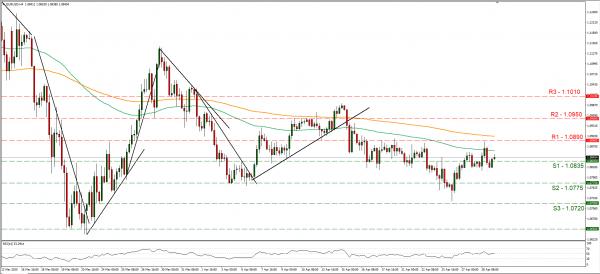

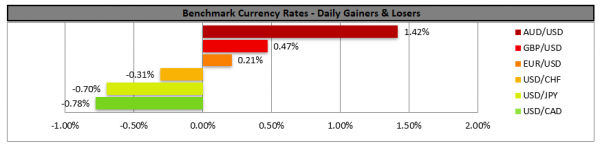

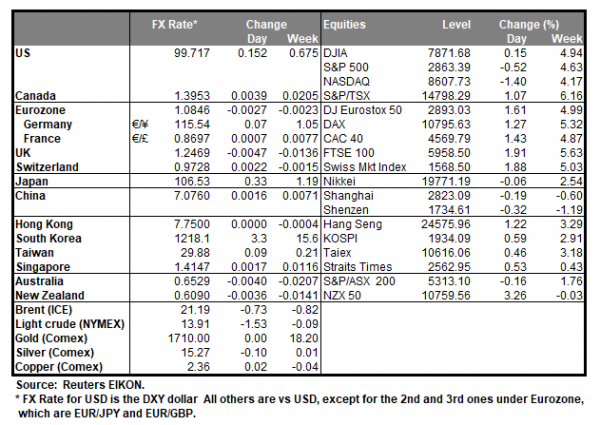

The USD weakened against a number of its counterparts yesterday and during today’s Asian session, due to further general market sentiment improvement. Once again, the improvement of the market sentiment tended to be associated with the efforts to reopen economies in various parts of the world. The greenback’s weakening comes ahead of the Fed’s interest rate decision later today (18:00, GMT), while the bank is expected to remain on hold at +0.25% and Feds Funds Futures imply a probability of 89.1% for such a scenario. Should the bank’s decision be to actually remain on hold as it is expected, the market’s attention could turn to the accompanying statement and Jerome Powel’s press conference later on (18:30, GMT). The bank is expected to maintain an accommodative stance and we could see some expansion of the bank’s QE program. The market may be interested in the bank’s economic forecasts in order to reach more conclusions about how long and how deep the crisis is, yet any forecasts may still be based on shaky ground as the pandemic is still feeding uncertainty. The event may have a bearish effect should the supply of USD in the international markets rise even further Also, we would like to underscore that a number of financial releases are due out and we highlight the release of the US GDP rate for Q1. Our main concern remains not only with the heavy negative forecasts for the release, but also for the fact that in Q1 the restrictions imposed affected only the last half of March, implying that Q2 may be even worse, given April’s full lockdown. EUR/USD rose testing the 1.0890 (R1) resistance line yesterday, before dropping and relenting any gains in the American session, yet during the Asian session, managed to remain afloat, above the 1.0835 (S1) support line. We tend to maintain a bias for a sideways motion, yet today’s financial releases, and the Fed’s interest rate decision, as well as ECB’s interest rate decision tomorrow, may create substantial volatility for the pair and change its direction. Should the pair come under the selling interest of the market, we could see it breaking the 1.0835 (S1) support line and aim for the 1.0775 (S2) support level. Should the pair’s long positions be favored by the market, we could see the pair breaking the 1.0890 (R1) line and aim higher.

Pound strengthens slightly as market sentiment improves

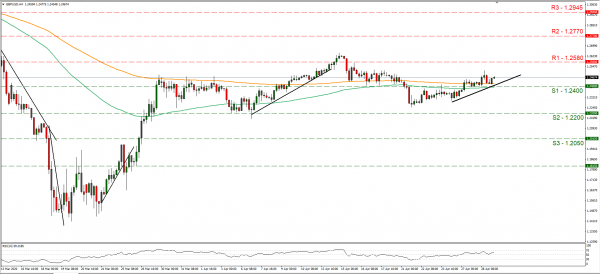

The pound tended to strengthen slightly against both the USD and the common currency yesterday as the general market sentiment improved somewhat. It should be noted though that despite the rise any gains made were capped as UK retailers reported the biggest fall in sales since 2008. Also, on the positive side the UK showed the lowest number of deaths in a day for four weeks, lifting the spirits of Britons somewhat. On the other hand, reports stated that a contact tracing app, which is considered a key tool to lift the lockdown restrictions, will not be in place for another three weeks, hence the measures may be extended. We maintain a cautious stance for the pound as fundamentals over the past days highlight the risks associated with it. GBP/USD rose slightly yesterday, remaining above the 1.2400 (S1) support line. Given also yesterday’s movement we maintain a bullish outlook for the pair as an upward trend line seems to be forming since the 24th of the month. Once again, we have to mention that the US financial releases and the Fed’s interest rate decision may alter the pair’s direction substantially, either way. Should the bulls maintain their control over the pair we could see it breaking the 1.2580 (R1) resistance line and aim for higher grounds. Should the bears take over, we could see cable breaking the 1.2400 (S1) support line and aim for the 1.2200 (S2) support level.

Other economic highlights today and early tomorrow

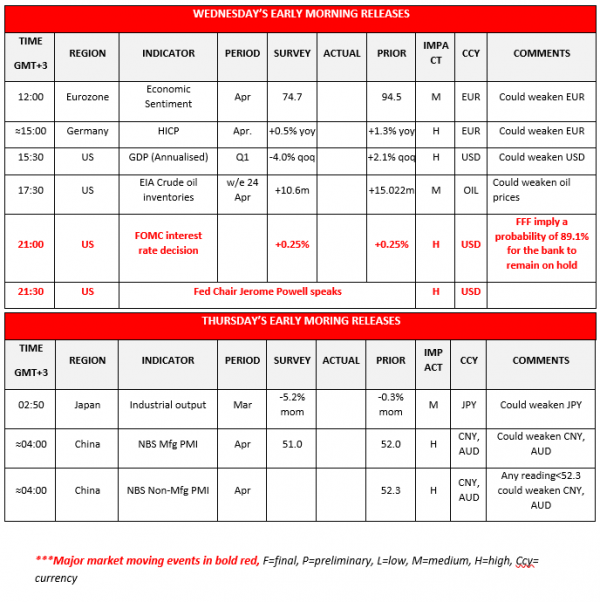

Today during the European session, we get Eurozone’s industrial sentiment and later on Germany’s preliminary HICP rate, both for April. In the American session, we get the US GDP growth rate for Q1 (advance as well as EIA’s crude oil inventories figure. During the Asian session tomorrow, we get Japan’s preliminary industrial output for March, as well as China’s NBS PMIs for April.

Support: 1.0835 (S1), 1.0775 (S2), 1.0720 (S3)

Resistance: 1.0890 (R1), 1.0950 (R2), 1.1010 (R3)

Support: 1.2400 (S1), 1.2200 (S2), 1.2050 (S3)

Resistance: 1.2580 (R1), 1.2770 (R2), 1.2945 (R3)