This week gave us some hard data on the impact of coronavirus containment measures. Canada’s employment numbers were as bad as feared, with 1 million people losing their jobs through mid-March and economy-wide hours worked falling by 15%. Conditions deteriorated toward the end of the month and in early-April, and more than 5 million Canadians have reportedly filed for employment insurance or other benefits (those payments have already started to roll out). The federal government’s wage subsidy program will help businesses rehire some former employees (a few large companies have announced their intentions to do so) and keep others on the payroll. Eligibility for that program was eased this week but implementing legislation has yet to be passed, and in any case it was expected to be several weeks before businesses could collect those subsidy payments. But another major program, government-supported lending to small businesses, is set to roll out next week and will deliver much needed funding to help cover fixed costs.

March’s dramatic job losses tee up for a significant decline in economic activity in the current quarter—our latest forecasts look for Canada’s Q2 GDP to fall by more than 30% at an annualized rate. That sharp slowdown will start to make its way into next week’s data. While February’s manufacturing report will already be out of date when it’s released, March’s home resales will show some coronavirus effects with local board releases indicating sales activity slowed sharply in the second half of the month. Wednesday’s Bank of Canada meeting isn’t likely to deliver any policy changes—the BoC was very active in March, cutting its policy rate to the effective lower bound and launching a new QE program (among other liquidity-supplying measures). We expect it to emphasize its willingness to do more if required, and in any case to reiterate that low rates and asset purchases will continue “until it’s clear the economic recovery is well underway.” On that last point, updated economic projections will reveal the BoC’s assessment of the near-term hit to GDP, as well as how much economic activity is expected to recover over the second half of the year and in 2021.

In the US, March retail sales are likely to show a significant hit to non-essential retail activity that will only be partially offset by stronger sales at grocery stores and pharmacies. A more than 10% decline in gasoline prices (normally a boon for consumer spending) will add to a significant drop sales volumes as Americans stayed closer to home. We don’t think the slowdown in March’s industrial production will be as severe. Goods producers in general are likely to be less impacted by containment measures than services industries (a role reversal relative to past recessions). The story could change in April—anecdotally we’ve seen reports of temporary shutdowns or curtailments in manufacturing.

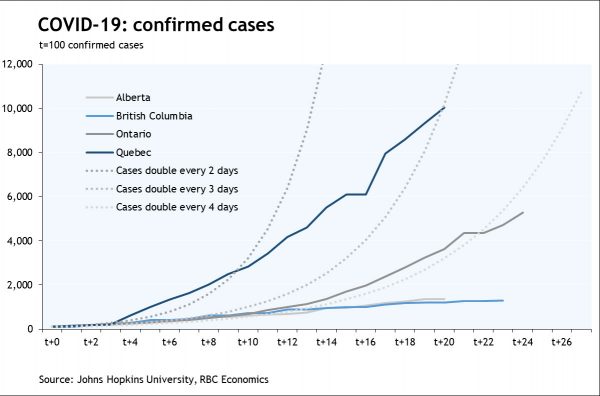

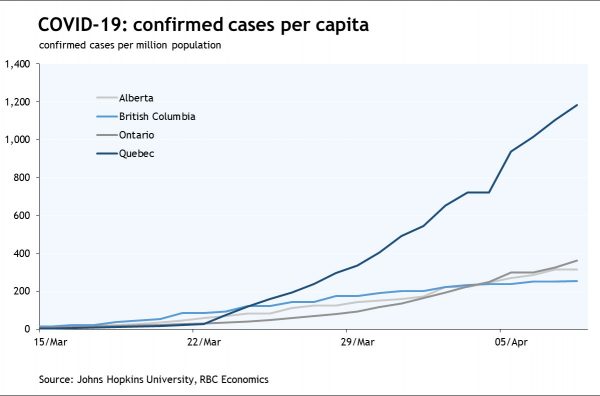

We’ll also be keeping an eye on COVID-19 cases, which just surpassed the 1.5 million mark globally, having increased 10% per day on average over the past week. Hard-hit Italy’s containment measures continue to bear fruit, while the US case trajectory remains troubling. Within Canada, British Columbia is having some success in bending the curve and Alberta’s numbers are only slightly worse on a population adjusted basis. Quebec stands out as having the worst outbreak by far, with the province’s early March break (more recreation and traveling before containment measures were increased) being at least partly to blame. Ontario’s case load isn’t much worse than BC and Alberta’s on a per capita basis, though more limited testing is likely understating the number of confirmed cases in Canada’s largest province.