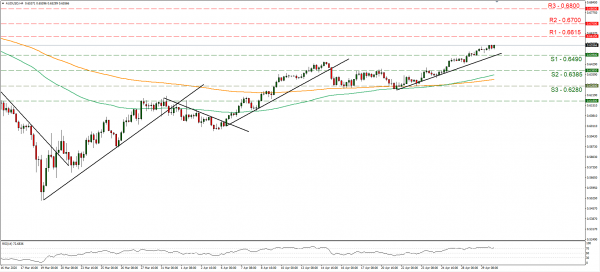

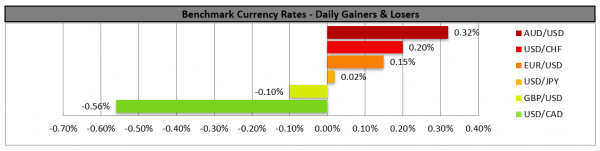

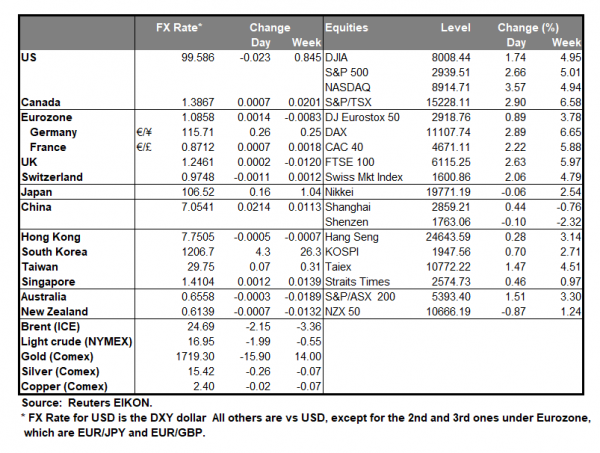

The USD weakened against a number of its counterparts yesterday, as the market sentiment continued to improve, and the Fed seems prepared for further monetary easing. Market sentiment got a boost as there are signs that coronavirus is receding in various parts of the world and there were positive trial results for a medication. On the monetary front the Fed decided to remain on hold as was expected and seemed prepared for further easing. It was characteristic that the Fed’s Chair in his press conference, stated that the economy needs more support ‘from all of us’, while also repeated the commitment for lending “forcefully, proactively, and aggressively”. Also, the preliminary US GDP growth rate for Q1 showed a wide contraction of -4.8% qoq, while the worse may still be to come, as the effect of the April lockdowns in the US has not been calculated yet. We to tend nurse worries though about the intensified rhetoric of US President Trump and other US officials against China. According to media, Trump stated that the trade deal with China has been upset very badly and that he was looking at different options in terms of consequences for Beijing over the virus. The US insistence on the issue, points towards a new escalation of tensions between the two countries, with a possible adverse effect on global economy. AUD/USD continued to rise, distancing itself from the 0.6490 (S1) support line. We maintain a bullish outlook for the pair as long as it remains above the upward trendline incepted on the 21st of April. Should the bulls actually maintain control over the pair’s direction, we could see it breaking the 0.6615 (R1) resistance line and aim for the 0.6700 (R2) resistance level. Should on the other hand the pair come under the influence of the bears, we could see AUD/USD breaking the 0.6490 (S1) support line and aim for the 0.6385 (S2) level.

