U.S. Highlights

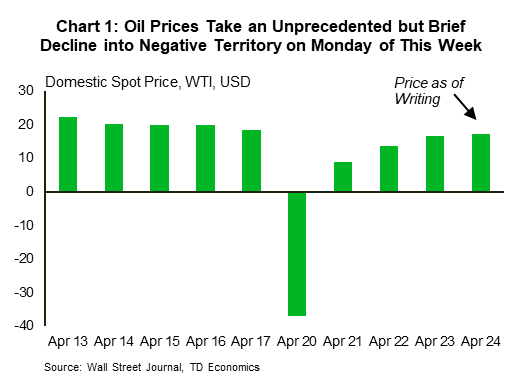

- Markets were volatile this week as oil prices plummeted to negative territory for the first time ever. The combination of weak demand and a lack of near-term storage capacity contributed to this strange result.

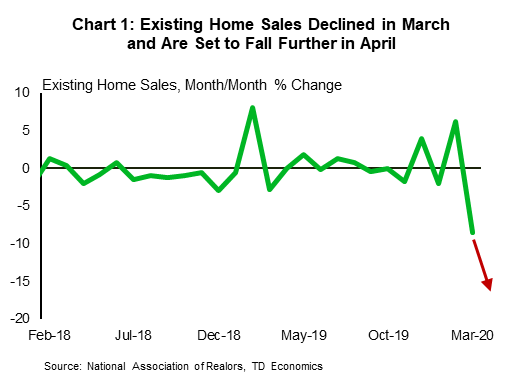

- COVID-19 and measures to contain it have hit housing activity, with existing home sales falling sharply in March, a precursor to even greater weakness in April.

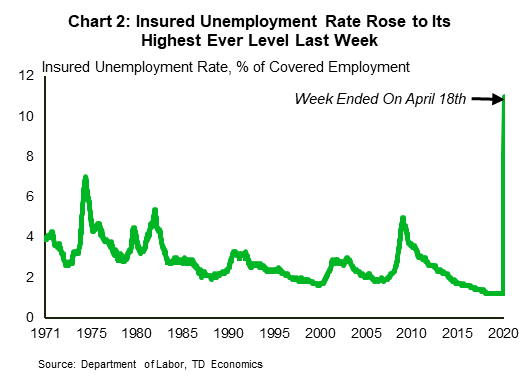

- Jobless claims remained elevated last week. Congress’ decision to expand the Paycheck Protection Program should keep layoffs from surging higher in the coming weeks.

Canadian Highlights

- In yet another shock to the country’s ailing energy sector, oil prices turned negative early this week. Prices bounced back in short order, but remain severely depressed.

- Several provinces gave guidance as to when their plans to cautiously re-open their respective economies will be made available. Saskatchewan went a step further this week, releasing their five phase re-opening plan, set to begin on May 4th.

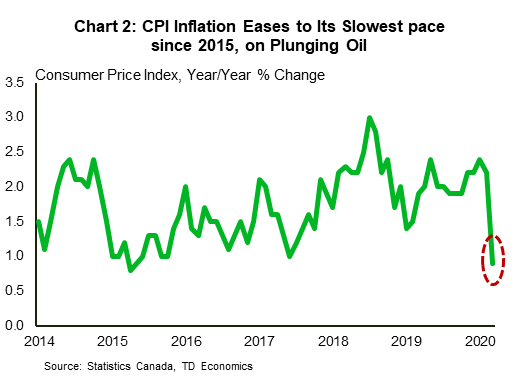

- Data releases this week were mostly negative. Retail sales printed positively in February, but will suffer an unprecedented drop in March. Local board data for Toronto points to both home sales and listings cratering at a record pace so far in April, while CPI inflation eased to its slowest pace since 2015 in March.

U.S. – COVID-19 Sends Oil Prices To Uncharted Territories

Markets saw some volatility this week but stabilized late in the week. The S&P 500 was down 2.6% from close last week (as of writing). The turbulence in the markets was mainly down to extraordinary movements in oil markets, where the WTI price plummeted to around -40 U.S. dollars per barrel! This was the first time ever oil prices fell into negative territory.

As we have written, there was a technical reason for this strange outcome (see report). The oil price quoted reflected the expiring May futures contract, which was driven negative by the combination of weak demand and a lack of readily-available storage capacity. With the contract expired and President Trump tweeting that the American Navy should destroy any Iranian gunboats harassing U.S. vessels, the price rebounded and currently sits at around $16. Nonetheless, with much of the global economy still in lock down keeping a firm lid on oil demand, this may not be the last time that oil prices dip negative.

The leading edge of the pullback in U.S. economic activity was evident in economic data for March released this week. Existing home sales declined by 8.5% in the month even though self-distancing protocols were only mandated by some states half-way through the month. Home sales will surely fall further in April when almost every state shutdown large parts of their economies (Chart 1).

