Canada is next in line, after the US, to publish a devastating jobs report thanks to the extraordinary Covid-19 lockdown. The report, due out on Thursday at 12:30 GMT, could pressure the loonie, though the size of volatility could largely be determined by the delayed OPEC+ video conference that is scheduled to take place on the same day at 14:00 GMT.

Employment forecasts

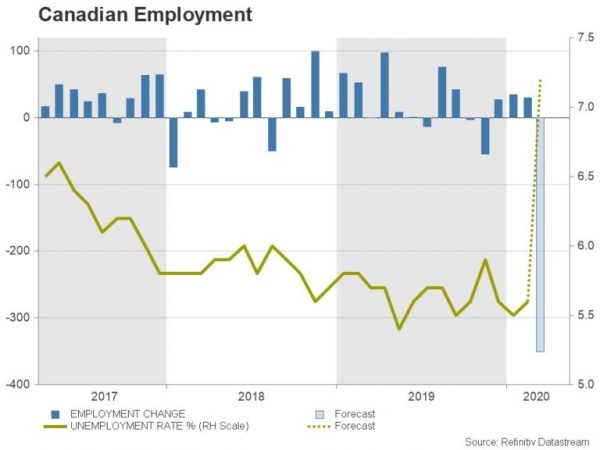

According to forecasts Canada is expected to see a historical reduction of 350k in new employment in March after a 30.3k increase in the preceding month, with the unemployment rate said to soar from 5.6% to a five-year high of 7.2%.

However, as in the US’s case, it is very likely that the numbers may turn out to be even worse than expected since the Prime Minister Justin Trudeau shut down the economy earlier than Trump did last month. Of course, a comparison between the countries could be misleading given population differences. Still, a bigger loss would not be surprising as the Canadian jobless claims are said to have accelerated during the month and especially in the second half.

Hence, markets may already be prepared to welcome something even more chaotic on Thursday. Also, there is no doubt that the economic situation will get uglier in the coming months despite fiscal and monetary stimulus as there is no clear indication when governments will start to dial back social distancing and business restrictions.

Wait for the OPEC bell

Simultaneously, the above narrative gives the impression that the loonie may have little space for more downside moves but second thoughts are coming in as besides the data, a rescheduled OPEC/Non-OPEC virtual meeting is expected to grab significant attention later on Thursday.

Oil is a major component of Canadian exports and therefore any news out of the industry is a market mover for the loonie. During the weekend, Saudi Arabia and Russia blamed each other for the recent collapse in oil prices instead of solving their differences and therefore no solid groundwork was laid before the OPEC+ meeting originally scheduled this past Monday. Consequently, the video conference has been postponed to Thursday and while Russia appeared optimistic this week that a production cut aiming to mitigate the negative virus impact on demand is a very close deal, there are a lot of unknowns behind the scenes that bother markets.

The first question is: will the cut be large enough to deal with the virus shock? Analysts are estimating approximately a 25 million barrels per day (bpd) loss in demand even though little is known about the damage Covid-19 could cause. If rumors of a bit more than 10 million bpd production cut are correct, then such a decision would not fully wipe out the downside pressure in the oil market but could rather disappoint traders, triggering another sell-off in the loonie as well. Recall that the supply glut in the oil industry has been another important matter in consideration over the past few years.

Assuming OPEC+ agrees to cut sufficiently for now, Russian exporters would not like to give up additional shares in international markets for free given that the virus is a global enemy and should be tackled by everyone. Instead, they would urge other non-OPEC countries such as the US, Canada, Norway and Brazil to participate. Canada and Norway have shown willingness to curb production, though some action from the US – having state regulators set lower output levels, for instance – would be more valuable since its output is the largest in the world. However, other than imposing tariffs on oil imports, the US has yet to make any other important comments on strategy.

Technical picture

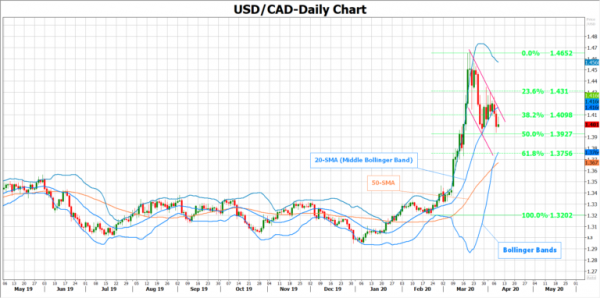

From a technical perspective, negative risks seem to be increasing in the USD/CAD market as the pair has closed below the middle Bollinger band and that bodes well for the Canadian dollar. However, fundamentally, if the Canadian jobs report disappoints, a noticeable rally in the loonie could emerge only if the OPEC+ meeting delivers a remarkable cut in oil production shared by other non-OPEC exporters and particularly the US.

In such a case, USD/CAD could slump towards the 61.8% Fibonacci of the 1.3200-1.4654 upleg at 1.3756 and the lower part of the descending channel if the 50% Fibonacci of 1.3927 proves an easy obstacle.

Otherwise, if the OPEC+ meeting announces a smaller-than-expected output cut with or without the support of the US, USD/CAD could shift north, where any break above the 38.2% Fibonacci of 1.4098 and out of the channel could confirm that the downward-sloping channel is just a pause in an upward trending market.

Should OPEC/Non-OPEC producers fail to agree on a cut, USD/CAD could stage a sharper rebound.