US stocks rose yesterday as investors started to digest the latest corporate earnings. Yesterday, early results showed that profits from US banks had plunged in the first quarter. JP Morgan’s and Wells Fargo’s net income dropped by 62% and 82% respectively. These losses were mostly because the banks set aside billions of dollars for provisions of bad debt. The two banks set aside $6.8 billion and $3.83 billion respectively. In addition, the two banks said that they would support their customers by waiving some late fees and allowing some of them to suspend their payments for a short period. Today, we will receive earnings from banks like Morgan Stanley, Citigroup, Bank of America, and Goldman Sachs.

Asian stocks wobbled today as investors reflected on the blistering report by the International Monetary Fund (IMF). In the report, the organization said that the world was heading towards the worst financial calamity since the great depression that happened in the late 1920s. The report said that the world economy would shrink by 3% this year. Most advanced economies will shrink by 6.1% while emerging markets will shrink by 1%. The organisation warned that the hit will be double if the current lockdown continues through this quarter.

Focus today will be on the Bank of Canada, which is expected to release its interest rates decision. The bank is expected to leave interest rates unchanged at the current 0.25%. It is also expected to make a statement on the current state of the Canadian economy and what it plans to do to cushion businesses and households. We will also receive retail sales and industrial production data from the United States, crude oil inventories, and inflation data from Europe.

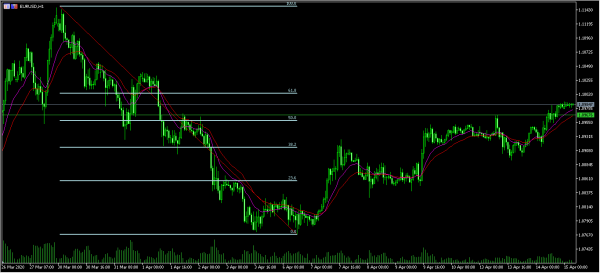

EUR/USD

The EUR/USD pair rose to an intraday high of 1.0984, which is its highest level since April 1. The price is slightly above the 50% Fibonacci Retracement level and above the important resistance of 1.0967. The price is also slightly above the 14-day and 28-day exponential moving averages on the hourly chart. The pair may continue rising and possibly test the 61.8% retracement level at 1.1000.

GBP/USD

The GBP/USD pair continued its two-week rally in overnight trading. The pair reached a high of 1.2650, which is the highest it has been since March 16. On the four-hour chart, the price is above the 61.8% Fibonacci Retracement level. It is also above the Ichimoku cloud and the short and medium-term moving averages while the RSI has moved above the overbought level of 70. The pair may continue rising as it aims for the 1.2725 resistance level.

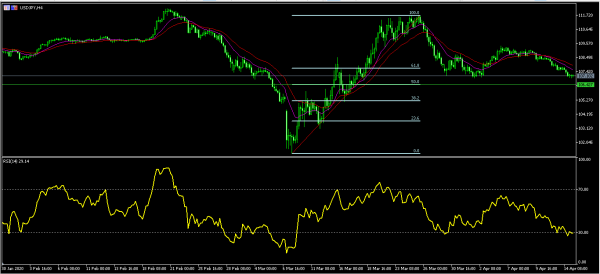

USD/JPY

The USD/JPY pair declined to an intraday low of 106.96 partly because of the overall dollar weakness. The pair has been sliding since March 26, when it was trading at 111.66. The price is between the 50% and 61.8% Fibonacci Retracement level and below the short and medium-term moving averages. The RSI has fallen to the oversold level. The pair will likely move lower as it aims to the 50% retracement level of 106.42.