March quarter CPI 0.3%qtr/2.2%yr Trimmed mean 0.47%qtr/1.8%yr Weighted median 0.52%qtr/1.7%yr

March quarter CPI a bit stronger than expected highlighting a core inflationary pulse as we headed into the COVID-19 shock.

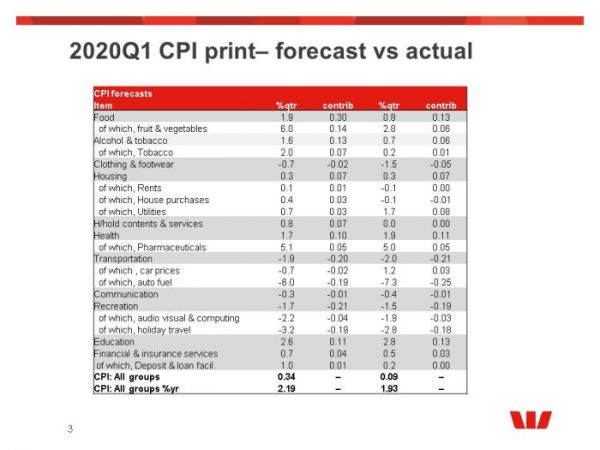

The March quarter CPI rose 0.3%, a touch stronger than the market median (0.2%) and Westpac’s forecast (0.1%). At two decimal places, the CPI gained 0.34% (Westpac’s forecast 0.09%) lifting the annual rate to 2.2%yr from 1.8%yr.

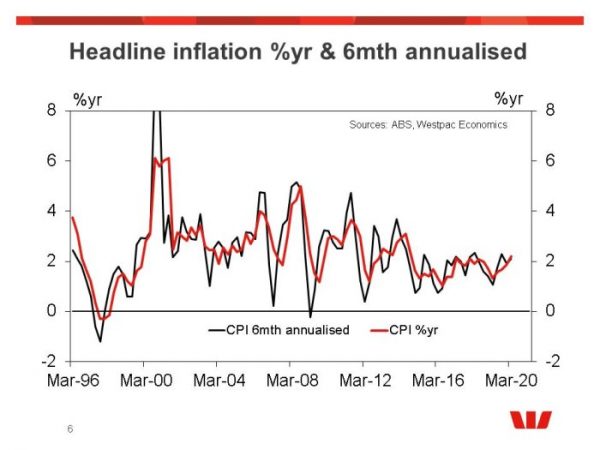

Inflationary momentum, which we measure by a six month annualised pace of the seasonally adjusted CPI, was 2.1%yr a lift from 1.9%yr in the December quarter but still down from the 2.3%yr pace in the September quarter.

Australia’s inflationary momentum has been in a 1.6%yr and 2.3%yr range from sometime and was looking like it might start to drift higher but clearly, the significant deflationary impact of COVID-19 will hit the Q2 estimate quite hard pushing the CPI into deflationary territory. This was an important update as both the headline print, and the finer details, suggest the inflationary pulse was a little more robust heading in the COVID crisis.

Turning to the details the most interesting surprises where around food (1.9% vs 0.8% fcst), tobacco (2.0% vs. 0.2% fcst), clothing & footwear (-0.7% vs -1.5% fcst) and household contents (0.8% vs 0.0% fcst).

But more important for the near term outlook for core inflation, while the overall housing cost series came in as expected (0.3%) the breakdown suggests a more robust than expected housing market.

Rents, which have been very stable rose 0.1% vs. -0.1% forecast. Subsidies and discounts are being reported in Q2 but care must be taken when looking forward and public sector housing rents, which are already subsidised will be more stable. And also remember that rents here are all existing rents and not just the new reported rental contacts that are signed in the quarter.

Dwellings prices rose 0.4% vs -0.1% forecasts with prices rising in both Sydney (0.8% and the first rise in 4 quarters) and Melbourne (0.6%). We were surprised by the strength of dwelling prices in Q1 which may be a caution before getting too negative for dwelling in Q2.

Housing costs were moderated by softer utilities, 0.7% vs 1.7% forecast and this disinflationary pulse is likely to remain going forward.

Overall the details in the March quarter CPI suggests to us that the underlying inflationary momentum was a bit more robust than we had expected. We are noting this and it will form an important backdrop to our formulation on just how negative the Q2 CPI might be.

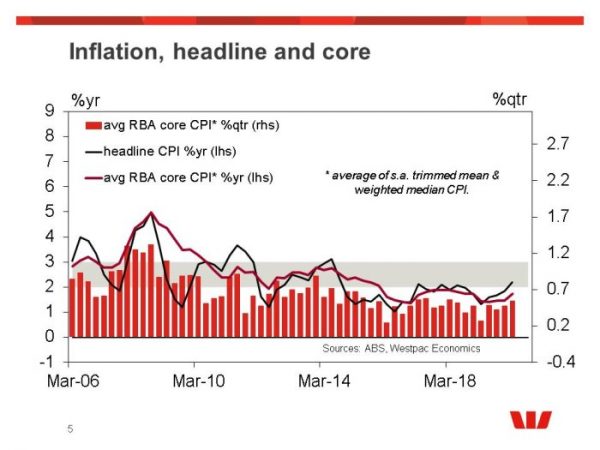

Highlighting this, the trimmed mean rose 0.5%qtr/1.8%yr – still below the bottom of the RBA’s target band but drifting higher from the March quarter 2019 low of 1.5%yr.