For the 24 hours to 23:00 GMT, the EUR rose 0.66% against the USD and closed at 1.0946.

On the macro front, Euro-zone’s consumer price index rose 0.4% on a yearly basis in April, beating market expectations for a rise of 0.1%. In the previous month, the index had recorded an advance of 0.7%. Meanwhile, the unemployment rate climbed to 7.4% in March, less than market forecast and compared to a 7.3% rate in the prior month. Moreover, the seasonally adjusted gross domestic product (GDP) dropped 3.8% on a quarterly basis in first quarter of 2020, more than market consensus for a drop of 3.5%. In the previous month, GDP had recorded a rise of 0.1%. Separately, retail sales fell 5.6% on a monthly basis in March, recording its lowest level since 2007 and less than market anticipations for a drop of 7.3%. In the prior month, retail sales had recorded a revised rise of 0.8%. Furthermore, Germany’s seasonally adjusted unemployment rate climbed to 5.8% in April, more than market forecast of 5.2% and compared to a rate of 5.0% in the earlier month.

The European Central Bank (ECB), in its interest rate decision, revealed that it has kept its key interest rate unchanged at 0.25%, following the ease in conditions on the targeted longer-term refinancing operations, or TLTRO III, during the period from June 2020 to June 2021 to 50 basis points below the average interest rate. Also, it has mentioned that the 19-member region’s economy contracted by 3.8% in the first quarter. Further, the ECB President Christine Lagarde said the governing council is fully prepared to increase its stimulus measures, in the time of facing a deep economic crisis.

In the US, the personal income slid 2.0% on a monthly basis in March, more than market expectations for a drop 1.5% and compared to a rise of 0.6% in the previous month. Additionally, the personal spending tumbled 7.5% in March, more than market consensus for a fall of 5.0% and compared to a rise of 0.2% in the prior month. Moreover, the initial jobless claims decreased to 3839.0K in the week ended 24 April 2020, more than market anticipations and compared to a revised reading of 4442.0K in the earlier month. However, the Chicago Purchasing Managers’ index dropped to 35.4 in April, more than market forecast for a drop to a level of 38.0. In the previous month, the index had recorded a reading of 47.8.

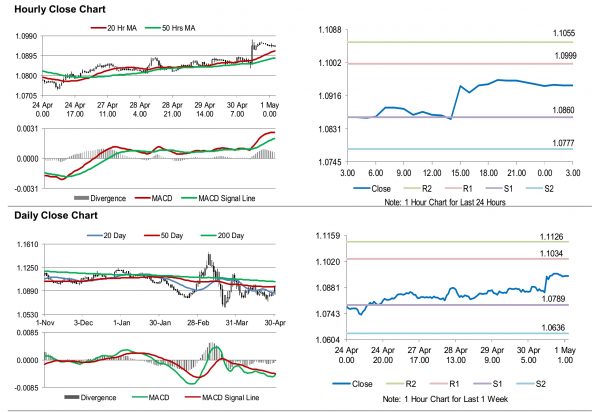

In the Asian session, at GMT0300, the pair is trading at 1.0943, with the EUR trading marginally lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0860, and a fall through could take it to the next support level of 1.0777. The pair is expected to find its first resistance at 1.0999, and a rise through could take it to the next resistance level of 1.1055.

With no major macroeconomic releases in the Euro-zone today, investors would focus on the US Markit Manufacturing PMI and ISM Manufacturing PMI, both for April, along with construction spending for March, slated to release later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.