The price of crude oil rose as the market waited for more news on the upcoming meeting of OPEC members. The virtual meeting will take place tomorrow and will be followed by another meeting of G20 ministers. The hope is that this meeting will be more successful than the previous one because of how things have changed. For one, Saudi Arabia has shown the extent it can go, to punish other oil producing countries, including the US. The challenge now is whether any supply cuts will have a major impact on oil prices in the long term. While a 10 million barrels a day cut will be welcome, it will leave the world oversupplied by about 2 million barrels at a time when there is no demand.

Wall Street turned lower yesterday as the market started looking ahead to corporate earnings. The numbers will start coming out in the coming week when big banks like Wells Fargo, Citi, and JP Morgan will release their numbers. These results will shed light on the impact of the coronavirus and provide a picture of what to expect going forward. Additionally, the market continued to worry about Coronavirus and the damage it is causing to the US, where more than 10,000 people have died. The Dow, Nasdaq, and the S&P500 ended the day lower by less than 0.50%.

The economic calendar will be relatively light today with no major scheduled releases. The only big release will be the crude oil inventory data by the Energy Information Administration (EIA). The market expects that inventories rose by more than 9 million in the previous week after rising by 13 million the week before. The Fed will also release the meetings of the FOMC meeting that was held a few weeks ago. Also, we will receive the housing starts numbers from Canada.

EUR/USD

The EUR/USD pair turned lower as the market continued to focus on the coronavirus pandemic. The pair is trading at 1.0870, which is slightly lower than yesterday’s high of 1.0930. The price is along the 25-day and 14-day exponential moving average while the RSI has moved relatively lower. Looking at the chart, the pair may attempt to pull back to the important support of 1.0835 and probably resume the upward trend.

XTI/USD

The XTI/USD pair rose to an intraday high of 28.95 as the market waited for the OPEC+ virtual meeting. The price is stuck along the 14-day and 28-day exponential moving average while the signal and histogram bars of the MACD has made a bullish crossover. The RSI has jumped from the oversold level of 16 to the current 51. The pair may continue showing volatility ahead of the meeting because news can break at any time.

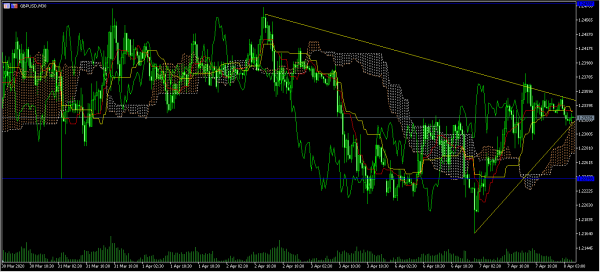

GBP/USD

The GBP/USD pair was little changed in overnight trading as Boris Johnson spent his second night in the ICU. The pair is trading at 1.2323, which is slightly higher than yesterday’s high of 1.2291. The pair has been forming a triangle pattern and is entering the Ichimoku cloud which means that a breakout in either direction could happen.