For the 24 hours to 23:00 GMT, the USD declined 2.33% against the JPY and closed at 107.58.

On the data front, Japan’s coincident index fell to 95.5 in February, compared to a revised level of 95.7 in the prior month. The preliminary figures had indicated a rise to 95.8. Meanwhile, the leading economic index rose to 91.7 in February, compared to a revised reading of 90.7 in the previous month. The preliminary figures had recorded a rise to 92.1.

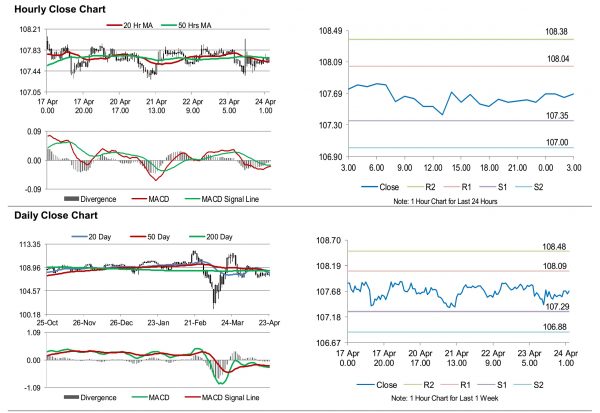

In the Asian session, at GMT0300, the pair is trading at 107.69, with the USD trading 0.10% higher against the JPY from yesterday’s close.

Overnight data indicated that Japan’s national consumer price index rose 0.4% on an annual basis in March, compared to a similar rise in the previous month. Additionally, the corporate service price index advanced 1.6% on a yearly basis in March, compared to a rise of 2.1% in the previous month.

The pair is expected to find support at 107.35, and a fall through could take it to the next support level of 107.00. The pair is expected to find its first resistance at 108.04, and a rise through could take it to the next resistance level of 108.38.

With no macroeconomic releases in Japan today, investor sentiment would be governed by global macroeconomic events.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.