Elsewhere in terms of economic data, the latest weekly jobless claims number continued to point to the devastating impact of the crisis on the labor market. For the week ending on April 18th, 4.4 million people filed for unemployment benefits. This took the total number of jobless claims to over 26 million since the middle of March. This represents almost a fifth of the entire labor force. As a result, the insured unemployment rate rose to 11.3% for the week, the highest it’s ever been (Chart 2).

The only piece of good news from this data release is that the number of people filing claims has been coming down since the beginning of April. This is due in part to employers retaining their employees and workers finding other jobs.

The immensely popular Payroll Protection Program (PPP) has undoubtedly helped employers retain their staff. The $350 billion fund was completely exhausted late last week with many medium and small sized enterprises still needing cash. Congress leaders responded this week by agreeing to provide more aid totaling $484 billion, of which $320 billion will go towards replenishing the PPP. The next step for Congress is to provide aid to state and local governments struggling with their finances. Early reports suggest that this may be an uphill battle due to resistance from some policymakers. We estimate state and local governments will need at least $200 billion to fill in budget gaps created by lost revenue (see report).

As some states show early signs of containing COVID-19, state governors have started to draw up plans to gradually relax restrictions on their economies. While this is encouraging news, states will have to be careful in their approach. Opening up the economy too quickly, without the proper testing infrastructure in place, could lead to a resurgence of the virus and prolonged economic pain.

Canada – Oil Under Water

This week was yet another one for the record books, as the COVID-19 pandemic continues to turn the world on its head. This time it was oil prices which, incredibly, turned negative on Monday (Chart 1). As noted in our commentary, this was largely down to near-term technical factors. Simply put, the key futures contract specifies physical delivery. So, anyone holding the May contract as it approached expiry early this week would have had to accept delivery of actual oil (and arrange storage for it) in a world where storage capacity is scarce. This forced a rush to liquidations at negative prices. These unusual circumstances meant that the foray into sub-zero territory for the commodity was short lived, although similar episodes cannot be ruled out given slumping demand and worsening storage issues.

These prices are, of course, still very low and are causing production shut-ins and slashed capital spending budgets in the oil sector. These details are provided in our latest provincial forecast update (see forecast), where we project Alberta’s economy to contract the most of any province this year. Of course, Alberta’s economy is not the only one feeling the pain. The magnitude of retrenchments forecast in other regions in large part depends on their exposure to the pandemic and the extent of social distancing measures put in place. On this score, Quebec has been the strictest. In contrast, B.C. and some of the Atlantic provinces are anticipated to weather the storm somewhat better, given their “less-bad” COVID-19 curves.

Many provinces have shown some tentative progress in containing the pandemic. This has paved the way for plans for the gradual re-starting of their economies. While nearly all provinces are set to deliver their schemes in coming weeks, Saskatchewan was a step ahead, releasing its five phase re-opening plan on Thursday. Set to begin on May 4th, phase one will see restrictions on certain medical services lifted, as well as for low-risk outdoor activities. Phase two, beginning May 19th, will see the opening of some retail businesses, such as bookstores, as well as some personal services such as hairstylists. Phase three will entail the re-opening of remaining personal services and an easing of restrictions on public gatherings, although no date for this has been communicated. Phases four and five will see further relaxations.

Turning to this week’s data releases, February’s retail sales report showed that volumes ticked higher month-on-month. That would have been good news, had the retail sector not been among the hardest hit by COVID-19 in March. Elsewhere, the Toronto Real Estate Board reported that home sales fell by about 70% year-on-year (y/y) so far in April, and listings are down nearly 65% y/y, as both buying and selling are in a deep freeze. Average home prices also plunged, though compositional effects (i.e. less activity at the top of the market), played a role. Finally, the March CPI report showed that inflation eased to 0.9% y/y (Chart 2). While inflation is the least of anyone’s concerns at the moment, the Bank of Canada expects it to fall to near zero percent in the second quarter, due largely to energy prices, which as we saw this week, continue to plumb new lows. .

U.S: Upcoming Key Economic Releases

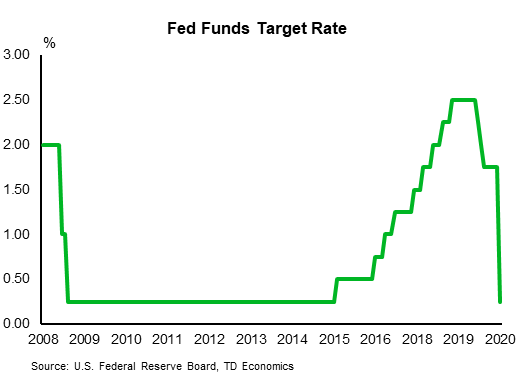

FOMC Rate Decision – April

Release Date: April 29, 2020

Previous: 0.00-0.25%

TD Forecast: 0.00-0.25%

Consensus: 0.00-0.25%

The Fed has already moved aggressively on the funds rate, QE, and lending programs. Lending programs are the main focus now and will probably be modified further in the weeks ahead, but we are not expecting any major announcements at the upcoming meeting. The tone will almost certainly remain dovish, however. The biggest unknown from a rates perspective will be IOER/RRP and we think that the Fed will hike both rates by 5bp to help EFFR stay firmly within the target band.

