For the 24 hours to 23:00 GMT, the USD rose 8.26% against the CAD and closed at 1.4119.

The Bank of Canada, in its interest rate decision, maintained its interest rate at 0.25%, as widely expected. Additionally, the central bank signalled that it is not planning to cut the rate to zero or into negative territory. Also, the bank cautioned that the outbreak has resulted worst impact on the economy as well as employment worldwide, following with the economic activity collapsed by drop of 9%. The central bank stated that it expects economic activity to slow by as much as 30% from end of 2019.

In the Asian session, at GMT0300, the pair is trading at 1.4124, with the USD trading marginally higher against the CAD from yesterday’s close.

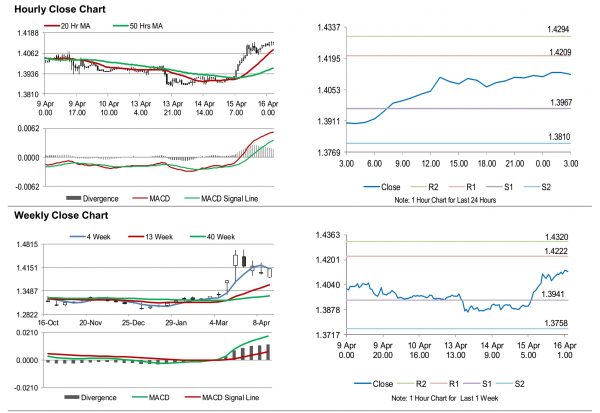

The pair is expected to find support at 1.3967, and a fall through could take it to the next support level of 1.3810. The pair is expected to find its first resistance at 1.4209, and a rise through could take it to the next resistance level of 1.4294.

Moving forward, investors would keep an eye on Canada’s manufacturing sales for February, slated to release in a few hours..

The currency pair is trading above its 20 Hr and 50 Hr moving averages.