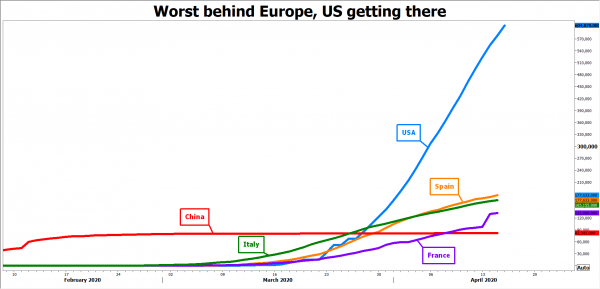

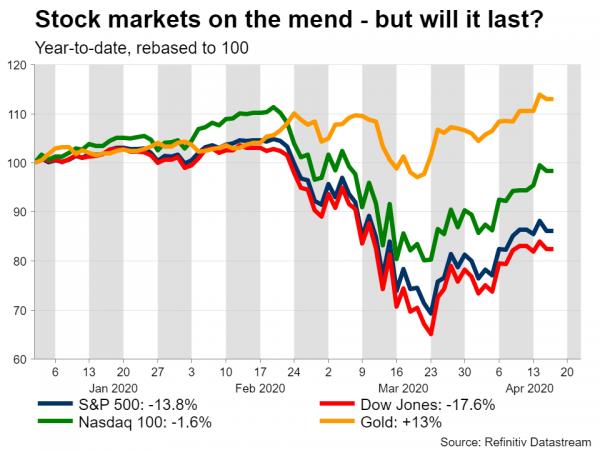

With the worst of the pandemic now behind Europe and the US also approaching a peak, markets have turned their sights to when economies will re-open. Stocks have recovered on hopes for a ‘return to normal’, but importantly, safe havens like the yen and gold are also gaining. The combination suggests that traders are still playing defense, and that the recent stock rally may be built on shaky foundations. Indeed, investors might be downplaying the scale of this crisis, and how long it will take for economies to recover. As such, the upcoming PMIs could provide a reality check.

Lay of the land

A lot of good news has been priced back into the markets, with investors taking heart from the slowdown in new infections in Europe and America, which allows for a gradual re-opening of the global economy. Italy and Spain have already started to ease some business restrictions, Germany announced plans to relax its lockdown in early May, and the US is thinking of its own exit strategy.

Hence, many investors are under the impression things will return to normal in a couple of months, setting the stage for a V-shaped recovery. Of course, the massive stimulus measures globally are feeding that narrative too.

While the stimulus is significant to be sure – as it will help prevent this crisis from evolving into a depression – investors might be underappreciating how deep this downturn will be and how long it will take for economies to recover. The speed of job losses in the US is simply terrifying. The unemployment rate will easily surpass 10% next month – the peak of the previous recession – and who knows how much higher it will climb as the pandemic cascades through the economy.

Those losses could take years to recover, especially when considering the scars this crisis might leave on consumer behaviour. Would you go to a restaurant or cinema the same day the lockdowns end, or play it safe and wait? Not to mention the risk of second waves of infections once the lockdowns are lifted, and the possibility of future shutdowns.

All this argues for a slow and protracted recovery as consumption remains soft, something that stock prices don’t seem to fully reflect. Indeed, the latest gains in gold and the yen suggest traders don’t have much faith in the recent stock rally either. The fact that oil prices can’t get off the floor either, despite huge supply cuts, argues the same point. It implies a real pickup in demand isn’t expected anytime soon.

European PMIs could be scary

Truth be told, in an environment as panicky as this one, economic data don’t mean much. Investors already know we are in a recession, and the real question is how deep it will be and how long it’s going to last. Economic data are usually backward-looking, so they don’t say much about the future.

The only numbers that could attract attention, are the PMIs for April. These business surveys are released earlier than official data and have a forward-looking component, by asking companies about the orders they’ve received for the next months and their future expectations.

The Eurozone’s preliminary PMIs will hit the markets on Thursday, and while everyone knows they are going to be bad, the question is how bad. Remember that the euro area was painfully slow to agree on a stimulus package, and on top of the pandemic ravaging consumption and sentiment, it’s likely the PMIs will be scary.

