nominal exports. That should result in a significantly wider trade deficit, an issue that is likely to remain throughout the year. Often-ignored services trade data also deserves some attention as it should capture significant declines in tourism flows.

In the US, March’s payroll survey (conducted a week earlier than Canada’s) showed a comparatively modest 700,000 jobs lost. We expect that figure will skyrocket to 20 million in April’s report. That could push the unemployment rate up to 17%—well past its financial crisis peak of 10%—though as with Canada there is some risk that unemployed persons are recorded as outside the labour force and thus don’t add to the unemployment rate. Out-of-work Americans are receiving a generous federal top-up to their state unemployment benefits, while forgivable loans through the Paycheck Protection Program should help employers re-hire even before they’re able to resume business.

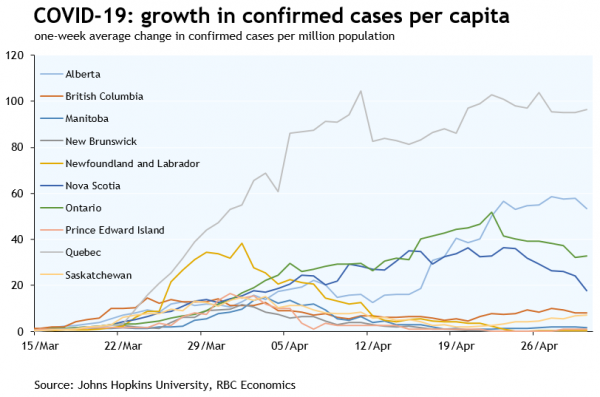

April could prove the low-point for economic activity as a number of provinces are starting to ease COVID-19 containment measures in May or plotting a course to do so. Re-opening some shuttered stores, construction sites, manufacturers and service-providers—and in some cases allowing children to return to schools and daycares—will provide a lift to economic activity though policymakers are (rightly) moving gradually. And income losses and/or consumer reticence to return to normal behaviour will mean demand recovering more slowly than supply (which itself is likely to be restricted by some businesses closing permanently). As provinces ease up on restrictions to economic and social activity, they’ll be keeping an eye on COVID-19 cases to ensure hard-won curve flattening isn’t reversed.