The Australian dollar rose slightly after China released weak first quarter economic data. The numbers showed that the country’s economy declined by 6.8% in the first quarter. This was worse than the expected 6.5% and the first contraction in more than 25 years. Perhaps, investors are optimistic that the economy is improving. For example, fixed investments declined by 16% in March, which was slightly better than the previous decline of 24%. Also, industrial production dropped by 1.1% in March after dropping by 13.5% in the previous month. Also, data released this month showed that manufacturing and trade improved in March.

US futures rallied in overnight trading after Gilead announced that its coronavirus drug was showing signs of effectiveness in clinical trials in Chicago. The stock price of Gilead rose by 16% after the news. The stocks also rallied after Donald Trump unveiled his plan to reopen the economy. In a statement to the press, he said that governors in states with fewer cases can start reopening their states. He also said that this decision will be theirs, a week after he claimed that he had total authority on reopening. Other positive news was that Boeing was planning to restart operations at its Seattle plant.

Today, the focus will remain on the coronavirus pandemic and how countries are planning to reopen their economies. We will also receive economic data from Europe. First, we will receive the auto registration data from countries like the UK, France, and Italy. We will also receive consumer price index data from the European Union. In Canada, we will receive the foreign securities purchases and the ADP employment change. The earning season will also continue. The key companies that will report today are Procter & Gamble, State Street, and Schlumberger.

EUR/USD

The EUR/USD pair rose slightly in overnight trading. It reached a high of 1.0878, which was higher than yesterday’s low of 1.0816. The rally started after the pair made a bullish hammer candlestick pattern yesterday. The price is along the 14-day exponential moving average and slightly above the 28-day EMA while the RSI has been rising. The price is also slightly below the Fibonacci Retracement level. Therefore, the pair may continue rising and possibly test the 61.8% retracement level at 1.0900.

XBR/USD

The XBR/USD pair rose after Russia and Saudi Arabia said that they were committed to making more supply cuts. The pair reached an intraday high of 31.33, which was higher than yesterday’s low of 29.45. This price is slightly below the 50% Fibonacci Retracement level on the hourly chart and slightly above the short and medium-term moving averages. The pair may continue to rally today and possibly retest the 61.8% Fibonacci Retracement level of 32.50.

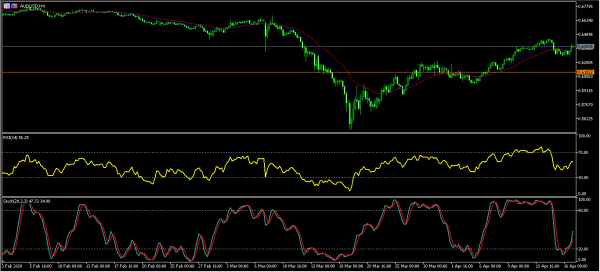

AUD/USD

The AUD/USD pair rose to an intraday high of 0.6383 after the Chinese data. On the hourly chart, the price is slightly above the 14-day and 28-day exponential moving average while the RSI has started to rise. The signal and main lines of the Stochastic Oscillator have also emerged from the oversold level. Therefore, the pair may continue rising and possibly test Wednesday’s high of 0.6450.