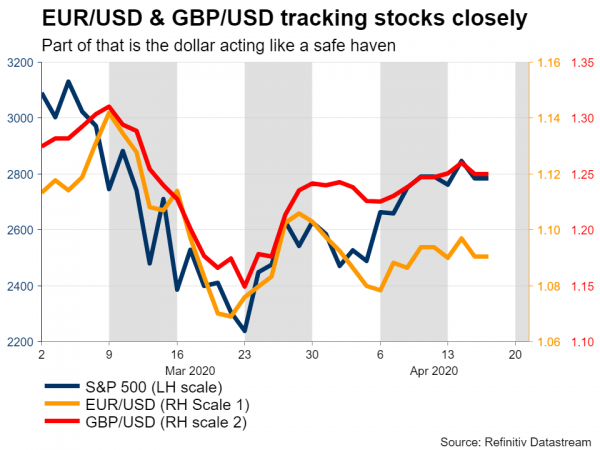

As for the euro, it has been mostly at the mercy of risk sentiment lately, rising and falling with stock markets. This has a lot to do with the dollar too, which has been trading like a safe haven in this crisis. Hence, euro/dollar tends to move in the same direction as stocks nowadays, and other FX pairs take their cue from it. Since the risk of another decline in stocks looks elevated, that would imply that the risks around euro/dollar also seem tilted to the downside, especially considering the EU’s inability to agree on a risk-sharing mechanism like Eurobonds.

Germany’s ZEW and Ifo surveys for April are also due on Tuesday and Friday, respectively.

US jobless claims and PMIs in focus

In America, all eyes will be on Thursday’s releases, when we get initial jobless claims and the flash Markit PMIs for April. Jobless claims have been a key metric to watch lately, as they are released weekly and give an up-to-date picture of how quickly jobs are being lost.

In the past four weeks alone, 22 million Americans have filed for unemployment benefits, amounting to roughly 13% of the entire workforce. While some of those jobs will come back once the crisis blows over, many others – especially in the retail sector – will be lost permanently. Without some massive job-creation program by the federal government, for instance on infrastructure, it might take years before the labour market recovers.

However, that gloom may not matter much for the dollar. The greenback isn’t just the US currency, it’s also the world’s reserve currency, and those defensive qualities have been on full display lately. When the world economy falls off a cliff, all investors and corporates want is the dollar – it’s stable, liquid, and accepted everywhere.

While any massive rally in the dollar seems unlikely from here, as the worst may be over, it’s also difficult to envision any major losses. If anything, the outlook looks mildly positive, especially against the euro and commodity-linked currencies, given the prospect that risk appetite sours again.

US durable goods orders are also due on Friday, and will give us a sense of how quickly business spending is falling.

Risk sentiment to drive commodity currencies, not data

Turning to the ‘commodity dollars’, New Zealand’s CPI inflation data for Q1 are due on Monday. Then early on Tuesday, the Reserve Bank of Australia will release the minutes of its latest meeting. Later in the day, Canada’s retail sales for March will hit the markets, before the nation’s CPI numbers on Wednesday.

Alas, as stated above, what will matter most for all these currencies is how risk sentiment evolves and therefore how commodity prices fare, not data.

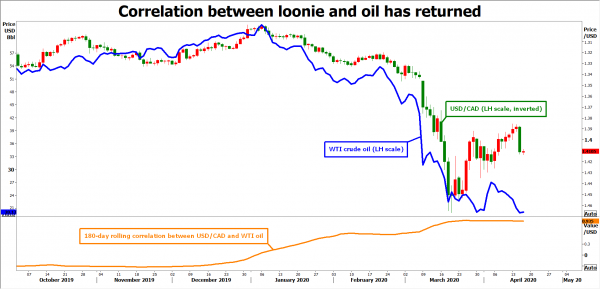

The Canadian dollar in particular has been trading almost entirely as a function of oil prices, with the correlation between the two soaring. In that regard, it will be crucial to see if WTI breaks below its recent lows – if it does, that could spell more pain for the battered loonie.

Pound also a function of risk appetite

The calendar in the UK is busy, with employment data for February being released on Tuesday, ahead of CPI numbers for March on Wednesday. Then on Thursday, both retail sales for March and the preliminary PMIs for April are due out.

While the PMIs might generate some volatility, the biggest driver for sterling will also be risk appetite. The correlation between the S&P 500 and Cable has skyrocketed lately, and while that’s partly owed to the dollar being a safe haven, it’s also a testament to how important investor sentiment is for an economy that basically intermediates financial flows, like the UK.