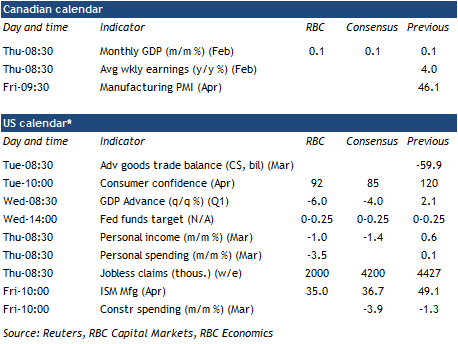

While GDP tends to draw more attention in normal times, the most relevant economic data next week will be timelier survey readings that better capture the economic damage being done by COVID-19 containment measures. In Canada, a full month of shutdowns should see April’s manufacturing purchasing managers’ index (PMI) building on March’s record declines in production, new orders and employment. That was certainly the case in Europe and the US where this week’s ‘flash’ readings for April were even worse than expected. Those countries’ surveys also emphasized a more widespread slowdown in services industries than the industrial sector. That’s a significant blind spot in Canada where PMI data only covers manufacturing.

A more significant hit to services industries (more than 70% of the economy) was anecdotally evident in last week’s March GDP “nowcast” which showed a 9% decline in economic activity in the month. That release makes next week’s February GDP report even less relevant, with an expected 0.1% increase now looking like a rounding error. If it weren’t for the coronavirus pandemic, we’d be focusing on the extent to which rail blockades disrupted economic activity in the month—something that will show up in the transportation component of GDP but wasn’t enough to prevent gains in manufacturing, wholesale and retail sales. There were some reports of COVID-19 impacting the aforementioned sectors in February, but we expect the bulk of coronavirus effects will show up in air travel with more widespread declines only appearing in March. We think April will be the low-point for monthly GDP, with May potentially seeing modest gains as some provinces (Saskatchewan and PEI have the most well-defined plans at this point) start the process of gradually re-opening their economies.

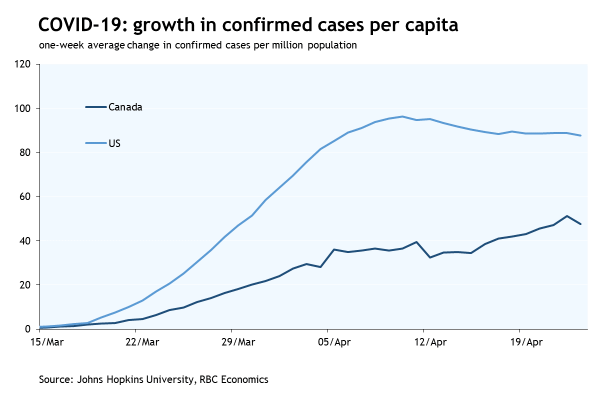

In the US, we are looking for a 6% annualized decline in Q1 GDP that will fall short of last recession’s 8.4% decline in late-2008 (“record breaking” will have to wait for Q2, with ISM data late next week set to show an intensifying slowdown in April). A less dramatic decline relative to Canada’s 10% Q1 drop reflects physical distancing generally ramping up slightly later south of the border. The US saw more than 10 million new claims for unemployment insurance in the final two weeks of March while Canadian jobless benefits were tracking proportionally higher over that period. The health toll of a slower COVID-19 response is evident in coronavirus case growth where the US curve has flattened the curve at a significantly higher level (per capita) than in Canada.

Next week’s rate announcement from the Fed is another event that would normally draw more attention, but has been effectively pre-empted with the central bank throwing out its calendar during the current crisis and announcing new programs and operations as needed. Chair Powell should provide an update on deployment of that extraordinary stimulus which has already swelled the Fed’s balance sheet by nearly $2.5 trillion (~11% of GDP) over the last two months. The committee is not scheduled to update its economic projections (something it opted not to do last month) but Chair Powell is likely to give some indication of how it sees the highly uncertain economic outlook evolving. His comments earlier this month emphasized that “very high” unemployment is like to be temporary and “there is every reason to believe that the economic rebound, when it comes, can be robust.