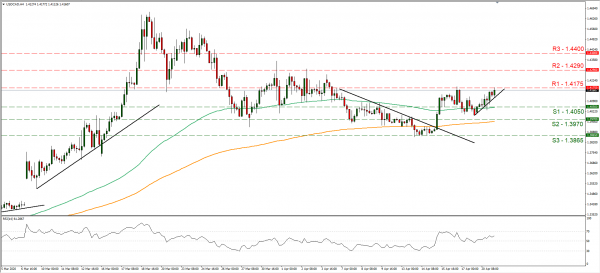

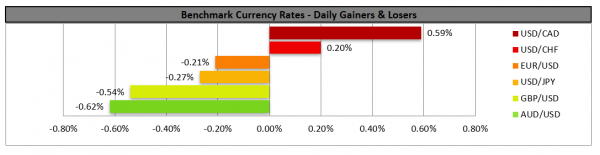

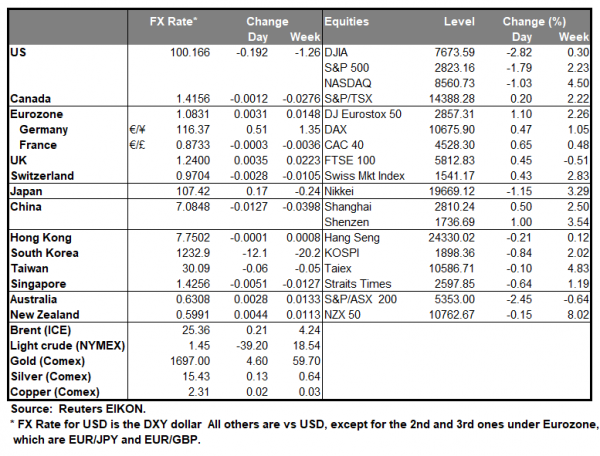

The greenback seems to be strengthening slightly but steadily against its counterparts as its safe haven qualities shine once again. The dollar’s ascent was noticed particularly against currencies of oil producing economies, such as the CAD, as U.S. crude futures prices reached historic lows, being below zero for US oil futures contracts, before correcting higher later on. The social distancing measures and US lockdown, as well as elsewhere, drove the demand for oil down, while at the same time the difficulty of oil producers to stop production, brought oil price to historic lows. It should be noticed that storage facilities are filling up slowly but steadily, due to the oversupply of the oil market. We expect that oil prices could continue to be under pressure as the existing oil inventories will have to be driven down at a later stage, when demand rebounds. However oil demand levels are directly dependant on how quickly the economy opens and with which intensity. Market worries about a possible future recovery of the US economy seem to persist. We expect the US Dollar to see some gains as a safe haven, while also we consider the Fed’s huge monetary stimulus which oversupplied the market with USD as the main reason preventing the greenback from a rally. Please note that the USD may have strengthened also after CNN reported that North Korea’s leader is in grave danger after a heart operation, albeit we consider this as of lesser importance at the current stage. We expect the USD to continue to be safe haven driven currently, as key US financial releases are due out on Thursday. USD/CAD rose testing the 1.4175 (R1) during the Asian session today. We expect the pair to rise further if it follows the upward trendline incepted since the 17th of April. If the bulls actually maintain control over the pair, we could see the pair breaking the 1.4175 (R1) line and aim for the 1.4290 (R2) level. If the bears dominate the pair’s direction, it could aim if not break the 1.4050 (S1) line in search of lower grounds.

Worries intensify for the Aussie

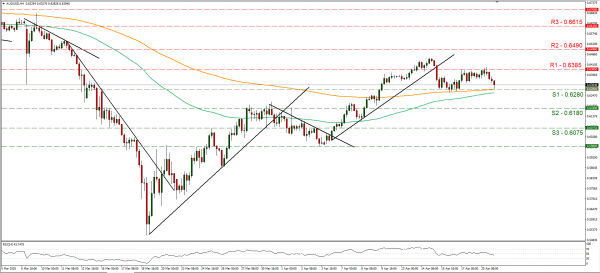

The Aussie weakened against the USD as worries have still a strong presence for the Australian economy, among investors for the time being. The Australian lockdown measures were underscored by a report issued by the bureau of statistics, which stated that the Australian economy may have lost around 780k jobs, between March 14th and April 4th. The Australian government stated that they want the community transmission rate to be under 1%, in order to substantially ease the measures in place. The minutes of RBA’s latest meeting showed that the bank worried about economic output shrinking markedly this quarter and remain subdued through the third quarter as well. On the positive side though the bank showed its readiness to continue to support the Australian economy with more purchases of government bonds. RBA Governor Lowe will be speaking shortly, yet AUD could remain driven by market sentiment as a commodity currency. AUD/USD dropped during the Asian session today at some point reaching the 0.6280 (S1) line which supported the pair’s price action during the 15th and the 16th of the month. Technically, currently the pair’s price action has not broken the lower boundary of its sideways movement, yet should it retreat below the 0.6280 (S1) line, we would tend to switch our outlook in favour of the bears. Should the pair actually come under the selling interest of the market we could see it breaking the 0.6280 (S1) line and aim for the 0.6180 (S2) support level. Should the pair’s long positions be favoured by the market on the other hand, we could see it aiming if not breaking the 0.6385 and moving for higher grounds.

Other economic highlights today and early tomorrow

Today, during the Asian session, we get UK’s employment data for February as well as Germany’s ZEW indicators for March. In the American session, we get Canada’s retail sales growth rate for February as well as the US number of existing home sales for March. Just before the Asian session starts, we get from the US the API weekly crude oil inventories figure.

Support: 1.4050 (S1), 1.3970 (S2), 1.3865 (S3)

Resistance: 1.4175 (R1), 1.4290 (R2), 1.4400 (R3)

Support: 0.6280 (S1), 0.6180 (S2), 0.6075 (S3)

Resistance: 0.6385 (R1), 0.6490 (R2), 0.6615 (R3)