- WTI oil price goes negative as physical storage space runs out

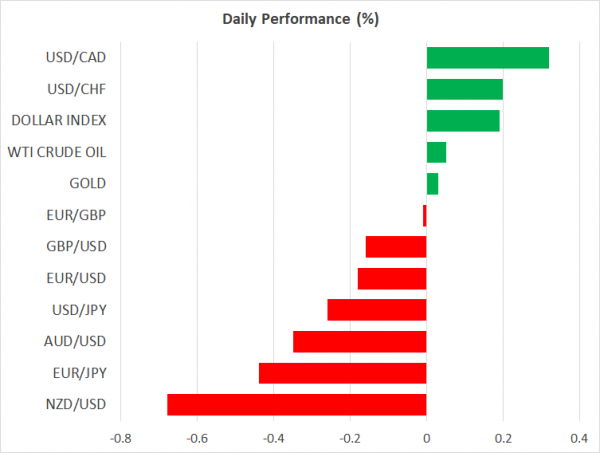

- Loonie and other oil-sensitive currencies retreat

- But little impact in other assets – mild risk aversion only

- Yen and dollar gain on defensive flows, stocks turn red, kiwi drops

Oil price turns negative as energy market craters

For the first time ever, the price on a barrel of WTI crude oil fell to zero yesterday and then traded negative, falling as low as -$40.32/barrel in a move so unprecedented it has left the financial community’s jaw on the floor.

How can a commodity go negative? It has a lot to do with storage capacity, or rather, the lack thereof. The WTI futures contract for May expires today, so people who are long that contract on expiry would need to take physical delivery on that oil. However, it seems that storage space in Cushing, Oklahoma – which is the main delivery point for most US oil contracts – is practically fully booked.

Therefore, some investors were left holding a contract they did not want and could not have delivered, and when they all attempted to sell in a market without buyers, prices literally fell through the floor. Specifically, prices fell enough for someone to be willing to incur the physical storage costs, or in simpler terms, storage space is so scarce that people were actually paid to take delivery of oil.

What does it all mean? In a nutshell, it’s not good. When oil turns into a negative-yielding asset, that’s a signal that the imbalance between supply and demand has reached a crescendo so great that producers are losing money to get oil off their books. And speculators are playing a game of ‘musical chairs’ to see who ends up holding those contracts at the end.

At the end of the day, the commodity market – which has not received any support from the Fed – might be sending the clearest signal yet that the wheels are coming off the global economy, something bond and stock markets may no longer reflect.

Loonie takes it on the chin

In the FX realm, it was the ‘usual oil suspects’ that suffered, namely the Canadian dollar, Russian ruble, and Norwegian krone. Yet, only the loonie was hit especially hard, as Canada faces similar storage issues as the US, painting a much bleaker picture for the nation’s future exports.

Looking ahead, unless storage space is somehow freed up in the coming weeks, we might see a repeat of this oil-crash movie play out when the contract for June matures next month. For that to be avoided, something drastic needs to change in the supply-demand equation, which is unlikely in the immediate term unless the US government fills up its strategic reserves to the brink.

Hence, the pain train for both spot oil and the loonie may not be over just yet. In the longer term, the sun will shine again as economies reopen (demand picks up) and supply is curtailed amid rock-bottom prices – however, that point may be several months away.

Investors hit the risk-off button, but don’t panic

Strikingly, the panic in the energy sector did not cascade into the broader market. Yes, global stocks are a sea of red today, while the defensive yen and the dollar are leading the charge in the FX market on defensive flows, but all these moves are relatively modest in size.

One would have expected markets to react more fiercely at the risk of a cascade of defaults in the US shale industry, but investors seem well sedated by the unprecedented stimulus measures globally and by hopes for a virus vaccine.

Finally, the kiwi is the worst performing major currency today, reeling after RBNZ Governor Orr said he is open minded about monetizing the government’s debt. Much of those losses may be owed to algorithmic selling on the headline, since Orr didn’t say anything groundbreaking – he’s just calling a spade a spade. Quantitative Easing is in practice monetization through the back door, without admitting it.