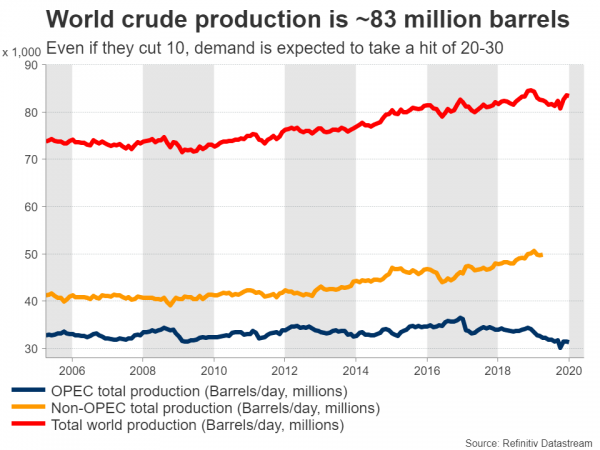

This will be a pivotal week for energy markets. The world’s largest oil producers will meet to discuss cutting their production in an attempt to stabilize a market that has been devastated by collapsing demand. OPEC and Russia will sit down for talks on Thursday, before the G20 energy ministers convene on Friday. The immediate reaction in oil prices will depend on whether a deal is struck at all, and if so, by how much they will cut. In the big picture though, even a sizeable cut won’t stabilize the market.

OPEC invites friends over

After the production alliance between Saudi Arabia and Russia fell apart last month, both sides decided to go on the offensive, ramping up their output and flooding the market with oil in an attempt to squeeze out higher-cost producers like US shale. At the same time, several economies went into lockdown to fight the coronavirus, leading to a dramatic drop in demand as people were told to stay home. Naturally, the combination of soaring supply and collapsing demand saw oil prices plummet, pushing WTI as low as $19.30 per barrel.

However, oil prices that low suit nobody, especially the US shale industry that was heavily indebted before this crisis and was about to be hit by waves of defaults. Hence, the US President used his influence to bring the two sides back to the negotiating table, promising that he has brokered an agreement for Saudi Arabia and Russia to collectively cut their production by 10-15 million barrels per day (mbpd) in order to shore up prices.

While both nations confirmed they are willing to discuss output reductions, they were clear that they will only cut if other major producers outside of OPEC – like the US, Canada, and Mexico – also contribute with cuts of their own.

Will they cut at all?

Probably. Even though there is always high uncertainty surrounding these events, every party involved has an incentive to stabilize the market and prices.

Even Saudi Arabia and Russia, both of which can weather low prices for longer than other countries given their low production costs, might not want to destroy smaller US producers entirely. In that case, giants like Chevron and ExxonMobil will probably buy the assets of those companies at a sharp discount, leading to a healthy restructuring of the industry that makes US oil even more competitive in the longer run.

How much?

The real question is how much will be cut. Even if everything goes smoothly with the deal and everyone chips in, it’s almost impossible to envision a cut bigger than 10 million barrels. In fact, there might even be some ‘shenanigans’ involved for the producers to reach a number that high.

Will a 10 million cut be calculated from today’s output levels, which are approximately 3 million barrels higher than a month ago, before Saudi Arabia and Russia went on a production spree? If that’s the case, then the real cut will only be around 7 million barrels.

Even if the real cut is 10 million though, that still most probably won’t be enough to stabilize the market. There is no real data so far, but most estimates suggest global oil demand will take a hit of around 20-30 million barrels from the virus-fighting lockdowns. Therefore, the market will still be left oversupplied on a scale never seen before.

In other words, this deal won’t be the medicine that cures the oil market. Instead, it will be a bandage on the wound.

Market implications

All told, it’s difficult to be optimistic on oil. While it’s quite likely that some deal will be hashed out this week, that might be ‘peanuts’ relative to the demand destruction.

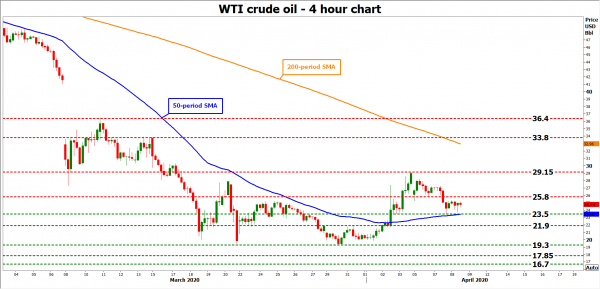

As such, while prices could jump initially on the headlines of a deal, there’s a high risk that any gains will remain short-lived or that the size of the cuts will disappoint investors, leading to a ‘sell the fact’ reaction in oil. For example, if they announce anything less than 10 million barrels in cuts, prices will probably drop. Looking at WTI, initial support may come from the $23.50 region, before the focus turns to $21.90.

If there is no deal at all, prices will plunge much more dramatically and the recent lows near $19.30 might be taken out.

The only scenario in which prices soar is where the cut is bigger than expected, say 15 million barrels. WTI could break above $25.80 to retest the $29.15 area. Even in this case though, the spot physical market will still be grossly oversupplied, so this won’t mark the beginning of a healthy uptrend in oil.

Consider this: even if they agree on huge cuts, what mechanism is there to guarantee that all these nations will truly abide by the levels they promise? The answer is none, and as anyone who watches OPEC knows, compliance with such deals is usually an issue.

In the FX market, one of the best proxies for oil prices is the Canadian dollar, given the nation’s reliance on energy exports. Other currencies that are sensitive to oil include the Norwegian krone, the Russian ruble and the Mexican peso. With the risks appearing tilted towards a disappointment by OPEC and friends, that would imply more pain ahead for the oil-sensitive group.