For the 24 hours to 23:00 GMT, the EUR declined 0.38% against the USD and closed at 1.0780.

On the macro front, Euro-zone’s Markit manufacturing PMI dropped to 33.6 in April, due to the measures taken to contain the spread of coronavirus and hitting its lowest level in 134 months. In the prior month, the PMI had recorded a level of 44.5. Additionally, the Markit services PMI plunged to 11.7 in April, compared to a reading of 26.4 in the prior month. Separately, Germany’s Markit manufacturing PMI declined to 34.4 in April, hitting its lowest level in 133-months and more than market anticipations for a drop to a level of 39.0. In the earlier month, the PMI had recorded a reading of 45.4. Moreover, the preliminary Markit services PMI slumped to 15.9 in April, more than market expectations for a fall to a reading of 28.5. In the previous month, the PMI had recorded a level of 31.7. Furthermore, the GfK consumer confidence survey declined to a historic low level of -23.4 in May, compared to a reading of 2.7 in the prior month.

In the US, the Markit manufacturing PMI tumbled to a 11-year low of 36.9 in April, compared to a reading of 48.5 in the previous month. Additionally, the Markit services PMI decreased to 27.0 in April, indicating its most rapid contraction since the series started in October 2009 and compared to a level of 39.8 in the earlier month. However, initial jobless claims slumped to 4427.0K in the week ended 17 April 2020, less than market expectations and compared to a revised reading of 5237.0K in the previous month. Moreover, new homes sales fell 15.4% to a level of 627.0K on a monthly basis in March, compared to a revised reading of 741.0K in the earlier month.

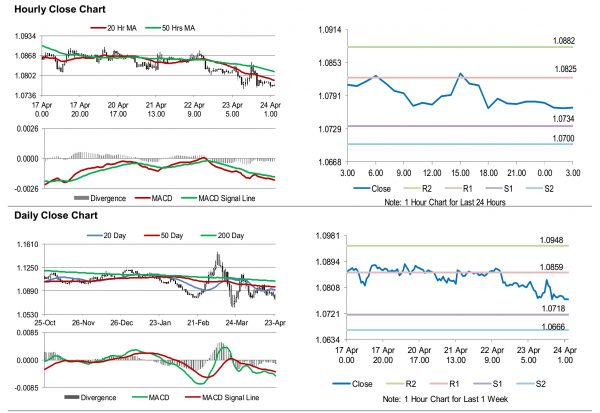

In the Asian session, at GMT0300, the pair is trading at 1.0769, with the EUR trading 0.10% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0734, and a fall through could take it to the next support level of 1.0700. The pair is expected to find its first resistance at 1.0825, and a rise through could take it to the next resistance level of 1.0882.

Looking forward, traders would keep a watch on Germany’s Ifo survey indices for April, slated to release in a few hours. Later in the day, the US durable goods orders for March and the Michigan consumer sentiment index for April, would keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.