For the 24 hours to 23:00 GMT, the USD declined 2.71% against the JPY and closed at 107.17.

On the data front, Japan’s construction plunged 14.3% on an annual basis in March, compared to a rise of 0.7% in the prior month. Additionally, housing starts fell 7.6% on a yearly in March, less than market forecast for drop of 16.0% and compared to fall of 12.3% in the previous month. Moreover, the consumer confidence index dropped to 21.6 in April, compared to a level of 30.9 in the earlier month.

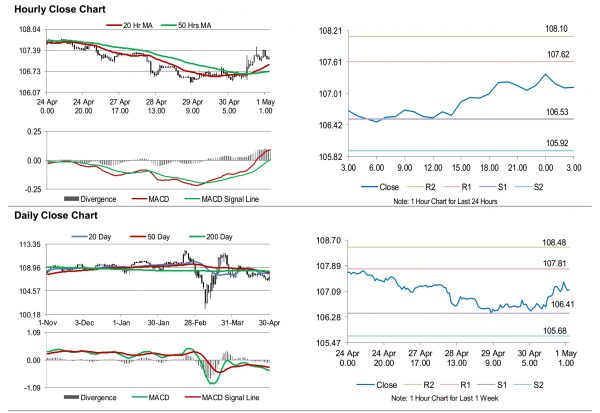

In the Asian session, at GMT0300, the pair is trading at 107.13, with the USD trading marginally lower against the JPY from yesterday’s close.

Overnight data showed that Japan’s Jibun Bank manufacturing PMI decreased to 41.9 in April, compared to a level of 43.7 in the prior month.

The pair is expected to find support at 106.53, and a fall through could take it to the next support level of 105.92. The pair is expected to find its first resistance at 107.62, and a rise through could take it to the next resistance level of 108.10.

With no macroeconomic releases in Britain today, investor sentiment would be governed by global macroeconomic events.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.