ECB’s interest rate decision awaited by EUR

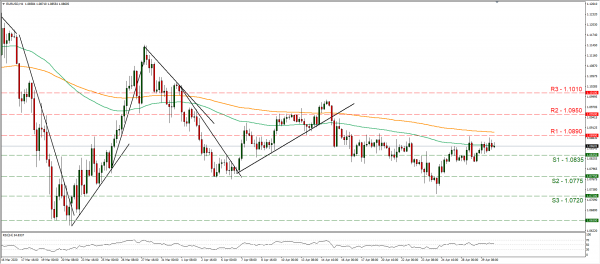

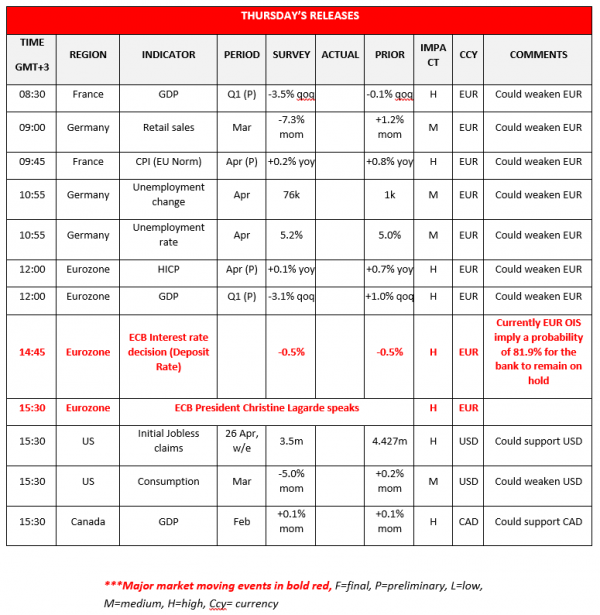

Today in the European session (11:45, GMT) ECB is to release its interest rate decision and is expected to remain on hold with the deposit rate being at -0.5%. Currently EUR OIS imply a probability of about 81.9% for the bank to remain on hold and the rest suggesting a 10 basis points rate cut. Should the bank remain on hold as expected, we could see the market’s attention turning to the accompanying statement and Christine Lagarde’s press conference later on (12:30, GMT), for any clues about the bank’s further intentions. We could see the bank maintaining a supporting stance for the area’s economy in the face of the COVID 19 led crisis, yet the devil may be in the details. The bank is expected expand its QE program through the PEPP (Pandemic Emergency Purchase Program) by a number of analysts however we maintain our doubts as the bank may prefer a wait and see position. Please note that the bank seems to have opened the door to accepting junk bonds as collateral, while Lagarde denied lending directly to national governments, practically drawing a line. EUR/USD maintained a sideways motion yesterday between the 1.0835 (S1) support line and the 1.0890 (R1) resistance line. We maintain a bias for a sideways movement, yet financial releases today and ECB’s interest rate decision could change the pair’s direction. Should the pair come under the selling interest of the market, we could see it breaking the 1.0835 (S1) support line and aim for the 1.0775 (S2) support level. On the flip side, should the pair’s long positions be favoured by the market we could see it breaking the 1.0890 (R1) resistance line and aim for the 1.0950 (R2) resistance level.

Other economic highlights today and early tomorrow

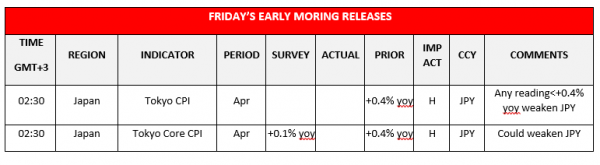

Today during the European session, we get France’s and Eurozone’s preliminary GDP rates for Q1 as well as the preliminary HICP rates for April. Also, we get Germany’s retail sales growth rates for March as well as Germany’s employment data for April. In the American session, we get from the US the initial jobless claims figure for last week, as well as the US consumption rate for March and Canada’s GDP rate for February. During tomorrow’s Asian session we get from Japan, Tokyo’s inflation rates for April.

Support: 0.6490 (S1), 0.6385 (S2), 0.6280 (S3)

Resistance: 0.6615 (R1), 0.6700 (R2), 0.6800 (R3)

Support: 1.0835 (S1), 1.0775 (S2), 1.0720 (S3)

Resistance: 1.0890 (R1), 1.0950 (R2), 1.1010 (R3)