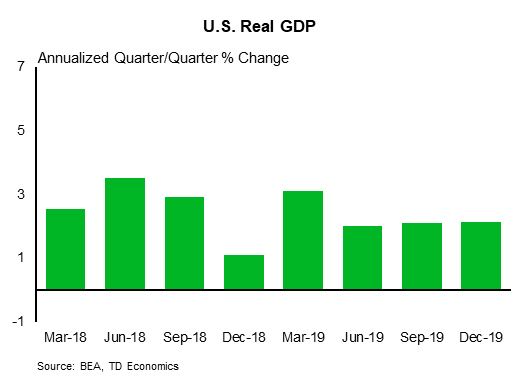

Real GDP Growth – Q1

Release Date: April 29, 2020

Previous: 2.1%

TD Forecast: -4.5%

Consensus: -3.7%

Real GDP probably fell sharply in Q1, even with just the last two weeks of the quarter affected significantly by lockdowns and social distancing; Q2 GDP growth is likely to be much weaker (surely in the double-digits). Our forecast for a sharp 4.5% q/q saar contraction counts on BEA officials assuming sizable declines in the data not yet reported, although we suspect there will also be a downward revision when more complete information is available.

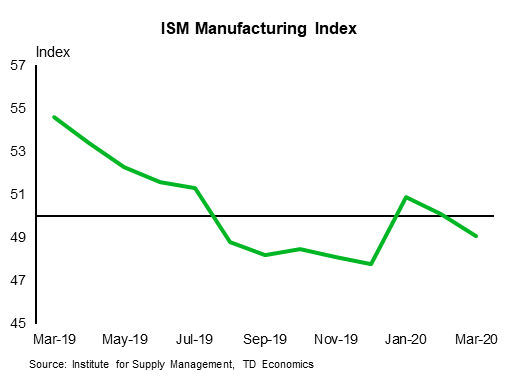

ISM Manufacturing Index – April

Release Date: May 1st, 2020

Previous: 49.1

TD Forecast: 35.0

Consensus: 37.0

We forecast a large decline for the ISM manufacturing index to 35.0 from 49.1 in March, which would represent its lowest level since the financial crisis. We will review our ISM index forecast after more regional surveys are released, but a sharp decline has already been signaled by data from Markit (36.9) and three regional Fed surveys (NY Empire, Philadelphia and Kansas City), which average 32.4 on an ISM-equivalent basis.

Canada: Upcoming Key Economic Releases

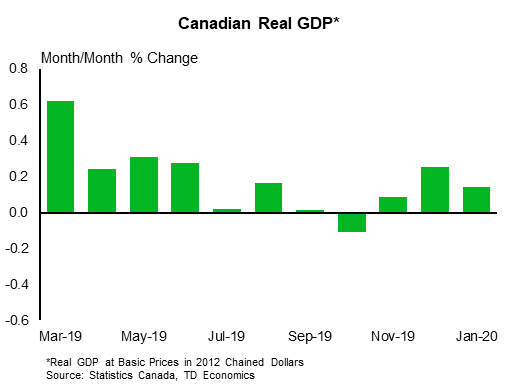

Industry-level GDP – February

Release Date: April 30, 2020

Previous: 0.1%

TD Forecast: 0.4%

Consensus: NA

TD looks for industry-level GDP growth of 0.4% in February despite a modest drag from railway disruptions. Activity data for the month has been constructive, with a strong performance across goods producing industries including a solid (0.8%) increase in real manufacturing sales alongside stronger residential investment and preliminary crude production. Services will see a more subdued increase, owing to a soft month for retail trade, food services, and a drag from protests that weighed on rail transport. While this report should confirm that the economy was on a solid footing heading into the COVID shutdowns, it has little to no impact on the near-term outlook as the historic pullback expected in March will dwarf any implications from February GDP growing at an above-trend pace.

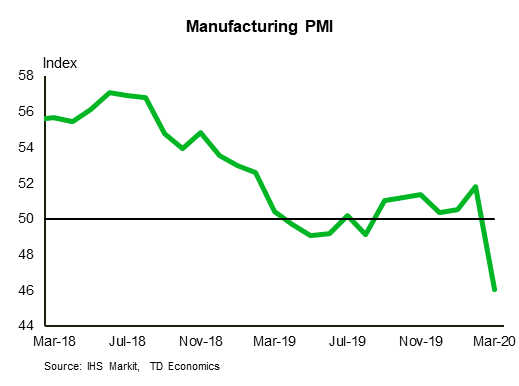

Markit Manufacturing PMI – April

Release Date: May 1st, 2020

Previous: 46.1

TD Forecast: 34.5

Consensus: NA

Manufacturing PMI for April will give an early update on the extent to which broad restrictions against non-essential firms have weighed on the industrial sector. Last month’s reading was the lowest in 10 years at 46.1, although we expect a much sharper contraction for April, with the index falling to a new record low of 34.5. This is consistent with the historic pullbacks observed in other regions and points towards another outsized drop in industry-level GDP for April following the (projected) 9% decline in March.