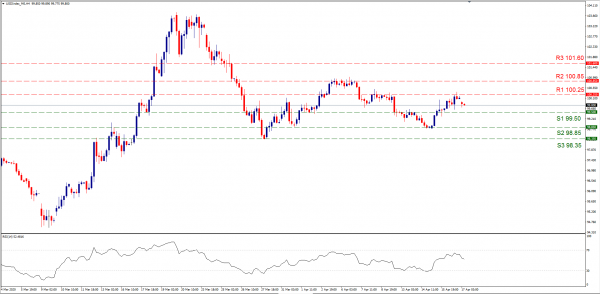

During the past days, some governors of various US states have seemingly made efforts to gradually reopen businesses and ease social-distancing guidelines. Last night, US President Donald Trump affirmed it was up to governors of individual states to determine when it will be most appropriate to lift restrictions. Optimism on reopening parts of the US economy comes as economic releases from the US during the past week, implied the economy is currently in a decline. According to sources, over 20M people have signed unemployment forms and the total figure for April is expected to rise even more. The idea of reopening parts of the economy can lift optimism in the US economy and could be supporting the USD at the moment. However, some other states are expected to extend their shutdowns into the next month as the pandemic still carries health and other risks. The Dollar Index, a metric of the greenback’s strength against other major currencies moved higher for the second consecutive day on Thursday and tested the (R1) 100.25 level but was not able to breach it. However, if the momentum continues we could see the index heading towards the (R2) 100.85 line that was tested many times in April’s first days while the (R3) refers to prices last seen in March. If the Index is to correct lower, then the (S1) 99.50 may come into play. The (S2) 98.95 is also a level lower that could be tested, while the (S3) 98.35 could be found even lower.

OPEC releases April report, changes its outlook

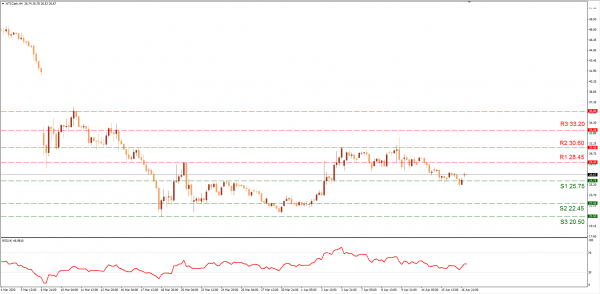

According to its new report, OPEC expects demand for its crude to drop to a three decades low. For 2020, the world oil demand growth forecast was revised lower to a historical drop of around 6.8 million bpd. The report referred to China’s reduced transportations and industrial activities which are now spreading around the globe, as the main reason for the reduced demand outlook. OPEC also left the door open for further adjustments on its outlook as they will continue to monitor the situation in the second quarter of the year and provide further guidance. Yet, added that downward risks remain significant. Even so, OPEC’s forecast on reduced oil demand is better for Oil’s price compared to the International Energy Agency, which on Wednesday reported it saw a 9.3 million bpd dive in April. WTI prices moved lower in the past days as the news leans towards a bearish sentiment. WTI yesterday tested our (S1) 25.75 level constantly but proved strong enough to withhold the pressure. For lower levels we note the (S2) 22.45 line and then the (S3) 20.50 hurdle as the lowest price reached in 2020. Upwards, we note the (R1) 28.45 line the (R2) 30.60 level and the (R3) 33.20 hurdle. Overall the commodity remains in a sideways motion in April. Trading between the (R2) 30.60 resistance level and the (S1) 25.75 support level.

Economic highlights today and early Monday

Today in the European session, we get Eurozone’s final HICP rates for March. In the American session, we get the US Bake Hughes Oil rig count. Finally, in the Asian session on Monday, we get the New Zealand Inflation data that stands out.

Support: 99.50 (S1), 98.85 (S2), 98.35 (S3)

Resistance: 100.25 (R1), 100.85 (R2), 101.60 (R3)

Support: 25.75 (S1), 22.45 (S2), 20.50 (S3)

Resistance: 28.45 (R1), 30.60 (R2), 33.20 (R3)