The world is seeking clues on how painful the virus economic impact could be and China’s GDP growth readings for Q1 released on Friday at 02:00 GMT may give a bitter taste. Despite that, a rebound in monthly retail sales, urban investment and industrial production data accompanying the report may steal all the attention, letting the aussie to recoup more lost ground.

Between a rock and a hard place

The global economy is between a rock and a hard place in the absence of a cure for Covid-19. In order to stop the spread and avoid packed hospitals, China first and then the rest of the world shut down businesses and forced consumers to stay home, acknowledging that such measures may exponentially raise the odds for another global recession. To ease the risk of default, governments and central banks came to rescue, spending billions to boost liquidity among consumers and businesses and planning additional stimulus packages. But financial aid can’t continue forever as sources are limited while a resumption of economic activities would threaten more lives.

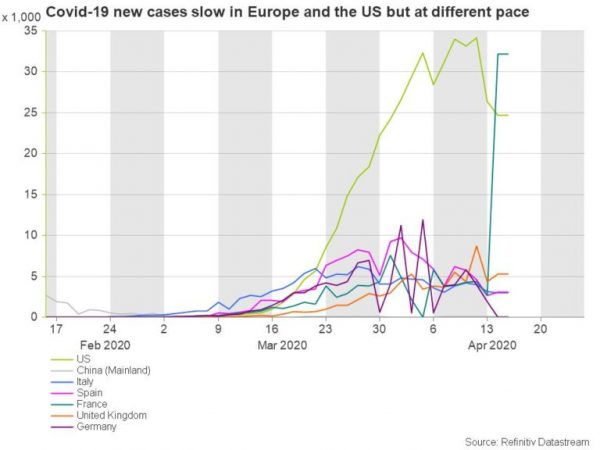

Hence, a gradual removal of restrictions is on the cards now as an intermediate solution, with China having already started the process, and particularly in Wuhan, following the desired fall in new cases. Europe and the US have also detected a slowdown, though the situation is more complicated. The virus is still spreading differently in different regions across the continents, questioning whether the peak has been reached and consequently putting governments in a dilemma about when to start dialing back restrictions.

China could report record growth decline but eyes will turn elsewhere

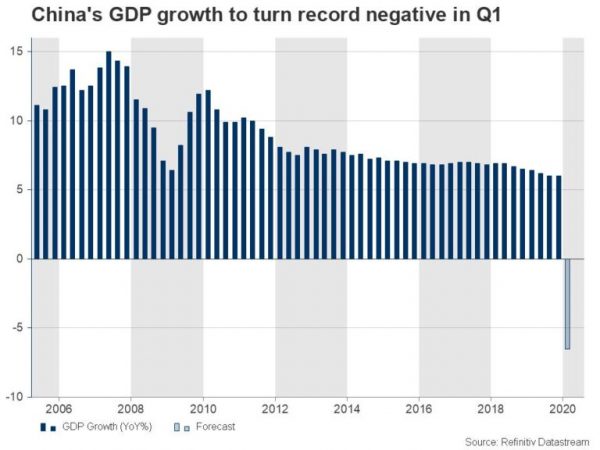

The timing of a gradual removal of restrictions could be a function of how much financial damage an economy can afford but nobody is certain about the full impact of the virus. Therefore, China’s GDP growth figures on Friday may shed some light of what to expect. According to forecasts, China may have shrunk by 6.5% year-on-year in the first quarter after closing positive in 2019 at 6.0% y/y. On a quarterly basis, the picture could be gloomier, with the gauge correcting lower by 9.9% from a positive 1.5% seen previously.

If that is the case, the world’s second biggest economy will experience a record negative growth. Nevertheless, traders are already aware that a potential financial shock may be greater than the 2008-2009 crisis or the Great depression in 1930s, therefore such an outcome would not make much difference.

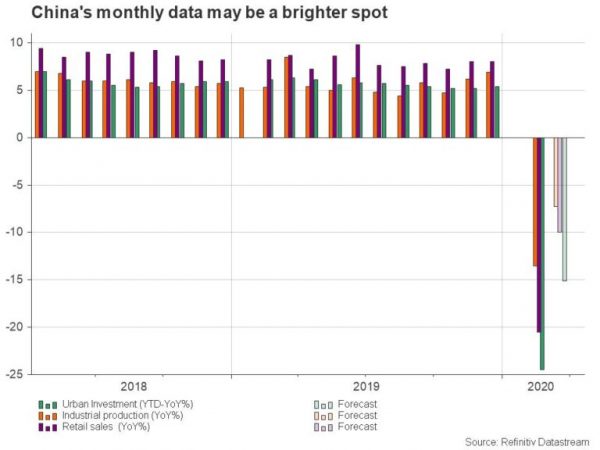

On the other hand, since markets are starving for some good news and restrictions have been less strongly enforced in March in China, an improvement in the monthly figures delivered along with GDP readings may encourage that the second quarter may not be as dark as the first one and that fiscal and monetary support is indeed providing some floor.

Better-than-expected trade data have already raised hopes and the spotlight is now turning to retail sales, industrial production and urban investment. Projections are for retail sales and industrial production to have halved February’s decline to 10% y/y and 7.3% y/y respectively, while investments in construction projects are also forecast to have declined at a softer pace, decreasing by 15.1% year-to-date versus the 24.5% loss in the previous month.

Market reaction

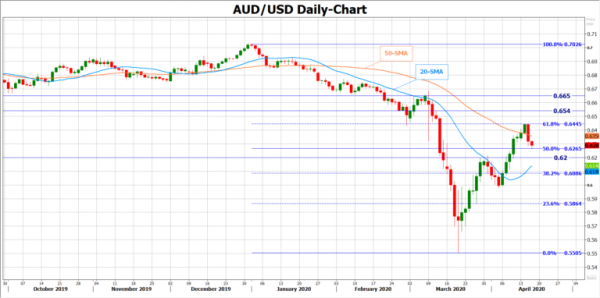

In case the monthly figures surprise to the upside and in a more positive scenario Q1 GDP growth data follow suit, the Australian dollar which is sensitive to the Chinese economy due to the tied trade relations between the countries – lockdowns are mainly limiting human traveling not trade in goods – could bounce back towards the 61.8% Fibonacci retracement of the recent downfall at 0.6445, where any decisive close higher may hit resistance around 0.6540 and then near 0.6650.

Otherwise, in the event March figures miss forecasts and/or GDP growth declines faster, AUD/USD could target the 0.6200-0.6265 region on the donwside which includes the 50% Fibonacci before meeting the 38.2% Fibonacci of 0.6086.